Question

MEEM Inc. rents out storage space it does not use to HOME Inc. for $300 per mo On October 1, 2020 MEEM Inc. collected

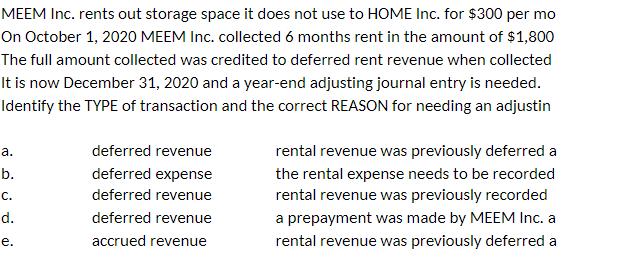

MEEM Inc. rents out storage space it does not use to HOME Inc. for $300 per mo On October 1, 2020 MEEM Inc. collected 6 months rent in the amount of $1,800 The full amount collected was credited to deferred rent revenue when collected It is now December 31, 2020 and a year-end adjusting journal entry is needed. Identify the TYPE of transaction and the correct REASON for needing an adjustin a. b. C. d. e. deferred revenue deferred expense deferred revenue deferred revenue accrued revenue rental revenue was previously deferred a the rental expense needs to be recorded rental revenue was previously recorded a prepayment was made by MEEM Inc. a rental revenue was previously deferred a

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

option D right Calculate total cost Identify economies of scale diseconomies of scale and constant r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: LibbyShort

7th Edition

78111021, 978-0078111020

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App