Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Meet Andre and Danielle DuBois, a happily married couple celebrating their tenth-year anniversary. Currently residing in their cozy, older home for the last 5

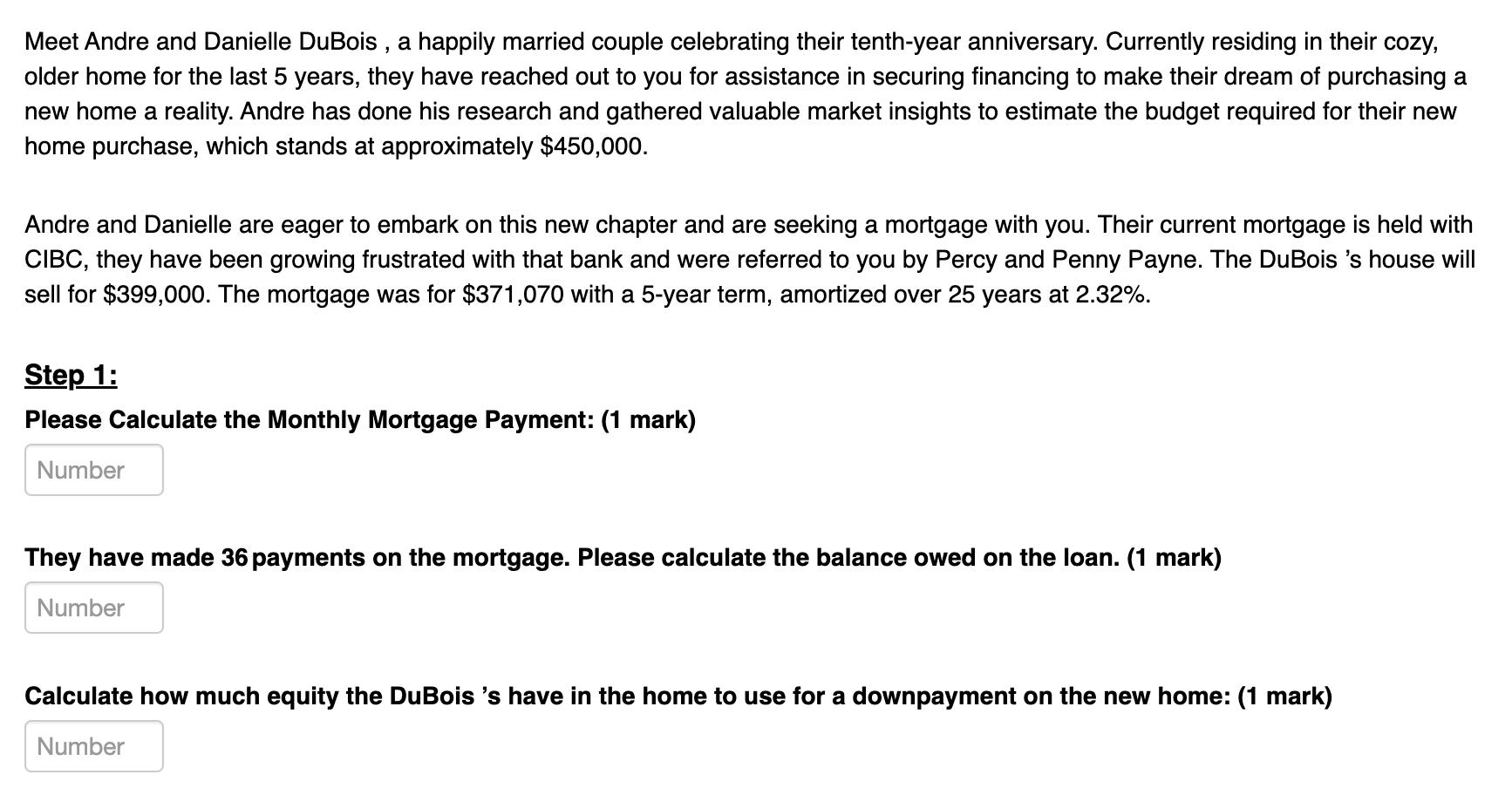

Meet Andre and Danielle DuBois, a happily married couple celebrating their tenth-year anniversary. Currently residing in their cozy, older home for the last 5 years, they have reached out to you for assistance in securing financing to make their dream of purchasing a new home a reality. Andre has done his research and gathered valuable market insights to estimate the budget required for their new home purchase, which stands at approximately $450,000. Andre and Danielle are eager to embark on this new chapter and are seeking a mortgage with you. Their current mortgage is held with CIBC, they have been growing frustrated with that bank and were referred to you by Percy and Penny Payne. The DuBois 's house will sell for $399,000. The mortgage was for $371,070 with a 5-year term, amortized over 25 years at 2.32%. Step 1: Please Calculate the Monthly Mortgage Payment: (1 mark) Number They have made 36 payments on the mortgage. Please calculate the balance owed on the loan. (1 mark) Number Calculate how much equity the DuBois 's have in the home to use for a downpayment on the new home: (1 mark) Number

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Calculations Step 1 Monthly Mortgage Payment Original ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started