Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The transactions of Westinghouse Enterprises during July 2021 are shown below: Austin Powell invested cash of P100,000 in a small equipment store. Paid to

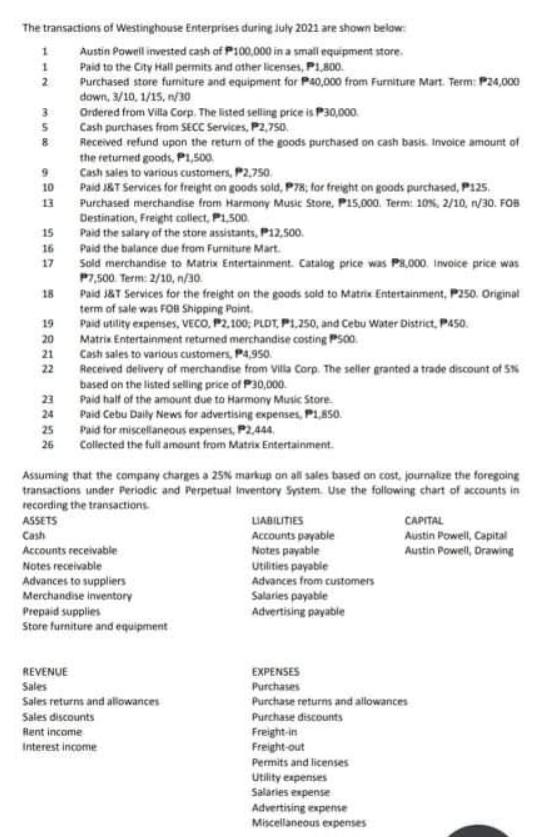

The transactions of Westinghouse Enterprises during July 2021 are shown below: Austin Powell invested cash of P100,000 in a small equipment store. Paid to the City Hall permits and other licenses, P1,800. Purchased store fumiture and equipment for P40,000 from Furniture Mart. Term: 24,000 down, 3/10, 1/15, n/30 Ordered from Villa Corp. The listed selling price is P30,000. Cash purchases from SECC Services, P2,750. Received refund upon the return of the goods purchased on cash basis. Invoice amount of the returned goods, P1,500 Cash sales to various customers, P2,750 Paid J&T Services for freight on goods sold, P78, for freight on goods purchased, P125, Purchased merchandise from Harmony Music Store, P15,000. Term: 10%, 2/10, 1/30. FOB Destination, Freight collect, P1,500 Paid the salary of the store assistants, P12,500. Paid the balance due from Furniture Mart. 1 1 2 3 5 9 10 15 16 17 18 19 20 21 22 23 24 25 26 Sold merchandise to Matrix Entertainment. Catalog price was P8,000. Invoice price was P7,500 Term: 2/10, n/30. Paid J&T Services for the freight on the goods sold to Matrix Entertainment, P250. Original term of sale was FOB Shipping Point. Paid utility expenses, VECO, P2,100, PLDT, P1,250, and Cebu Water District, P450. Matrix Entertainment returned merchandise costing P500 Cash sales to various customers, P4,950. Received delivery of merchandise from Villa Corp. The seller granted a trade discount of 5% based on the listed selling price of P30,000 Paid half of the amount due to Harmony Music Store Paid Cebu Daily News for advertising expenses, P1,850. Paid for miscellaneous expenses, P2,444, Collected the full amount from Matrix Entertainment. Assuming that the company charges a 25% markup on all sales based on cost, journalize the foregoing transactions under Periodic and Perpetual Inventory System. Use the following chart of accounts in recording the transactions. ASSETS Cash Accounts receivable Notes receivable Advances to suppliers Merchandise inventory Prepaid supplies Store furniture and equipment REVENUE Sales Sales returns and allowances Sales discounts Rent income Interest income LIABILITIES Accounts payable Notes payable Utilities payable Advances from customers Salaries payable Advertising payable EXPENSES Purchases Purchase returns and allowances Purchase discounts Freight-in Freight-out Permits and licenses Utility expenses Salaries expense CAPITAL Austin Powell, Capital Austin Powell, Drawing Advertising expense Miscellaneous expenses

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Periodic Inventory System 1 Austin Powell invested cash of P100000 Debit Cash Credit Austin Powell C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started