Answered step by step

Verified Expert Solution

Question

1 Approved Answer

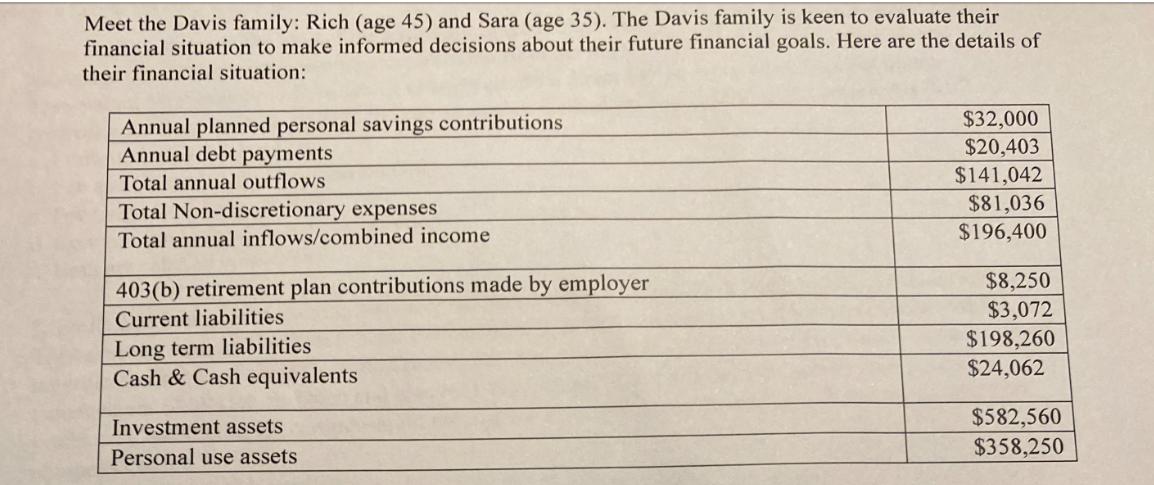

Meet the Davis family: Rich (age 45) and Sara (age 35). The Davis family is keen to evaluate their financial situation to make informed

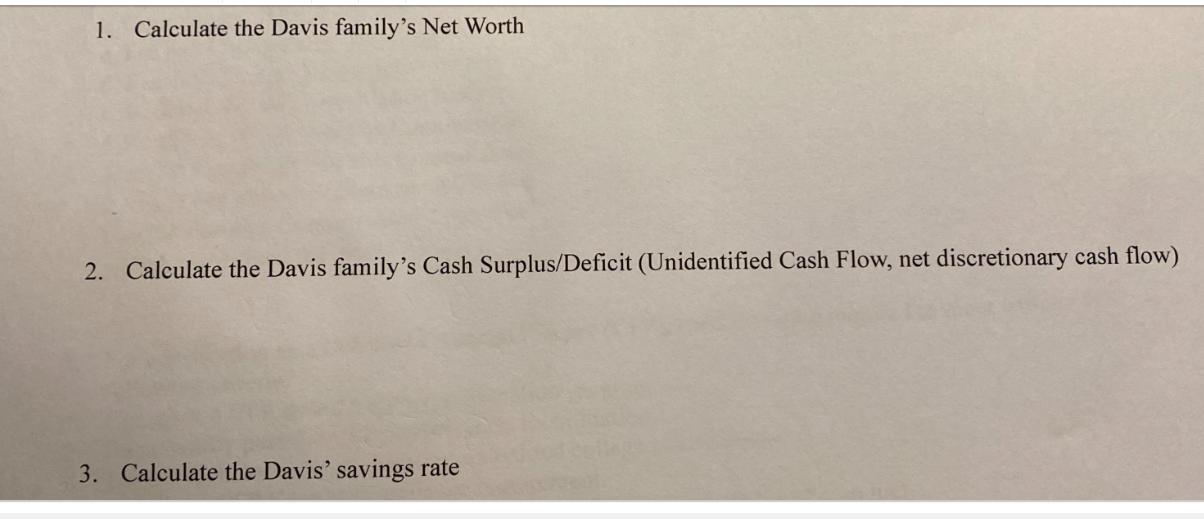

Meet the Davis family: Rich (age 45) and Sara (age 35). The Davis family is keen to evaluate their financial situation to make informed decisions about their future financial goals. Here are the details of their financial situation: Annual planned personal savings contributions $32,000 Annual debt payments $20,403 Total annual outflows $141,042 Total Non-discretionary expenses $81,036 Total annual inflows/combined income $196,400 403(b) retirement plan contributions made by employer $8,250 Current liabilities $3,072 Long term liabilities $198,260 Cash & Cash equivalents $24,062 Investment assets Personal use assets $582,560 $358,250 1. Calculate the Davis family's Net Worth 2. Calculate the Davis family's Cash Surplus/Deficit (Unidentified Cash Flow, net discretionary cash flow) 3. Calculate the Davis' savings rate 4. Calculate the Davis family's emergency fund ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started