Meg dent N ID am Dur of Exi or's S Case study (3) As of December 31, 2018, Eman Corporation reported the Dividends payable

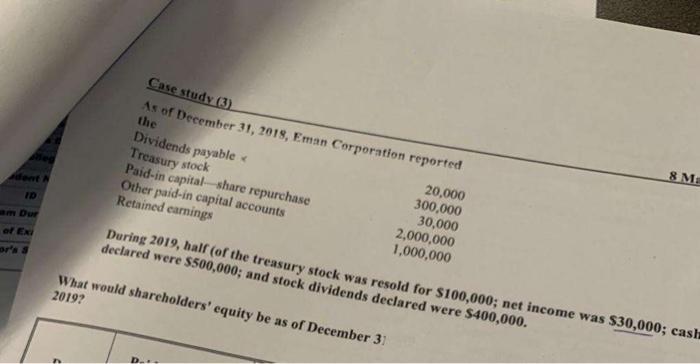

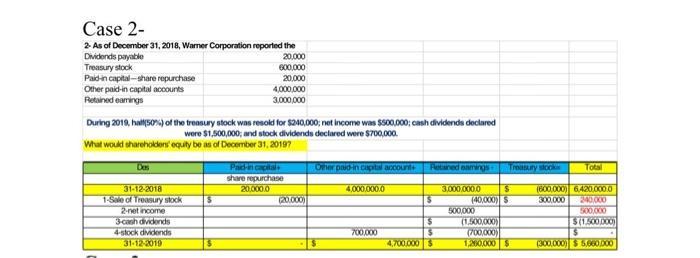

Meg dent N ID am Dur of Exi or's S Case study (3) As of December 31, 2018, Eman Corporation reported the Dividends payable < Treasury stock Paid-in capital-share repurchase Other paid-in capital accounts Retained earnings What would shareholders' equity be as of December 31 2019? 20,000 300,000 30,000 During 2019, half (of the treasury stock was resold for $100,000; net income was $30,000; casla declared were $500,000; and stock dividends declared were $400,000. D... 8 Ma 2,000,000 1,000,000 Case 2- 2-As of December 31, 2018, Warner Corporation reported the Dividends payable 20,000 600,000 20.000 Treasury stock Paid-in capital-share repurchase Other paid-in capital accounts Retained earings During 2019, hall(50%) of the treasury stock was resold for $240,000; net income was $500,000; cash dividends declared were $1,500,000; and stock dividends declared were $700,000. What would shareholders' equity be as of December 31, 20197 Des 31-12-2018 1-Sale of Treasury stock 2-net income 3-cash dividends 4-stock dividends 31-12-2019 4,000,000 3,000,000 $ Pad-in capitals share repurchase 20.000.0 (20.000) Other paid-in capital accounts 4.000.000.0 700,000 4,700.000 Retained eamings- $ $ 3.000.000.0 Treasury stock $ (40,000) $ 500,000 (1,500,000) (700,000) 1,200,000 $ Total (600.000) 6.420.000.0 300,000 240,000 500,000 $(1.500.000) $ (300,000) $5.660.000

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The case study above can be solved as illustrated below Hence To...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started