Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mega Company is evaluating the acquisition of General Casting. General casting has a tax loss carry forward of Rs.1.2 million. Mega can purchase Genera

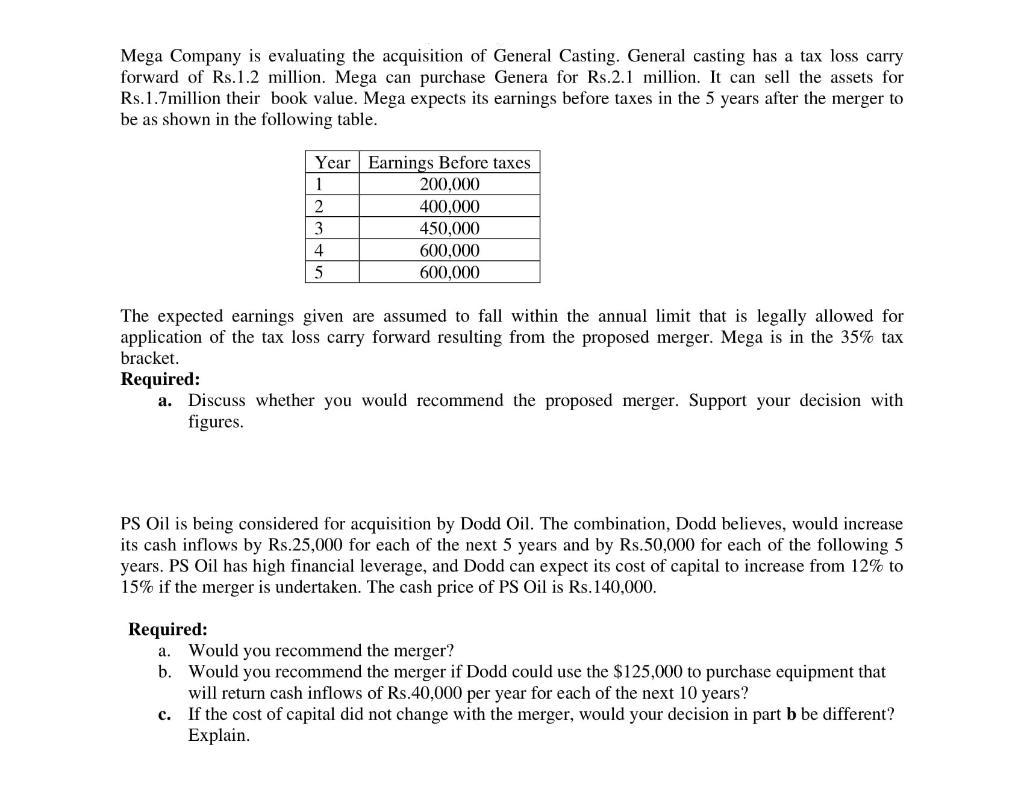

Mega Company is evaluating the acquisition of General Casting. General casting has a tax loss carry forward of Rs.1.2 million. Mega can purchase Genera for Rs.2.1 million. It can sell the assets for Rs.1.7million their book value. Mega expects its earnings before taxes in the 5 years after the merger to be as shown in the following table. Year Earnings Before taxes 1 2 3 4 5 200,000 400,000 450,000 600,000 600,000 The expected earnings given are assumed to fall within the annual limit that is legally allowed for application of the tax loss carry forward resulting from the proposed merger. Mega is in the 35% tax bracket. Required: Required: a. Discuss whether you would recommend the proposed merger. Support your decision with figures. PS Oil is being considered for acquisition by Dodd Oil. The combination, Dodd believes, would increase its cash inflows by Rs.25,000 for each of the next 5 years and by Rs.50,000 for each of the following 5 years. PS Oil has high financial leverage, and Dodd can expect its cost of capital to increase from 12% to 15% if the merger is undertaken. The cash price of PS Oil is Rs.140,000. a. Would you recommend the merger? b. Would you recommend the merger if Dodd could use the $125,000 to purchase equipment that will return cash inflows of Rs.40,000 per year for each of the next 10 years? c. If the cost of capital did not change with the merger, would your decision in part b be different? Explain.

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Evaluation of the proposed merger with General Casting To determine whether the proposed merger is favorable for Mega Company we need to analyze the financial implications and potential benefits Her...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started