mega jaya berhad Accounting policies, changes in accounting estimated and errors.

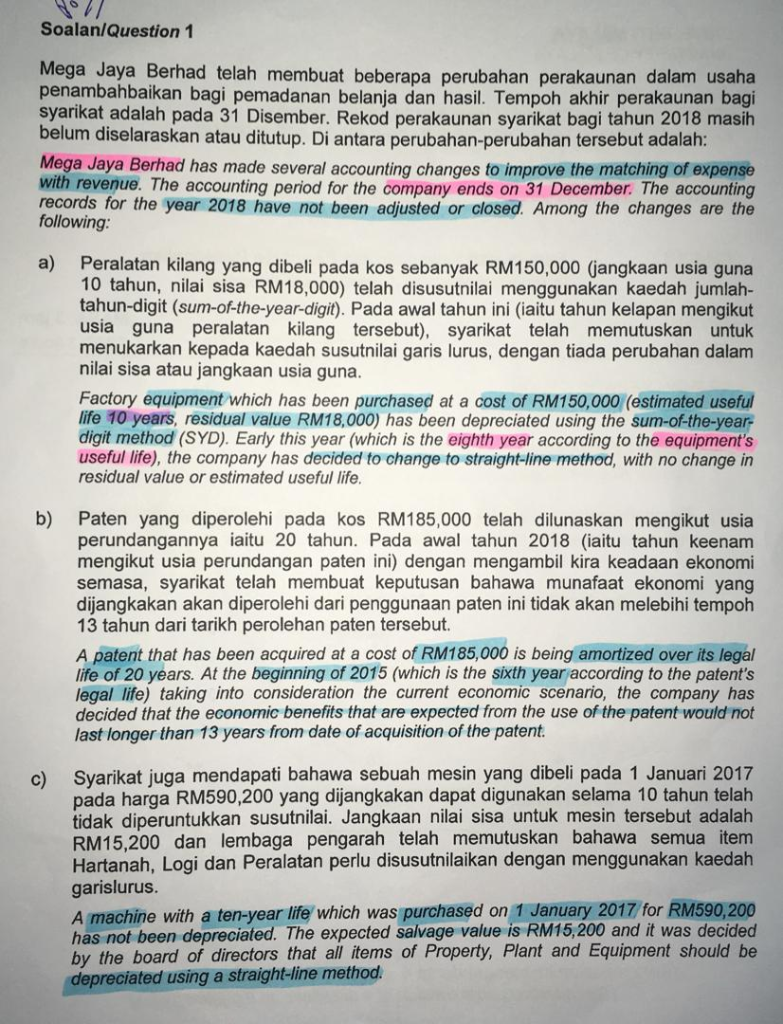

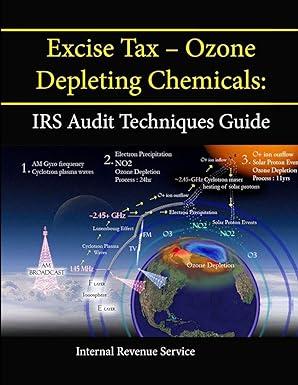

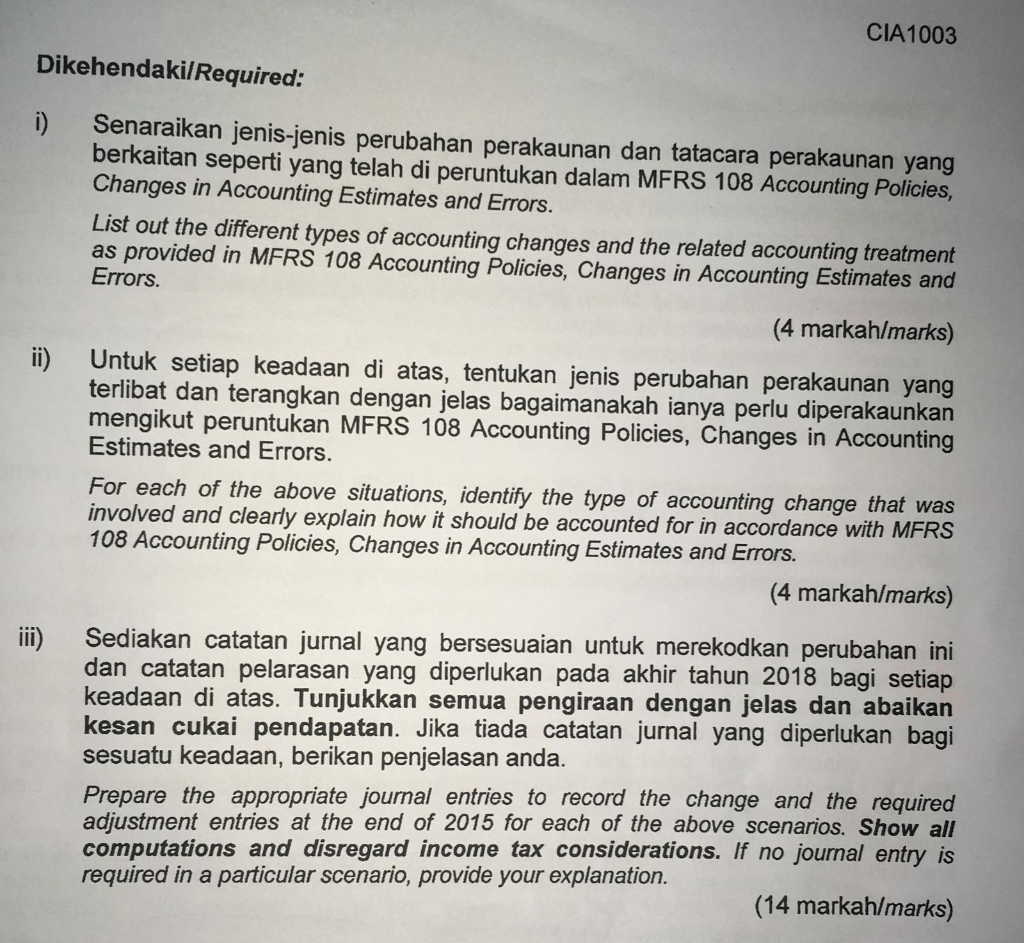

Soalan/Question 1 Mega Jaya Berhad telah membuat beberapa perubahan perakaunan dalam usaha penambahbaikan bagi pemadanan belanja dan hasil. Tempoh akhir perakaunan bagi syarikat adalah pada 31 Disember. Rekod perakaunan syarikat bagi tahun 2018 masih belum diselaraskan atau ditutup. Di antara perubahan-perubahan tersebut adalah: Mega Jaya Berhad has made several accounting changes to improve the matching of expense with revenue. The accounting period for the company ends on 31 December. The accounting records for the year 2018 have not been adjusted or closed. Among the changes are the following: a) Peralatan kilang yang dibeli pada kos sebanyak RM150,000 (jangkaan usia guna 10 tahun, nilai sisa RM18,000) telah disusutnilai menggunakan kaedah jumlah- tahun-digit (sum-of-the-year-digit). Pada awal tahun ini (iaitu tahun kelapan mengikut usia guna peralatan kilang tersebut), syarikat telah memutuskan untuk menukarkan kepada kaedah susutnilai garis lurus, dengan tiada perubahan dalam nilai sisa atau jangkaan usia guna. Factory equipment which has been purchased at a cost of RM150,000 (estimated useful life 10 years, residual value RM18,000) has been depreciated using the sum-of-the-year digit method (SYD). Early this year (which is the eighth year according to the equipment's useful life), the company has decided to change to straight-line method, with no change in residual value or estimated useful life b) Paten yang diperolehi pada kos RM185,000 telah dilunaskan mengikut usia perundangannya iaitu 20 tahun. Pada awal tahun 2018 (iaitu tahun keenam mengikut usia perundangan paten ini) dengan mengambil kira keadaan ekonomi semasa, syarikat telah membuat keputusan bahawa munafaat ekonomi yang dijangkakan akan diperolehi dari penggunaan paten ini tidak akan melebihi tempoh 13 tahun dari tarikh perolehan paten tersebut A patent that has been acquired at a cost of RM185,000 is being amortized over its legal life of 20 years. At the beginning of 2015 (which is the sixth year according to the patent's legal life) taking into consideration the current economic Scenario, the company has decided that the economic benefits that are expected from the use of the patent would not last longer than 13 years from date of acquisition of the patent Syarikat juga mendapati bahawa sebuah mesin yang dibeli pada 1 Januari 2017 c) pada harga RM590,200 yang dijangkakan dapat digunakan selama 10 tahun telah tidak diperuntukkan susutnilai. Jangkaan nilai sisa untuk mesin tersebut adalah RM15,200 dan lembaga pengarah telah memutuskan bahawa semua item Hartanah, Logi dan Peralatan perlu disusutnilaikan dengan menggunakan kaedah garislurus. A machine with a ten-year life which was purchased on 1 January 2017 for RM590,200 has not been depreciated. The expected salvage value is RM15,200 and it was decided by the board of directors that all items of Property, Plant and Equipment should be depreciated using a straight-line method Soalan/Question 1 Mega Jaya Berhad telah membuat beberapa perubahan perakaunan dalam usaha penambahbaikan bagi pemadanan belanja dan hasil. Tempoh akhir perakaunan bagi syarikat adalah pada 31 Disember. Rekod perakaunan syarikat bagi tahun 2018 masih belum diselaraskan atau ditutup. Di antara perubahan-perubahan tersebut adalah: Mega Jaya Berhad has made several accounting changes to improve the matching of expense with revenue. The accounting period for the company ends on 31 December. The accounting records for the year 2018 have not been adjusted or closed. Among the changes are the following: a) Peralatan kilang yang dibeli pada kos sebanyak RM150,000 (jangkaan usia guna 10 tahun, nilai sisa RM18,000) telah disusutnilai menggunakan kaedah jumlah- tahun-digit (sum-of-the-year-digit). Pada awal tahun ini (iaitu tahun kelapan mengikut usia guna peralatan kilang tersebut), syarikat telah memutuskan untuk menukarkan kepada kaedah susutnilai garis lurus, dengan tiada perubahan dalam nilai sisa atau jangkaan usia guna. Factory equipment which has been purchased at a cost of RM150,000 (estimated useful life 10 years, residual value RM18,000) has been depreciated using the sum-of-the-year digit method (SYD). Early this year (which is the eighth year according to the equipment's useful life), the company has decided to change to straight-line method, with no change in residual value or estimated useful life b) Paten yang diperolehi pada kos RM185,000 telah dilunaskan mengikut usia perundangannya iaitu 20 tahun. Pada awal tahun 2018 (iaitu tahun keenam mengikut usia perundangan paten ini) dengan mengambil kira keadaan ekonomi semasa, syarikat telah membuat keputusan bahawa munafaat ekonomi yang dijangkakan akan diperolehi dari penggunaan paten ini tidak akan melebihi tempoh 13 tahun dari tarikh perolehan paten tersebut A patent that has been acquired at a cost of RM185,000 is being amortized over its legal life of 20 years. At the beginning of 2015 (which is the sixth year according to the patent's legal life) taking into consideration the current economic Scenario, the company has decided that the economic benefits that are expected from the use of the patent would not last longer than 13 years from date of acquisition of the patent Syarikat juga mendapati bahawa sebuah mesin yang dibeli pada 1 Januari 2017 c) pada harga RM590,200 yang dijangkakan dapat digunakan selama 10 tahun telah tidak diperuntukkan susutnilai. Jangkaan nilai sisa untuk mesin tersebut adalah RM15,200 dan lembaga pengarah telah memutuskan bahawa semua item Hartanah, Logi dan Peralatan perlu disusutnilaikan dengan menggunakan kaedah garislurus. A machine with a ten-year life which was purchased on 1 January 2017 for RM590,200 has not been depreciated. The expected salvage value is RM15,200 and it was decided by the board of directors that all items of Property, Plant and Equipment should be depreciated using a straight-line method