MegaHoldings Group, a significant conglomerate, and MiniFirm Ltd, its subsidiary, are involved in a financial transaction. Initially, on January 1, 2021, MegaHoldings Group issued

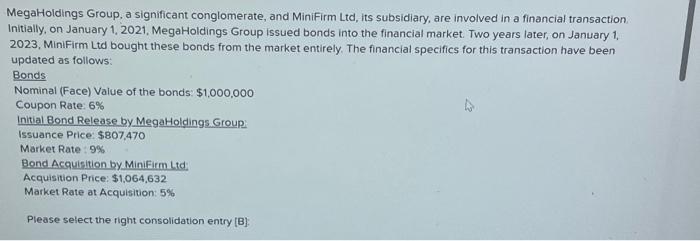

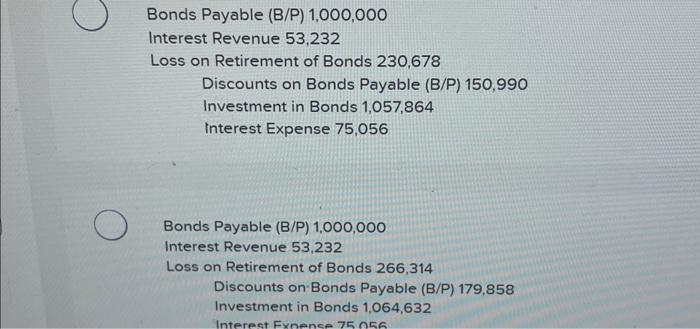

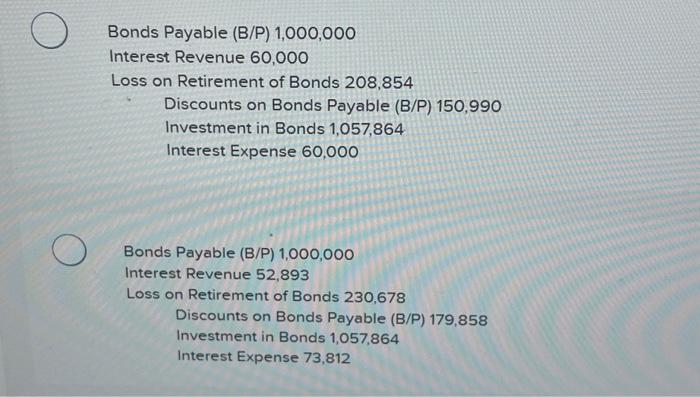

MegaHoldings Group, a significant conglomerate, and MiniFirm Ltd, its subsidiary, are involved in a financial transaction. Initially, on January 1, 2021, MegaHoldings Group issued bonds into the financial market. Two years later, on January 1, 2023, MiniFirm Ltd bought these bonds from the market entirely. The financial specifics for this transaction have been updated as follows: Bonds Nominal (Face) Value of the bonds: $1,000,000 Coupon Rate: 6% Initial Bond Release by MegaHoldings Group Issuance Price: $807,470 Market Rate: 9% Bond Acquisition by MiniFirm Ltd: Acquisition Price: $1,064,632 Market Rate at Acquisition: 5% Please select the right consolidation entry [B] Bonds Payable (B/P) 1,000,000 Interest Revenue 53,232 Loss on Retirement of Bonds 230,678 Discounts on Bonds Payable (B/P) 150,990 Investment in Bonds 1,057,864 Interest Expense 75,056 Bonds Payable (B/P) 1,000,000 Interest Revenue 53,232 Loss on Retirement of Bonds 266,314 Discounts on Bonds Payable (B/P) 179,858 Investment in Bonds 1,064,632 Interest Expense 75.056 Bonds Payable (B/P) 1,000,000 Interest Revenue 60,000 Loss on Retirement of Bonds 208,854 Discounts on Bonds Payable (B/P) 150,990 Investment in Bonds 1,057,864 Interest Expense 60,000 Bonds Payable (B/P) 1,000,000 Interest Revenue 52,893 Loss on Retirement of Bonds 230,678 Discounts on Bonds Payable (B/P) 179,858 Investment in Bonds 1,057,864 Interest Expense 73,812

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The correct answer is B Bonds Payable BP 1000000 Interest Revenue 53232 Loss on Retirement of Bonds 266314 Discounts on Bonds Payable BP 179858 Investment in Bonds 106 4632 Interest Expense 750... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards