Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Megan has been dreaming of owning her own home since childhood. Her incredible ability to save money has resulted in her having $180,000 available

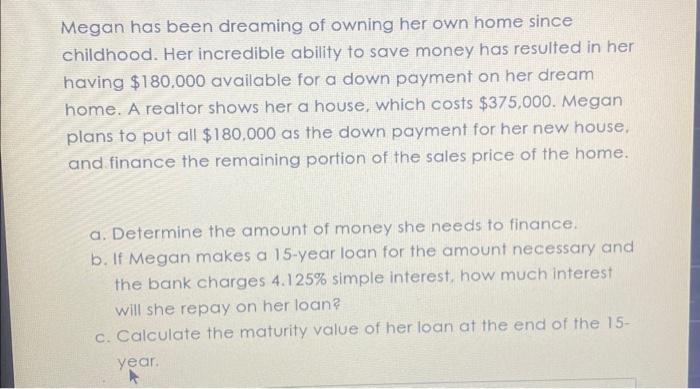

Megan has been dreaming of owning her own home since childhood. Her incredible ability to save money has resulted in her having $180,000 available for a down payment on her dream home. A realtor shows her a house, which costs $375,000. Megan plans to put all $180,000 as the down payment for her new house, and finance the remaining portion of the sales price of the home. a. Determine the amount of money she needs to finance. b. If Megan makes a 15-year loan for the amount necessary and the bank charges 4.125% simple interest, how much interest will she repay on her loan? c. Calculate the maturity value of her loan at the end of the 15- year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started