Answered step by step

Verified Expert Solution

Question

1 Approved Answer

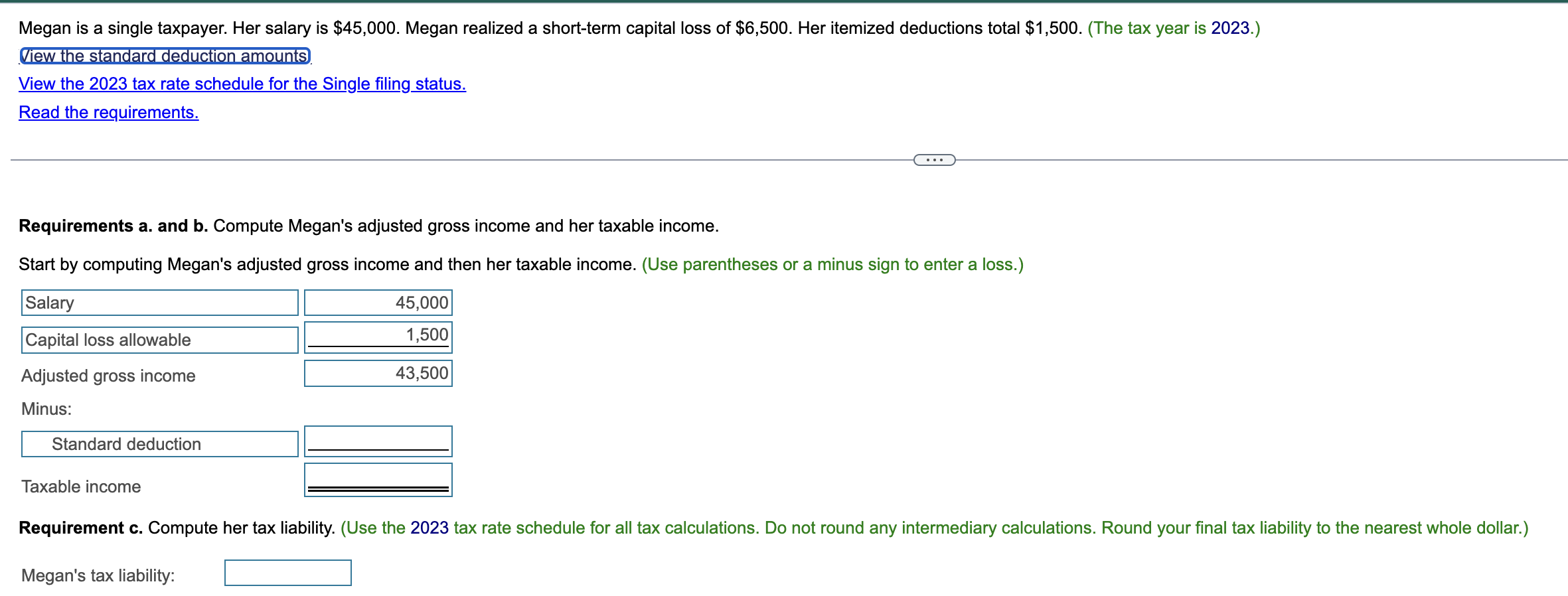

Megan is a single taxpayer. Her salary is $45,000. Megan realized a short-term capital loss of $6,500. Her itemized deductions total $1,500. (The tax

Megan is a single taxpayer. Her salary is $45,000. Megan realized a short-term capital loss of $6,500. Her itemized deductions total $1,500. (The tax year is 2023.) View the standard deduction amounts View the 2023 tax rate schedule for the Single filing status. Read the requirements. Requirements a. and b. Compute Megan's adjusted gross income and her taxable income. Start by computing Megan's adjusted gross income and then her taxable income. (Use parentheses or a minus sign to enter a loss.) Salary Capital loss allowable Adjusted gross income Minus: Standard deduction Taxable income 45,000 1,500 43,500 Requirement c. Compute her tax liability. (Use the 2023 tax rate schedule for all tax calculations. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) Megan's tax liability:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets solve this problem stepbystep a Compute Megans adjusted gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started