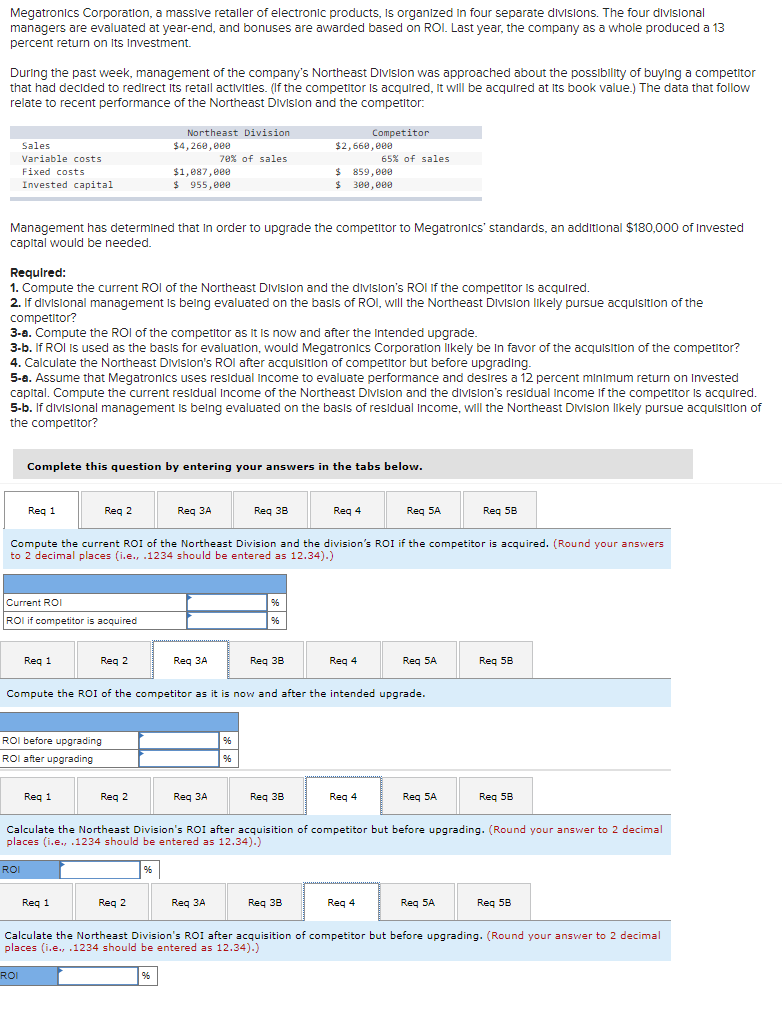

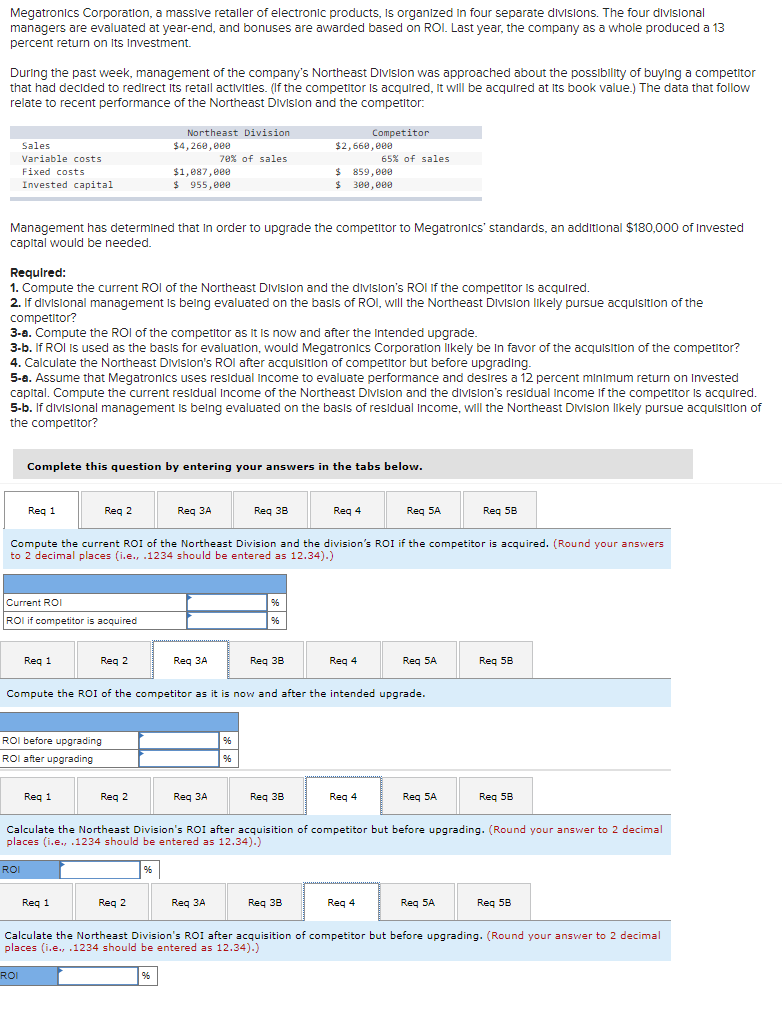

Megatronics Corporation, a massive retaller of electronic products, is organized in four separate divisions. The four divisional managers are evaluated at year-end, and bonuses are awarded based on ROI. Last year, the company as a whole produced a 13 percent return on Its Investment. During the past week, management of the company's Northeast Division was approached about the possibility of buyling a competitor that had decided to redirect its retall actlvitles. (If the competitor is acquired, It will be acquired at its book value.) The data that follow relate to recent performance of the Northeast Division and the competitor: Management has determined that In order to upgrade the competitor to Megatronics' standards, an additional $180,000 of Invested capital would be needed. Required: 1. Compute the current ROI of the Northeast Division and the division's ROI If the competitor is acquired. 2. If divisional management is being evaluated on the basis of ROI, Will the Northeast Division likely pursue acquisition of the competitor? 3-a. Compute the ROI of the competitor as It Is now and after the Intended upgrade. 3-b. If ROI is used as the basis for evaluation, would Megatronics Corporation likely be In favor of the acquisition of the competitor? 4. Calculate the Northeast Division's ROI after acquisition of competitor but before upgrading. 5-a. Assume that Megatronics uses residual Income to evaluate performance and desires a 12 percent minimum return on Invested capital. Compute the current residual Income of the Northeast Division and the division's residual income if the competitor is acquired. 5-b. If divisional management is belng evaluated on the basis of residual Income, will the Northeast Division IIkely pursue acquisition of the competitor? Complete this question by entering your answers in the tabs below. Compute the current ROI of the Northeast Division and the division's ROI if the competitor is acquired. (Round your answers to 2 decimal places (i.e.. 1234 should be entered as 12.34).) Compute the ROI of the competitor as it is now and after the intended upgrade. Calculate the Northeast. Division's ROI after acquisition of competitor but before upgrading. (Round your answer to 2 decimal places (i.e., .1234 should be entered as 12.34).) % Calculate the Northeast Division's ROI after acquisition of competitor but before upgrading. (Round your answer to 2 decimal places (i.e., 1234 should be entered as 12.34).)