Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Meghan had a life insurance policy with coverage of $150,000. On the application, she had named her son Jonah as the beneficiary. In a later

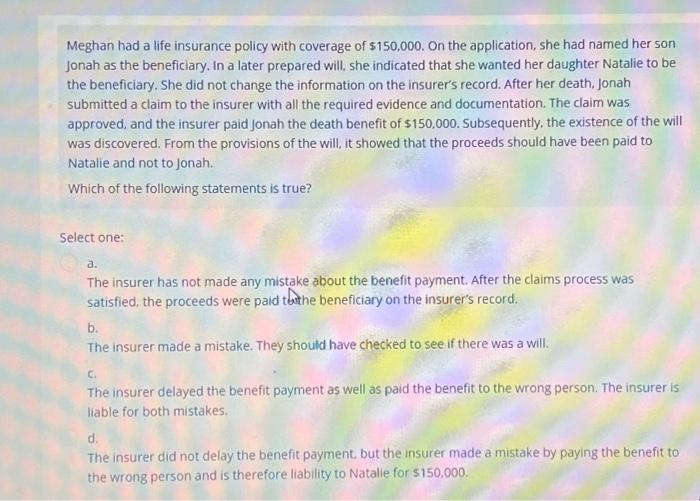

Meghan had a life insurance policy with coverage of $150,000. On the application, she had named her son Jonah as the beneficiary. In a later prepared will, she indicated that she wanted her daughter Natalie to be the beneficiary. She did not change the information on the insurer's record. After her death, Jonah submitted a claim to the insurer with all the required evidence and documentation. The claim was approved, and the insurer paid Jonah the death benefit of $150,000. Subsequently, the existence of the will was discovered. From the provisions of the will, it showed that the proceeds should have been paid to Natalie and not to Jonah. Which of the following statements is true? Select one: a. The insurer has not made any mistake about the benefit payment. After the claims process was satisfied, the proceeds were paid to the beneficiary on the insurer's record. b. The insurer made a mistake. They should have checked to see if there was a will. C. The insurer delayed the benefit payment as well as paid the benefit to the wrong person. The insurer is liable for both mistakes. d. The insurer did not delay the benefit payment, but the insurer made a mistake by paying the benefit to the wrong person and is therefore liability to Natalie for $150,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started