Question

Meir, Benson, and Lau are partners and share income and loss in a 3:2:5 ratio. The partnership's capital balances are as follows: Meir, $103,000; Benson,

Meir, Benson, and Lau are partners and share income and loss in a 3:2:5 ratio. The partnership's capital balances are as follows: Meir, $103,000; Benson, $69,000; and Lau, $178,000. Benson decides to withdraw from the partnership, and the partners agree not to have the assets revalued upon Benson's retirement.

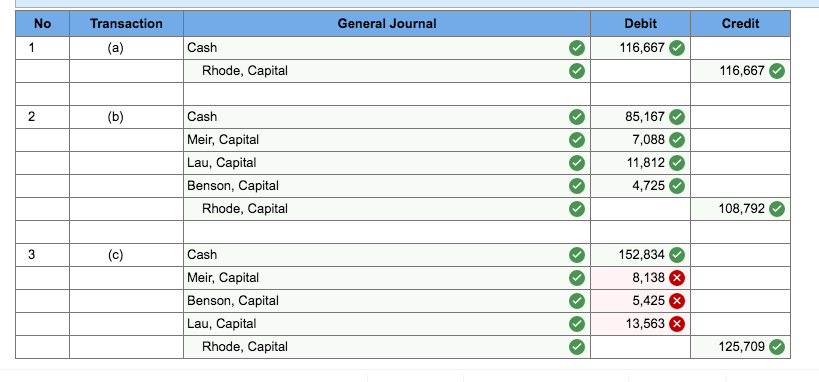

Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhodes entry into the partnership under each of the following separate assumptions: Rhode invests (a) $116,667; (b) $85,167; and (c) $152,834. (Do not round your intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started