Answered step by step

Verified Expert Solution

Question

1 Approved Answer

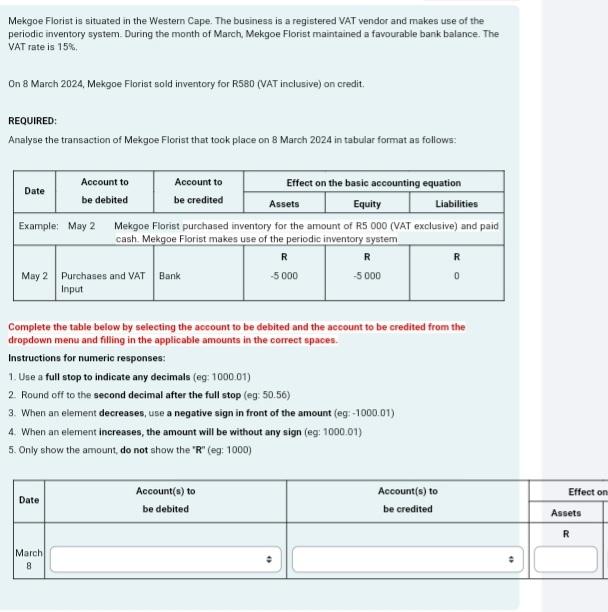

Mekgoe Florist is situated in the Western Cape. The business is a registered VAT vendor and makes use of the periodic inventory system. During

Mekgoe Florist is situated in the Western Cape. The business is a registered VAT vendor and makes use of the periodic inventory system. During the month of March, Mekgoe Florist maintained a favourable bank balance. The VAT rate is 15%. On 8 March 2024, Mekgoe Florist sold inventory for R580 (VAT inclusive) on credit. REQUIRED: Analyse the transaction of Mekgoe Florist that took place on 8 March 2024 in tabular format as follows: Date Account to be debited Account to be credited Assets Effect on the basic accounting equation Equity Liabilities Example: May 2 Mekgoe Florist purchased inventory for the amount of R5 000 (VAT exclusive) and paid cash. Mekgoe Florist makes use of the periodic inventory system May 2 Purchases and VAT Bank Input R -5000 R -5000 0 Complete the table below by selecting the account to be debited and the account to be credited from the dropdown menu and filling in the applicable amounts in the correct spaces. Instructions for numeric responses: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the second decimal after the full stop (eg: 50.56) 3. When an element decreases, use a negative sign in front of the amount (eg:-1000.01) 4. When an element increases, the amount will be without any sign (eg: 1000.01) 5. Only show the amount, do not show the "R" (eg: 1000) Date March 8 Account(s) to be debited 0 Account(s) to Effect on be credited Assets R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Sales amount including VAT R580 2 VAT rate 15 3 Calculate VAT amount on sales VAT Sales amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started