Question

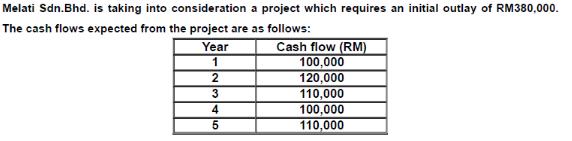

Melati Sdn.Bhd. is taking into consideration a project which requires an initial outlay of RM380,000. The cash flows expected from the project are as

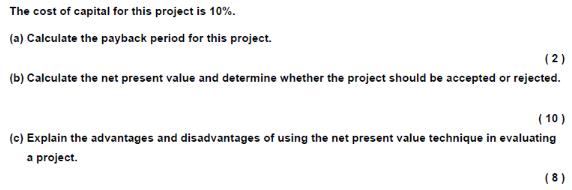

Melati Sdn.Bhd. is taking into consideration a project which requires an initial outlay of RM380,000. The cash flows expected from the project are as follows: Year Cash flow (RM) 1 100,000 2 3 4 5 120,000 110,000 100,000 110,000 The cost of capital for this project is 10%. (a) Calculate the payback period for this project. (2) (b) Calculate the net present value and determine whether the project should be accepted or rejected. (10) (c) Explain the advantages and disadvantages of using the net present value technique in evaluating a project. (8)

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the payback period we need to determine the time it takes for the cumulative cash inflows to equal or exceed the initial outlay of RM38...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics For Contemporary Decision Making

Authors: Black Ken

8th Edition

978-1118494769, 1118800842, 1118494768, 9781118800843, 978-1118749647

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App