Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Melbourne Metal is considering becoming a supplier of transmission housings. It would require buying a new forge that would cost $125,000 (including all setup

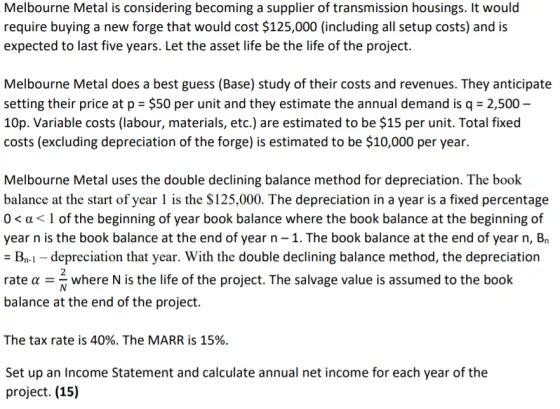

Melbourne Metal is considering becoming a supplier of transmission housings. It would require buying a new forge that would cost $125,000 (including all setup costs) and is expected to last five years. Let the asset life be the life of the project. Melbourne Metal does a best guess (Base) study of their costs and revenues. They anticipate setting their price at p = $50 per unit and they estimate the annual demand is q = 2,500 - 10p. Variable costs (labour, materials, etc.) are estimated to be $15 per unit. Total fixed costs (excluding depreciation of the forge) is estimated to be $10,000 per year. Melbourne Metal uses the double declining balance method for depreciation. The book balance at the start of year 1 is the $125,000. The depreciation in a year is a fixed percentage 0 < a < 1 of the beginning of year book balance where the book balance at the beginning of year n is the book balance at the end of year n-1. The book balance at the end of year n, Bn = Ba-1-depreciation that year. With the double declining balance method, the depreciation rate a = where N is the life of the project. The salvage value is assumed to the book balance at the end of the project. The tax rate is 40%. The MARR is 15%. Set up an Income Statement and calculate annual net income for each year of the project. (15)

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To set up an income statement and calculate the annual net income for each year of the project we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started