Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Melissa, Nicole, and Ben are equal partners in the Opto Partnership (a calendar-year- end entity). Melissa decides she wants to exit the partnership and

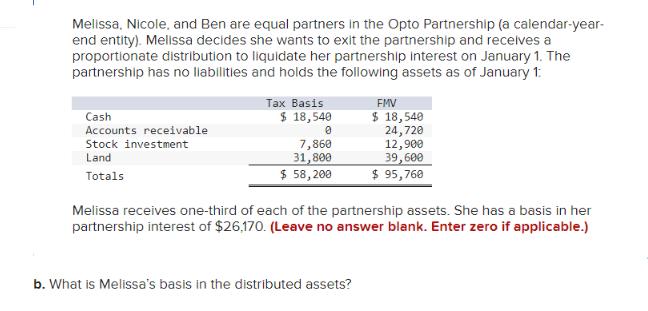

Melissa, Nicole, and Ben are equal partners in the Opto Partnership (a calendar-year- end entity). Melissa decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1: Cash Accounts receivable Stock investment Land Totals Tax Basis $ 18,540 0 7,860 31,800 $ 58,200 FMV $ 18,540 24,720 12,900 39,600 $ 95,768 Melissa receives one-third of each of the partnership assets. She has a basis in her partnership interest of $26,170. (Leave no answer blank. Enter zero if applicable.) b. What is Melissa's basis in the distributed assets?

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The calculation of Melissas basis in the distributed assets step by step Melissa is receiving a prop...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started