Melissa recently paid $415 for round-trip airfare to San Francisco to attend a business conference for...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

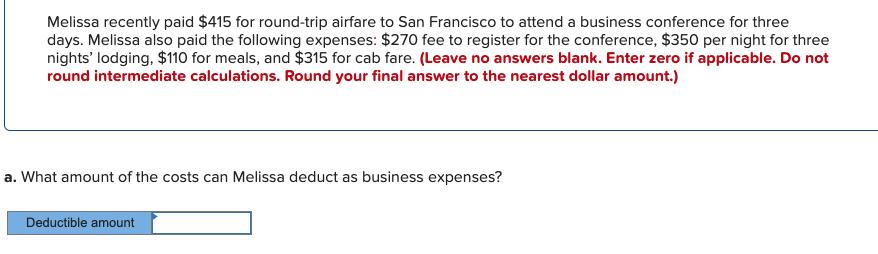

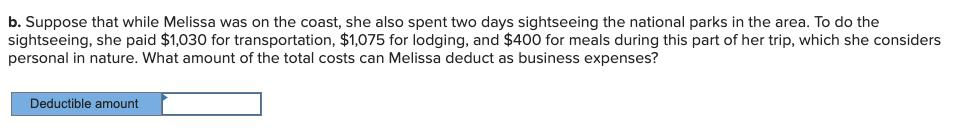

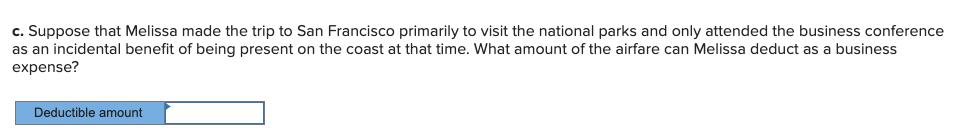

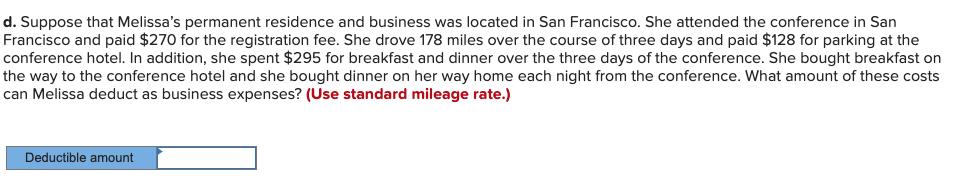

Melissa recently paid $415 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $270 fee to register for the conference, $350 per night for three nights' lodging, $110 for meals, and $315 for cab fare. (Leave no answers blank. Enter zero if applicable. Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) a. What amount of the costs can Melissa deduct as business expenses? Deductible amount b. Suppose that while Melissa was on the coast, she also spent two days sightseeing the national parks in the area. To do the sightseeing, she paid $1,030 for transportation, $1,075 for lodging, and $400 for meals during this part of her trip, which she considers personal in nature. What amount of the total costs can Melissa deduct as business expenses? Deductible amount c. Suppose that Melissa made the trip to San Francisco primarily to visit the national parks and only attended the business conference as an incidental benefit of being present on the coast at that time. What amount of the airfare can Melissa deduct as a business expense? Deductible amount d. Suppose that Melissa's permanent residence and business was located in San Francisco. She attended the conference in San Francisco and paid $270 for the registration fee. She drove 178 miles over the course of three days and paid $128 for parking at the conference hotel. In addition, she spent $295 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as business expenses? (Use standard mileage rate.) Deductible amount Melissa recently paid $415 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $270 fee to register for the conference, $350 per night for three nights' lodging, $110 for meals, and $315 for cab fare. (Leave no answers blank. Enter zero if applicable. Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) a. What amount of the costs can Melissa deduct as business expenses? Deductible amount b. Suppose that while Melissa was on the coast, she also spent two days sightseeing the national parks in the area. To do the sightseeing, she paid $1,030 for transportation, $1,075 for lodging, and $400 for meals during this part of her trip, which she considers personal in nature. What amount of the total costs can Melissa deduct as business expenses? Deductible amount c. Suppose that Melissa made the trip to San Francisco primarily to visit the national parks and only attended the business conference as an incidental benefit of being present on the coast at that time. What amount of the airfare can Melissa deduct as a business expense? Deductible amount d. Suppose that Melissa's permanent residence and business was located in San Francisco. She attended the conference in San Francisco and paid $270 for the registration fee. She drove 178 miles over the course of three days and paid $128 for parking at the conference hotel. In addition, she spent $295 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as business expenses? (Use standard mileage rate.) Deductible amount

Expert Answer:

Answer rating: 100% (QA)

Answer Airfare 415 Registration for conference 270 Loading charge 3503 105... View the full answer

Related Book For

Statistics The Exploration & Analysis of Data

ISBN: 978-1133164135

7th edition

Authors: Roxy Peck, Jay L. Devore

Posted Date:

Students also viewed these accounting questions

-

Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, ...

-

Melissa recently paid $530 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $585 fee to register for the conference,...

-

For the beam and loading shown, design the cross section of the beam, knowing that the grade of timber used has an allowable normal stress of 16 MPa. B 90 kN/m 3.2 m A d= mm X

-

Identify possible opportunities for denormalizing these relations as part of the physical design of the database. Which ones would you be most likely to implement

-

How does reliability differ from validity? Give examples of each.

-

A bar magnet is placed in a uniform magnetic field (Fig. P20.7). (a) What is the direction of the total force on the bar magnet? (b) What is the direction (clockwise or counterclockwise) of the...

-

Your brother recently graduated from college and started his first job. He rents half a duplex, but the owner has put the building up for sale. Your brother thinks that purchasing the building would...

-

Virginia Tech operates its own power generating plant. The electricity generated by this plant supplies power to the university and to local businesses and residences in the Blacksburg area. The...

-

Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution...

-

David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant, specializing in retail management and...

-

write down the matrix equations for the two-ports given in the figures below E1 186 Passive network [Z] Passive network [Y]] Passive network [ ABCD ] 12 v2 12 12 N 2

-

Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,950,000 in 2024 for the mining site and spent an additional $790,000 to prepare the mine for extraction of the...

-

List and describe the challenges that a global, virtual team must overcome to be successful.

-

Module: Qualitative Research - To determine the challenges faced by the automotive sector in the wake of the COVID-19 pandemic. a.) What effect has the coronavirus (COVID-19) pandemic had on the...

-

Selected data for Babar Ltd of past year of operations are presented below: Product X Production [ in units ] 4750 Sales [ in units ] 2800 Selling price $15.00 General activity [DL Hours] 5080...

-

1. What are the budget challenges New Jersey is facing? 2. What are the legal constraints of New Jersey (such as tax and expenditure limitations)?

-

The Ste. Marie Division of Pacific Media Corporation juststarted operations. It purchased depreciable assets costing $130million and having a four-year expected life, after which theassets can be s 2...

-

Use multiplication or division of power series to find the first three nonzero terms in the Maclaurin series for each function. y = e x2 cos x

-

Many people take ginkgo supplements advertised to improve memory. Are these over-the-counter supplements effective? In a study reported in the paper Ginkgo for Memory Enhancement (Journal of the...

-

When a surgeon repairs injuries, sutures (stitched knots) are used to hold together and stabilize the injured area. If these knots elongate and loosen through use, the injury may not heal properly...

-

An individual can take either a scenic route to work or a nonscenic route. She decides that use of the nonscenic route can be justified only if it reduces the mean travel time by more than 10...

-

Question: Martin, a diamond wholesaler, writes Serge, a jewelry retailer, offering to sell 75 specified diamonds for $2 million. Martin's offer sheet specifies the price, quantity, date of delivery,...

-

Question: To satisfy the UCC statute of frauds regarding the sale of goods, which of the following must generally be in writing? a. Designation of the parties as buyer and seller b. Delivery terms c....

-

Question: Warm, Inc. sells large, portable space heaters for industrial use. Warm sells Little Factory a unit and installs it. The sales contract states, "This heating unit is sold as is. There are...

Study smarter with the SolutionInn App