Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Menlo Park, September 1, 2022 Maebe Funke, partner at the VC & Growth PE firm of Divaaliya Capital Partners (DCP), looked out her office

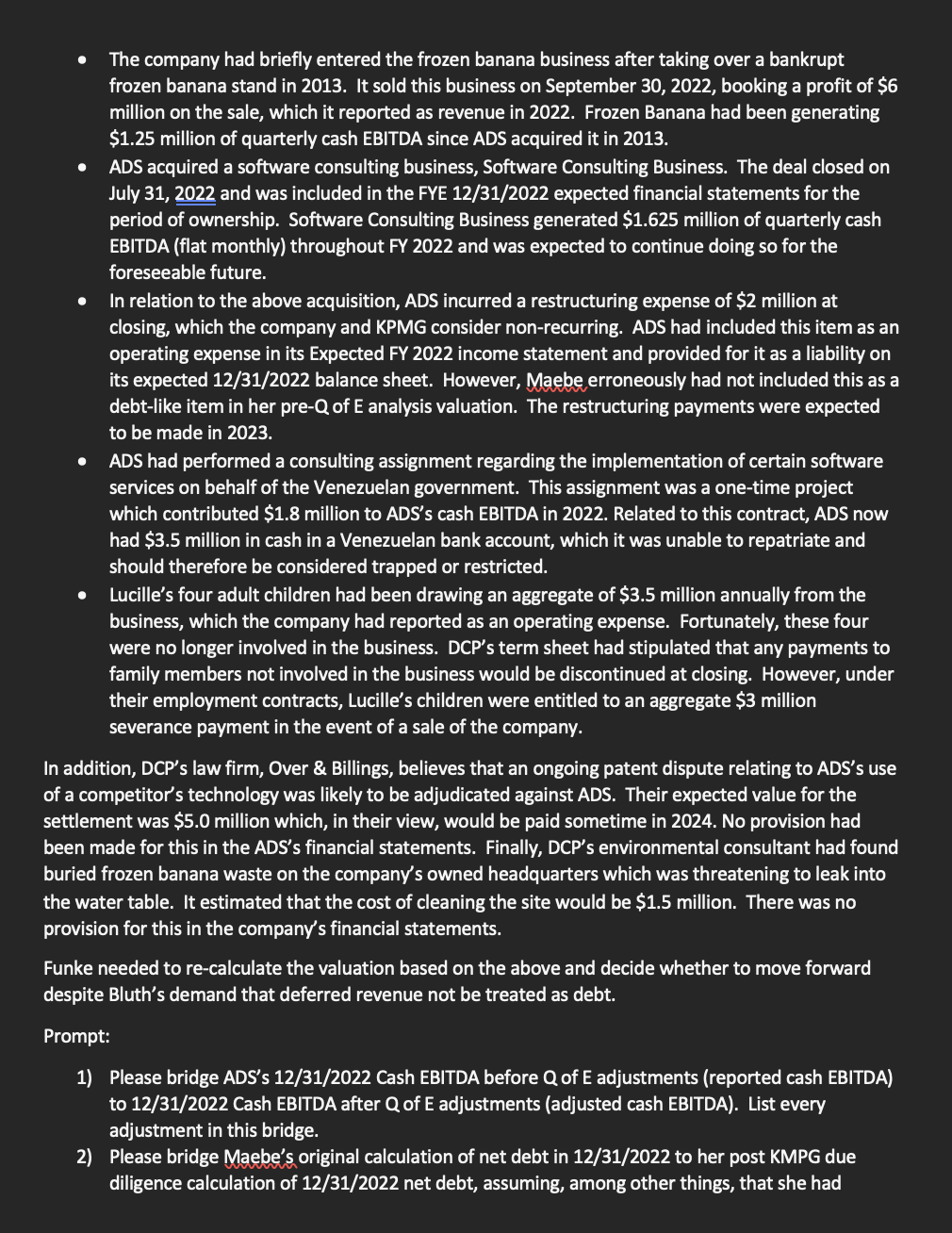

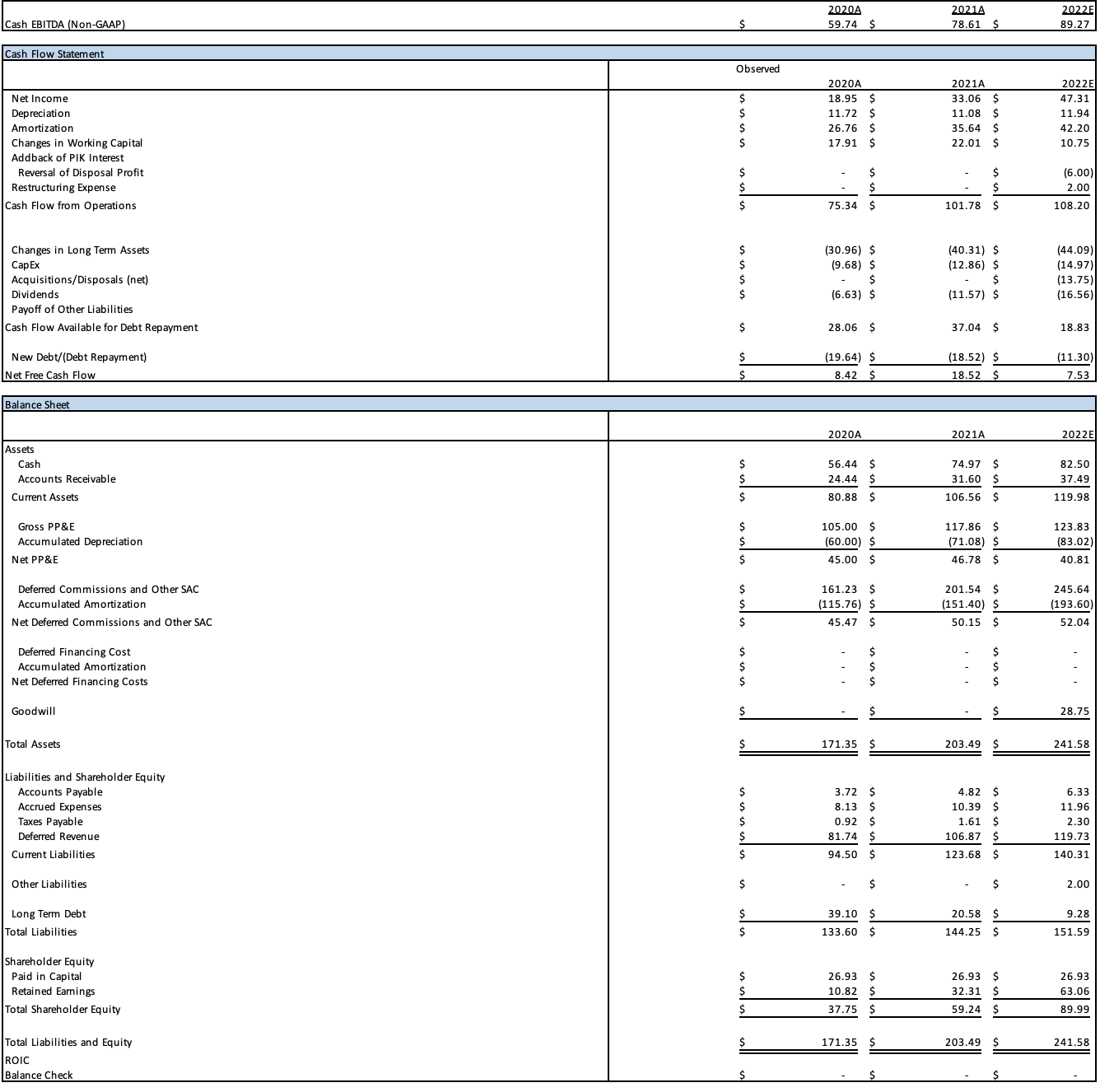

Menlo Park, September 1, 2022 Maebe Funke, partner at the VC & Growth PE firm of Divaaliya Capital Partners (DCP), looked out her office window at 3000 Sand Hill Road, wondering why so many business school cases started by having the protagonist looking out her office window. After pondering this subject, she turned her attention to her firm's potential investment in AD Systems ("ADS"), a successful yet relatively small provider of hosted HR management software services using the SaaS model. The company had been founded by George and Lucille Bluth in 2012. The two had divorced after George was convicted of fifty-seven counts of fraud, and Lucille had since been the CEO of the business. A month ago, DCP had been granted a 30-day exclusivity period to perform financial due diligence on AD Systems and had hired KPMG to perform the analysis. The exclusivity period had been granted based on the term sheet provided by DCP which stipulated that DCP would make a $100 million investment in ADS in exchange for newly issued convertible preferred shares. The parties had agreed on an enterprise value for ADS of 12x FYE 12/31/2022 expected cash EBITDA (a common non-GAAP metric in SaaS businesses). When calculating ADS's equity value, and therefore the % ownership in ADS to be acquired for the $100 million, DCP had stipulated that the deferred revenue liability would be treated as a debt- like item and that the FYE 12/31/2022 expected cash EBITDA would be adjusted pursuant to a quality of earnings analysis. Among other items, Divaaliya had been provided with historical financial statements for FYE 12/31/2020 and 2021 as well as expected FYE 12/31/2022 financial statements. Since then, Lucille Bluth had hired Joffrey's, a leading tech investment banking firm, to advise her. Joffrey's had insisted that it was market practice to treat deferred revenue as working capital rather than a debt-like item. Lucille now refused to move forward with the deal unless DCP made the corresponding adjustment to equity value. Additionally, KPMG had completed its work and surfaced several relevant issues: The company had briefly entered the frozen banana business after taking over a bankrupt frozen banana stand in 2013. It sold this business on September 30, 2022, booking a profit of $6 million on the sale, which it reported as revenue in 2022. Frozen Banana had been generating $1.25 million of quarterly cash EBITDA since ADS acquired it in 2013. ADS acquired a software consulting business, Software Consulting Business. The deal closed on July 31, 2022 and was included in the FYE 12/31/2022 expected financial statements for the period of ownership. Software Consulting Business generated $1.625 million of quarterly cash EBITDA (flat monthly) throughout FY 2022 and was expected to continue doing so for the foreseeable future. In relation to the above acquisition, ADS incurred a restructuring expense of $2 million at closing, which the company and KPMG consider non-recurring. ADS had included this item as an operating expense in its Expected FY 2022 income statement and provided for it as a liability on its expected 12/31/2022 balance sheet. However, Maebe erroneously had not included this as a debt-like item in her pre-Q of E analysis valuation. The restructuring payments were expected to be made in 2023. ADS had performed a consulting assignment regarding the implementation of certain software services on behalf of the Venezuelan government. This assignment was a one-time project which contributed $1.8 million to ADS's cash EBITDA in 2022. Related to this contract, ADS now had $3.5 million in cash in a Venezuelan bank account, which it was unable to repatriate and should therefore be considered trapped or restricted. Lucille's four adult children had been drawing an aggregate of $3.5 million annually from the business, which the company had reported as an operating expense. Fortunately, these four were no longer involved in the business. DCP's term sheet had stipulated that any payments to family members not involved in the business would be discontinued at closing. However, under their employment contracts, Lucille's children were entitled to an aggregate $3 million severance payment in the event of a sale of the company. In addition, DCP's law firm, Over & Billings, believes that an ongoing patent dispute relating to ADS's use of a competitor's technology was likely to be adjudicated against ADS. Their expected value for the settlement was $5.0 million which, in their view, would be paid sometime in 2024. No provision had been made for this in the ADS's financial statements. Finally, DCP's environmental consultant had found buried frozen banana waste on the company's owned headquarters which was threatening to leak into the water table. It estimated that the cost of cleaning the site would be $1.5 million. There was no provision for this in the company's financial statements. Funke needed to re-calculate the valuation based on the above and decide whether to move forward despite Bluth's demand that deferred revenue not be treated as debt. Prompt: 1) Please bridge ADS's 12/31/2022 Cash EBITDA before Q of E adjustments (reported cash EBITDA) to 12/31/2022 Cash EBITDA after Q of E adjustments (adjusted cash EBITDA). List every adjustment in this bridge. 2) Please bridge Maebe's original calculation of net debt in 12/31/2022 to her post KMPG due diligence calculation of 12/31/2022 net debt, assuming, among other things, that she had originally treated deferred revenue as a DLI, but will now treat it as a working capital item. Calculate the pre and post money equity valuation and the enterprise value for ADS before and after the adjustments, assuming that DCP still intends to invest $100 million at a TEV of 12x FYE 12/31/2022 adjusted cash EBITDA. What % of ADS's fully diluted shares outstanding would DCP's preferred stock be convertible into before and after the adjustments? Cash EBITDA (Non-GAAP) Cash Flow Statement Net Income Depreciation Amortization Changes in Working Capital Addback of PIK Interest Reversal of Disposal Profit Restructuring Expense Cash Flow from Operations Changes in Long Term Assets CapEx Acquisitions/Disposals (net) Dividends Payoff of Other Liabilities Cash Flow Available for Debt Repayment New Debt/(Debt Repayment) Net Free Cash Flow Balance Sheet Assets Cash Accounts Receivable Current Assets Gross PP&E Accumulated Depreciation Net PP&E Deferred Commissions and Other SAC Accumulated Amortization Net Deferred Commissions and Other SAC Deferred Financing Cost Accumulated Amortization Net Deferred Financing Costs Goodwill Total Assets Liabilities and Shareholder Equity Accounts Payable Accrued Expenses Taxes Payable Deferred Revenue Current Liabilities Other Liabilities Long Term Debt Total Liabilities Shareholder Equity Paid in Capital Retained Earnings Total Shareholder Equity Total Liabilities and Equity IROIC Balance Check 2020A 2021A 2022E $ 59.74 $ 78.61 $ 89.27 Observed 2020A 2021A 2022E $ 18.95 S 11.72 $ 33.06 $ 47.31 11.08 $ 11.94 $ 26.76 S 35.64 $ 42.20 $ 17.91 S 22.01 S 10.75 $ S $ (6.00) $ S $ 2.00 $ 75.34 $ 101.78 $ 108.20 $ (30.96) $ (40.31) $ (44.09) (9.68) $ (12.86) $ (14.97) $ $ $ (13.75) $ (6.63) $ (11.57) $ (16.56) $ 28.06 $ 37.04 $ 18.83 (19.64) $ 8.42 $ (18.52) $ 18.52 $ (11.30) 7.53 2020A 2021A 2022E $ 56.44 $ 74.97 $ 82.50 $ 24.44 $ 31.60 $ 37.49 $ 80.88 S 106.56 $ 119.98 $ 105.00 $ 117.86 $ 123.83 $ (60.00) $ (71.08) $ (83.02) $ 45.00 S 46.78 $ 40.81 $ 161.23 $ 201.54 $ 245.64 $ (115.76) $ (151.40) $ $ 45.47 $ 50.15 $ (193.60) 52.04 $ S S $ S $ $ $ $ 28.75 $ 171.35 S 203.49 241.58 3.72 S $ 8.13 S 4.82 10.39 $ $ 6.33 11.96 $ 0.92 S 81.74 S $ 94.50 S 1.61 S 106.87 $ 123.68 $ 2.30 119.73 140.31 $ $ S 2.00 $ 39.10 $ $ 133.60 S 20.58 $ 144.25 S 9.28 151.59 $ 26.93 $ 26.93 $ 26.93 $ 10.82 $ 32.31 $ 63.06 $ 37.75 $ 59.24 $ 89.99 171.35 $ 203.49 $ 241.58 $ S $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started