Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO,

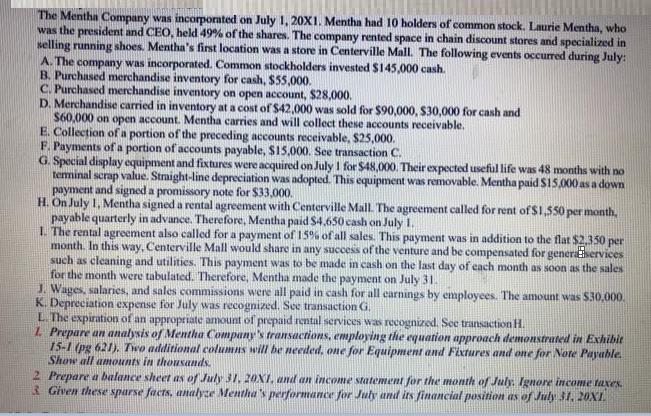

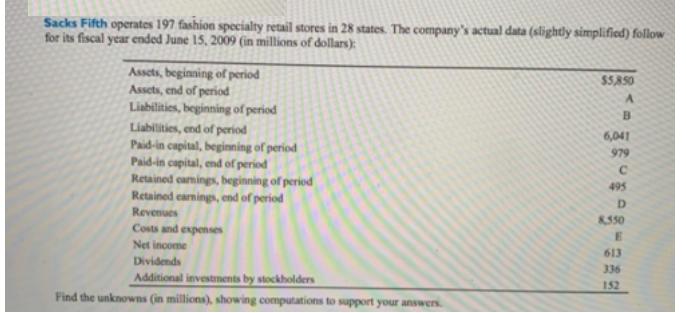

The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers The Mentha Company was incorporated on July 1, 20X1. Mentha had 10 holders of common stock. Laurie Mentha, who was the president and CEO, held 49% of the shares. The company rented space in chain discount stores and specialized in selling running shoes. Mentha's first location was a store in Centerville Mall. The following events occured during July: A. The company was incorporated. Common stockholders invested $145,000 cash. B. Purchased merchandise inventory for cash, $55,000. C. Purchased merchandise inventory on open account, $28,000. D. Merchandise carried in inventory at a cost of $42,000 was sold for $90,000, $30,000 for cash and $60,000 on open account. Mentha carries and will collect these accounts receivable. E. Collection of a portion of the preceding accounts receivable, $25,000. F. Payments ofa portion of accounts payable, S15,000. See transaction C. G. Special display equipment and fixtures were acquired on July I for $48,000. Their expected useful life was 48 months with no teminal scrap value. Straight-line depreciation was adopted. This equipment was removable. Mentha paid S15,000 as a down payment and signed a promissory note for $33,000. H. On July 1, Mentha signed a rental agreement with Centerville Mall The agreement called for rent of $1,550 per month, payable quarterly in advance. Therefore, Mentha paid $4.650 cash on July 1. L. The rental agreement also called for a payment of 15% ofall sales. This payment was in addition to the flat $2,350 per month. In this way, Centerville Mall would share in any success of the venture and be compensated for generservices such as cleaning and utilities, This payment was to be made in cash on the last day of each month as soon as the sales for the month were tabulated. Therefore, Mentha made the payment on July 31. J. Wages, salaries, and sales commissions were all paid in cash for all carnings by employees. The amount was S30,000. K. Depreciation expense for July was recognized. See transaction G. L The expiration of an appropriate amount of prepaid rental services was recognized. See transactionH. L Prepare an analysis of Mentha Company's transactions, employing the equation approach demonstrated in Exhibit 15-1 (pg 621). Two additional columns will be needed, one for Equipment and Fixtures and one for Note Payable. Show all amounts in thousands. 2 Prepare a balance sheet as of July 31, 2OXI, and an income statement for the month of July. Ignore income taxes 3 Given these sparse facts, analyze Mentha's performance for July and its financial position as of July 31, 20XI. Sacks Fifth operates 197 fashion specialty retail stores in 28 states. The company's actual data (slightly simplified) follow for its fiscal year ended June 15, 2009 (in millions of dollars): Assets, beginning of period Assets, end of period Liabilities, beginning of period $5,850 V. B. Liabilities, end of period Paid-in capital, beginning of period Paid-in capital, end of period Retained carmings, beginning of period Retained carnings, end of period 6,041 979 495 D. Revenues 8.550 Costs and expenses Net income 613 Dividends 336 Additional investments by stockholders 152 Find the unknowns (in millions), showing computations to support your answers

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started