Question

Meow Int [ MEW ], reported several transactions during 2016 which are stated below. i] On February 1, the company purchased 24,000 of its own

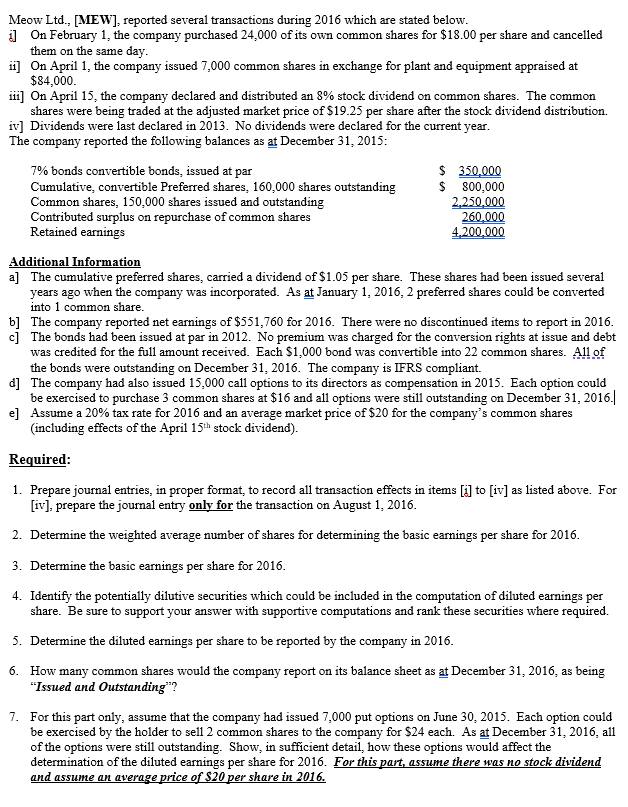

Meow Int [MEW], reported several transactions during 2016 which are stated below.

Meow Int [MEW], reported several transactions during 2016 which are stated below.

i] On February 1, the company purchased 24,000 of its own common shares for $18.00 per share and cancelled them on the same day.

ii] On April 1, the company issued 7,000 common shares in exchange for plant and equipment appraised at $84,000.

iii] On April 15, the company declared and distributed an 8% stock dividend on common shares. The common shares were being traded at the adjusted market price of $19.25 per share after the stock dividend distribution.

iv] Dividends were last declared in 2013. No dividends were declared for the current year.

The company reported the following balances as at December 31, 2015:

7% bonds convertible bonds, issued at par $ 350,000

Cumulative, convertible Preferred shares, 160,000 shares outstanding $ 800,000

Common shares, 150,000 shares issued and outstanding 2,250,000

Contributed surplus on repurchase of common shares 260,000

Retained earnings 4,200,000

Additional Information

a] The cumulative preferred shares, carried a dividend of $1.05 per share. These shares had been issued several years ago when the company was incorporated. As at January 1, 2016, 2 preferred shares could be converted into 1 common share.

b] The company reported net earnings of $551,760 for 2016. There were no discontinued items to report in 2016.

c] The bonds had been issued at par in 2012. No premium was charged for the conversion rights at issue and debt was credited for the full amount received. Each $1,000 bond was convertible into 22 common shares. All of the bonds were outstanding on December 31, 2016. The company is IFRS compliant.

d] The company had also issued 15,000 call options to its directors as compensation in 2015. Each option could be exercised to purchase 3 common shares at $16 and all options were still outstanding on December 31, 2016.

e] Assume a 20% tax rate for 2016 and an average market price of $20 for the companys common shares (including effects of the April 15th stock dividend).

Required:

1. Prepare journal entries, in proper format, to record all transaction effects in items [i] to [iv] as listed above. For [iv], prepare the journal entry only for the transaction on August 1, 2016.

2. Determine the weighted average number of shares for determining the basic earnings per share for 2016.

3. Determine the basic earnings per share for 2016.

4. Identify the potentially dilutive securities which could be included in the computation of diluted earnings per share. Be sure to support your answer with supportive computations and rank these securities where required.

5. Determine the diluted earnings per share to be reported by the company in 2016.

6. How many common shares would the company report on its balance sheet as at December 31, 2016, as being Issued and Outstanding?

7. For this part only, assume that the company had issued 7,000 put options on June 30, 2015. Each option could be exercised by the holder to sell 2 common shares to the company for $24 each. As at December 31, 2016, all of the options were still outstanding. Show, in sufficient detail, how these options would affect the determination of the diluted earnings per share for 2016. For this part, assume there was no stock dividend and assume an average price of $20 per share in 2016.

Meow Ltd., [MEW), reported several transactions during 2016 which are stated below. i] On February 1, the company purchased 24,000 of its own common shares for $18.00 per share and cancelled them on the same day. i] On April 1, the company issued 7,000 common shares in exchange for plant and equipment appraised at $84,000. iii] On April 15, the company declared and distributed an 8% stock dividend on common shares. The common shares were being traded at the adjusted market price of $19.25 per share after the stock dividend distribution. iv) Dividends were last declared in 2013. No dividends were declared for the current year. The company reported the following balances as at December 31, 2015: 7% bonds convertible bonds, issued at par $ 350,000 Cumulative, convertible Preferred shares. 160,000 shares outstanding $ 800,000 Common shares, 150,000 shares issued and outstanding 2.250.000 Contributed surplus on repurchase of common shares 260.000 Retained earnings 4,200,000 Additional Information a] The cumulative preferred shares, carried a dividend of $1.05 per share. These shares had been issued several years ago when the company was incorporated. As at January 1, 2016, 2 preferred shares could be converted into 1 common share. b] The company reported net earnings of $551,760 for 2016. There were no discontinued items to report in 2016. c] The bonds had been issued at par in 2012. No premium was charged for the conversion rights at issue and debt was credited for the full amount received. Each $1,000 bond was convertible into 22 common shares. All of the bonds were outstanding on December 31, 2016. The company is IFRS compliant. d] The company had also issued 15,000 call options to its directors as compensation in 2015. Each option could be exercised to purchase 3 common shares at $16 and all options were still outstanding on December 31, 2016./ e] Assume a 20% tax rate for 2016 and an average market price of $20 for the company's common shares (including effects of the April 15th stock dividend). Required: 1. Prepare journal entries, in proper format, to record all transaction effects in items [i] to [iv] as listed above. For [iv], prepare the journal entry only for the transaction on August 1, 2016. 2. Determine the weighted average number of shares for determining the basic earnings per share for 2016. 3. Determine the basic earnings per share for 2016. 4. Identify the potentially dilutive securities which could be included in the computation of diluted earnings per share. Be sure to support your answer with supportive computations and rank these securities where required. 5. Determine the diluted earnings per share to be reported by the company in 2016. 6. How many common shares would the company report on its balance sheet as at December 31, 2016, as being "Issued and Outstanding""? 7. For this part only, assume that the company had issued 7,000 put options on June 30, 2015. Each option could be exercised by the holder to sell 2 common shares to the company for $24 each. As at December 31, 2016, all of the options were still outstanding. Show, in sufficient detail, how these options would affect the determination of the diluted earnings per share for 2016. For this part, assume there was no stock dividend and assume an average price of $20 per share in 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started