Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mercier Corporation's stock is selling for $78.99. It has just paid a dividend of $4.25 a share. The expected growth rate in dividends is

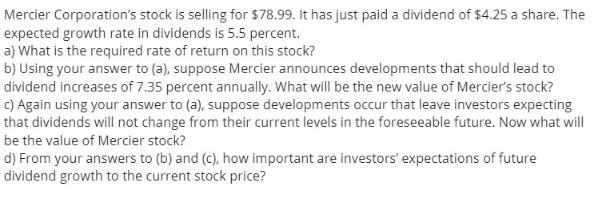

Mercier Corporation's stock is selling for $78.99. It has just paid a dividend of $4.25 a share. The expected growth rate in dividends is 5.5 percent. a) What is the required rate of return on this stock? b) Using your answer to (a), suppose Mercier announces developments that should lead to dividend increases of 7.35 percent annually. What will be the new value of Mercier's stock? c) Again using your answer to (a), suppose developments occur that leave investors expecting that dividends will not change from their current levels in the foreseeable future. Now what will be the value of Mercier stock? d) From your answers to (b) and (c), how important are investors' expectations of future dividend growth to the current stock price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the required rate of return k on the stock we can use the Gordon Growth Model Dividend Dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started