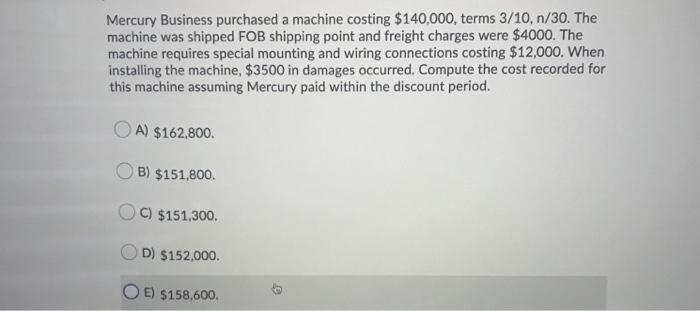

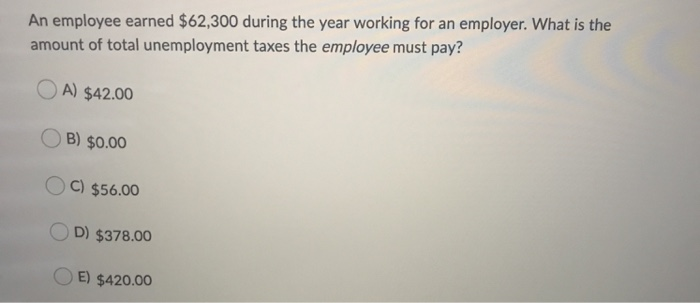

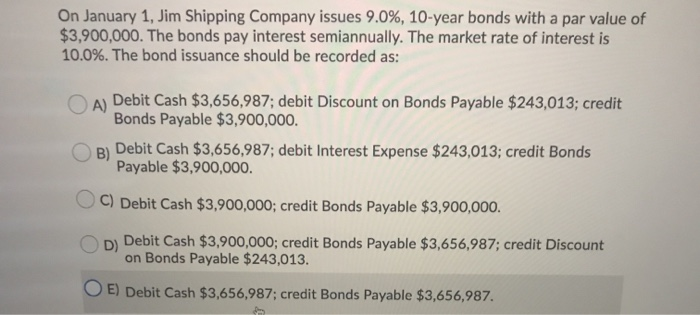

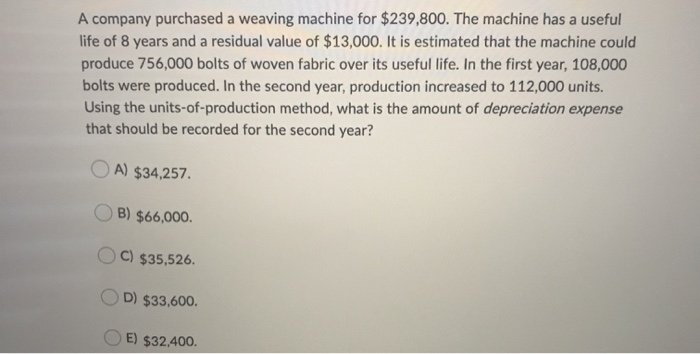

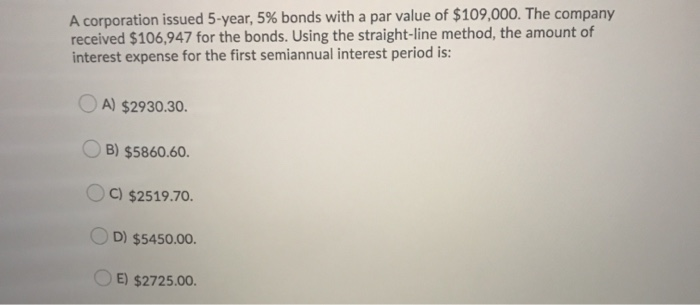

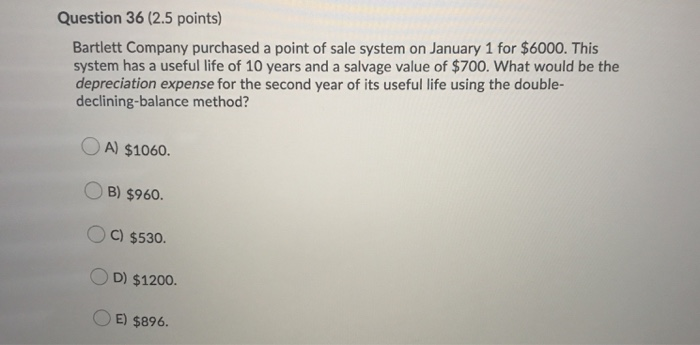

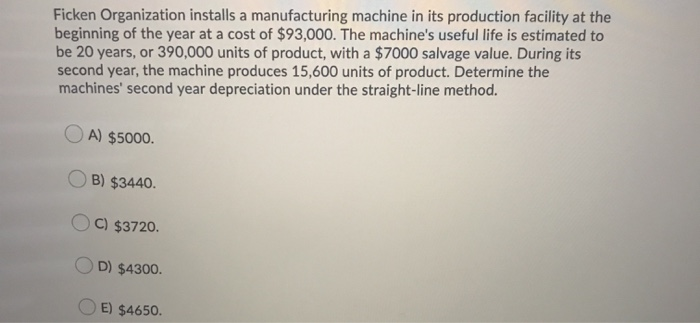

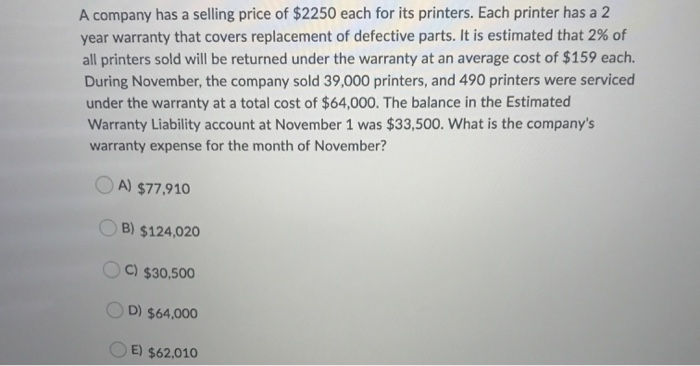

Mercury Business purchased a machine costing $140,000, terms 3/10, n/30. The machine was shipped FOB shipping point and freight charges were $4000. The machine requires special mounting and wiring connections costing $12,000. When installing the machine, $3500 in damages occurred. Compute the cost recorded for this machine assuming Mercury paid within the discount period. OA) $162,800. OB) $151,800. C) $151,300. OD) $152,000. O E) $158,600. An employee earned $62,300 during the year working for an employer. What is the amount of total unemployment taxes the employee must pay? OA) $42.00 OB) $0.00 OC) $56.00 OD) $378.00 E) $420.00 On January 1, Jim Shipping Company issues 9.0%, 10-year bonds with a par value of $3,900,000. The bonds pay interest semiannually. The market rate of interest is 10.0%. The bond issuance should be recorded as: Bonds Payable $3,900,000. B) Debit Cash $3,656,987; debit Interest Expense $243,013; credit Bonds Payable $3,900,000. C) Debit Cash $3,900,000; credit Bonds Payable $3,900,000. D) Debit Cash $3,900,000; credit Bonds Payable $3,656,987; credit Discount on Bonds Payable $243,013. OE) Debit Cash $3,656,987; credit Bonds Payable $3,656,987. A company purchased a weaving machine for $239,800. The machine has a useful life of 8 years and a residual value of $13,000. It is estimated that the machine could produce 756,000 bolts of woven fabric over its useful life. In the first year, 108,000 bolts were produced. In the second year, production increased to 112,000 units. Using the units-of-production method, what is the amount of depreciation expense that should be recorded for the second year? OA) $34,257 OB) $66,000. C) $35,526. OD) $33,600 E) $32,400. A corporation issued 5-year, 5% bonds with a par value of $109,000. The company received $106,947 for the bonds. Using the straight-line method, the amount of interest expense for the first semiannual interest period is: A) $2930.30. B) $5860.60 C) $2519.70. D) $5450.00 E) $2725.00 Question 36 (2.5 points) Bartlett Company purchased a point of sale system on January 1 for $6000. This system has a useful life of 10 years and a salvage value of $700. What would be the depreciation expense for the second year of its useful life using the double- declining-balance method? OA) $1060 OB) $960. C) $530. OD) $1200 E) $896. Ficken Organization installs a manufacturing machine in its production facility at the beginning of the year at a cost of $93,000. The machine's useful life is estimated to be 20 years, or 390,000 units of product, with a $7000 salvage value. During its second year, the machine produces 15,600 units of product. Determine the machines' second year depreciation under the straight-line method. OA) $5000 OB) $3440 OC) $3720. OD) $4300 O E) $4650. A company has a selling price of $2250 each for its printers. Each printer has a 2 year warranty that covers replacement of defective parts. It is estimated that 2% of all printers sold will be returned under the warranty at an average cost of $159 each. During November, the company sold 39,000 printers, and 490 printers were serviced under the warranty at a total cost of $64,000. The balance in the Estimated Warranty Liability account at November 1 was $33,500. What is the company's warranty expense for the month of November? A) $77,910 B) $124,020 C) $30,500 OD) $64,000 E) $62.010