Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mercury Industries Ltd is a debt-free company. Its paid-up share capital comprises of 40 lac shares of face value Rs 10 each. Mercury has now

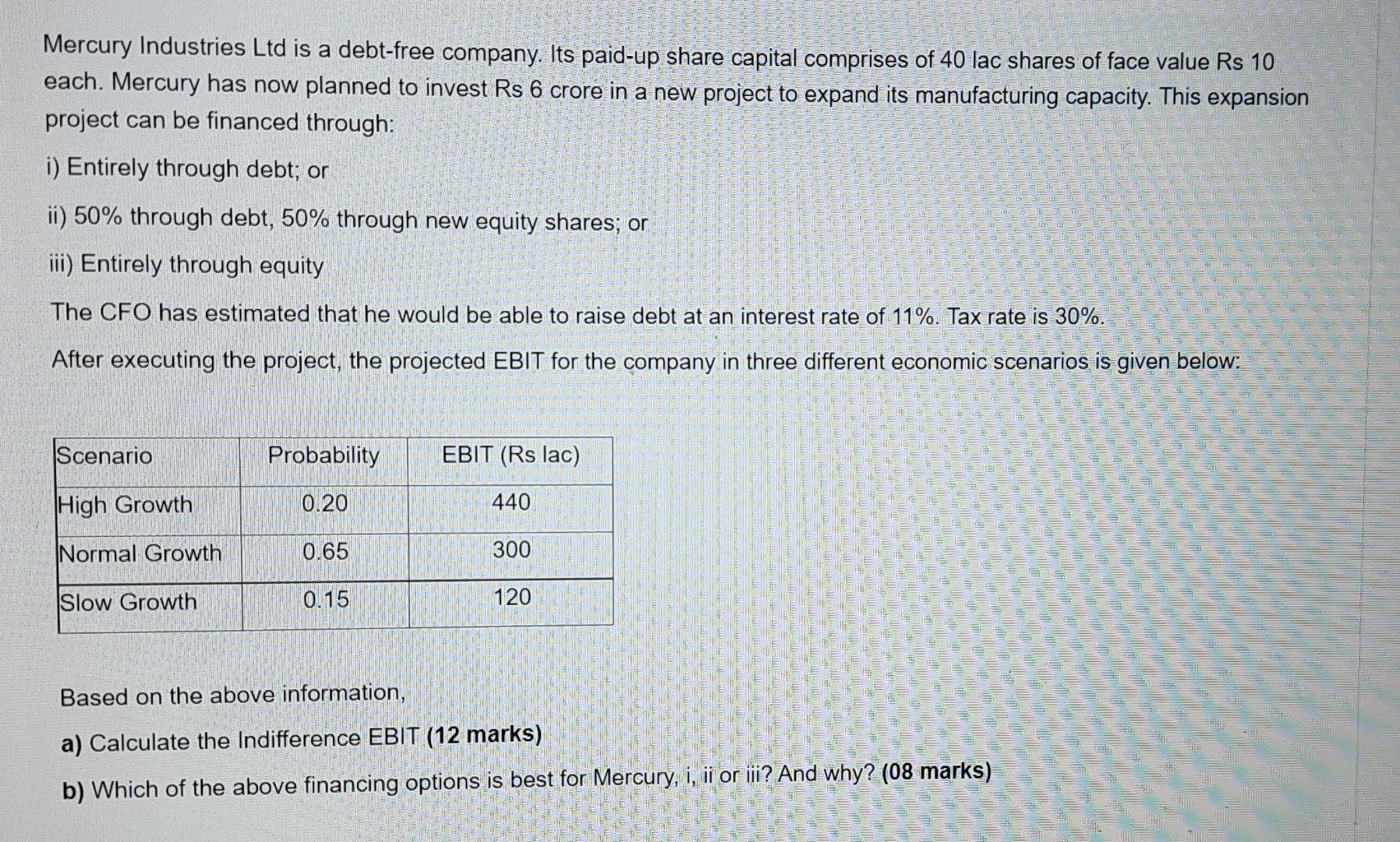

Mercury Industries Ltd is a debt-free company. Its paid-up share capital comprises of 40 lac shares of face value Rs 10 each. Mercury has now planned to invest Rs 6 crore in a new project to expand its manufacturing capacity. This expansion project can be financed through: i) Entirely through debt; or ii) 50% through debt, 50% through new equity shares; or iii) Entirely through equity The CFO has estimated that he would be able to raise debt at an interest rate of 11%. Tax rate is 30%. After executing the project, the projected EBIT for the company in three different economic scenarios is given below. Scenario Probability EBIT (Rs lac) High Growth 0.20 440 Normal Growth 0.65 300 Slow Growth 0.15 120 Based on the above information, a) Calculate the Indifference EBIT (12 marks) b) Which of the above financing options is best for Mercury, i, ii or iji? And why? (08 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started