Answered step by step

Verified Expert Solution

Question

1 Approved Answer

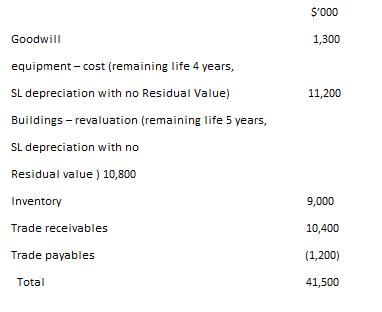

Mercury Limited had decided to dispose of an operation and the operation includes allocated goodwill as follows at 12-31-2019: The fair value of the net

Mercury Limited had decided to dispose of an operation and the operation includes allocated goodwill as follows at 12-31-2019:

The fair value of the net assets of the operation at 12-31-2019 was $40,000 (in thousands) and the estimated costs of selling the company were $1,000 (in thousands).

Requirements:

Assumed that the transaction met the criteria for IFRS 5,

- Indicate whether the disposal group has impairment at 12-31-2019.

- If impaired, determine the allocated amount of impairment to each of the account in the disposal group on 12-31-2019

- Prepare the entries, if any, on 12-31-2019.

- Determine the depreciation amount, if any , on 12-31-2020.

$'000 Goodwill 1,300 equipment - cost (remaining life 4 years, SL depreciation with no Residual Value) 11,200 Buildings - revaluation (remaining life 5 years, SL depreciation with no Residual value ) 10,800 Inventory 9,000 Trade receivables 10,400 Trade payables (1,200) Total 41,500

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

As per IFRS 5 post tax gain or loss on disposal of discontinued operation has ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started