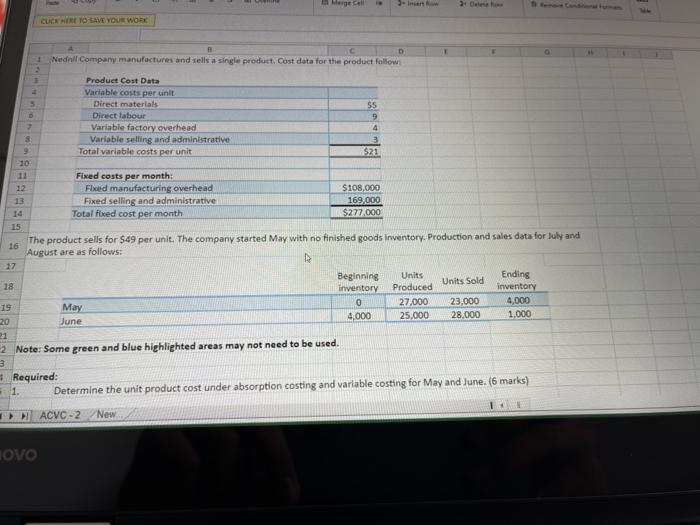

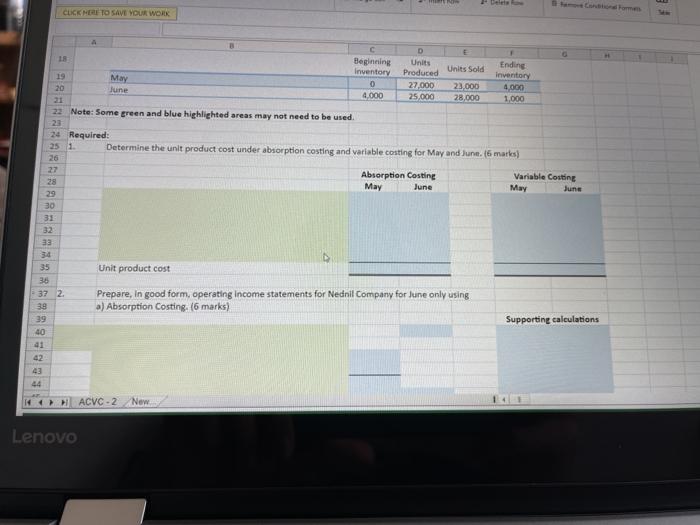

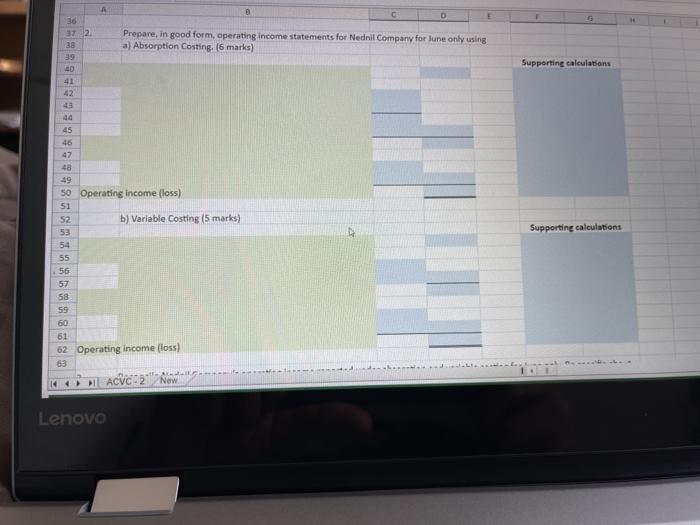

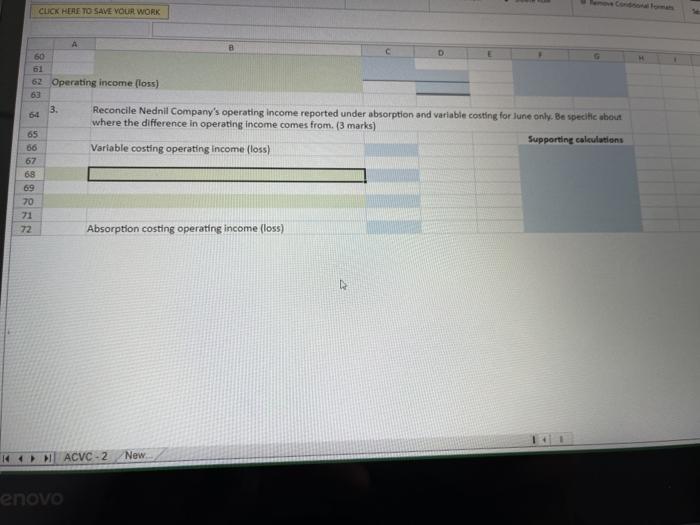

Merge Cell - In CUCK HERE TO SAVE YOUR WORK 1 Nenil Company manufactures and sells a single product, Cost data for the product follow 2 Product Cost Data Variable costs per unit Direct materials Direct labour Variable factory overhead Variable selling and administrative Total variable costs per unit $5 9 4 3 $21 8 -10 11 12 13 Fixed costs per month: Fleed manufacturing overhead Fixed selling and administrative Total fixed cost per month $108,000 169.000 $277.000 15 16 The product sells for $49 per unit. The company started May with no finished goods inventory. Production and sales data for July and August are as follows: 17 18 Units Sold Beginning inventory 0 4,000 Units Produced 27,000 25,000 Ending inventory 4,000 1,000 19 20 May June 23,000 28,000 2 Note: Some green and blue highlighted areas may not need to be used. 3 Required: 1. Determine the unit product cost under absorption costing and variable costing for May and June (6 marks) ACVC -2 New TOVO CLICK HERE TO SAVE YOUR WORK D 18 Beginning Units Inventory Ending Units Sold Produced Inventory 19 May 0 20 27.000 23.000 4.000 June 4.000 25,000 28,000 1.000 22 Note: Some green and blue highlighted areas may not need to be used 23 24 Required: Determine the unit product cost under absorption costing and variable costing for May and June (6 marts) 26 27 Absorption Costing Variable Couting 28 May June May June 29 30 31 Unit product cost 33 34 35 36 37 2. 39 39 40 Prepare, in good form, operating income statements for Nednil Company for June only using a) Absorption Costing. (6 marks) Supporting calculations 42 43 44 II ACVC -2 New Lenovo 36 37 2 Prepare, in good form, operating income statements for Nednil Company for Jure only using a) Absorption Costing. (6 marks) 39 Supporting calculations 40 42 45 46 47 Supporting calculations 49 50 Operating income (loss) 51 52 b) Variable Costing (5 marks) 53 54 55 56 57 58 59 60 61 62 Operating income (loss) 63 HACVC 2 Now Lenovo CLICK HERE TO SAVE YOUR WORK A 60 D 62 Operating income (loss) 63 64 3. Reconcile Nednil Company's operating income reported under absorption and variable costing for lune only. Be specific about where the difference in operating Income comes from. (3 marks) 65 Supporting calculations 06 Variable costing operating Income (loss) 67 68 70 72 Absorption costing operating income (loss) KACVC - 2 New enovo