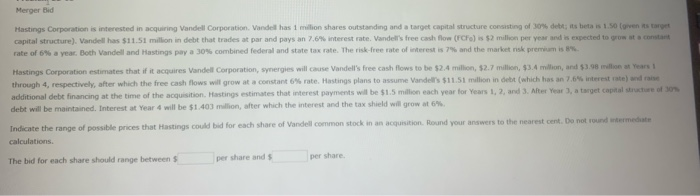

Merger Bid Hastings Corporation is interested in acquiring Vandell Corporation Vandell has 1 milion shares outstanding and a target capital structure consisting of 30% de s tetas 1.soren start capital structure). Vandell has $11.51 million in debt that trades at parand paysan 7.6% interest rate. Vandelsfree cash flow (FCF) is $2 million per year and is expected to grow at constant rate of 6% a year. Both Vandell and Hastings pay a 30% combined federal and state tax rate. The risk-free rate of w resti 7% and the market risk prem is Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell's free cash flows to be $2.4 million $2.7 million $3.4 million, and $3.98 m Years 1 through 4, respectively, after which the free cash flows will grow at a constant 6% rate. Hastings plans to assume Vander's $11.5 million in debt (which has an 7.6% interest rated additional debt financing at the time of the acquisition Hastings estimates that interest payments will be $1.5 million each year for Years 1, 2, and 3. Alter Year), a target capital of debt will be maintained. Interest at Year 4 will be $1.403 million, after which the interest and the tax shield will grow at 6% Indicate the range of possible prices that Hastings could bid for each share of Vandell common stock in an acquisition Round your answers to the nearest cent. Do not undermediate calculations. The bid for each share should range between $ per share and $ per share. Merger Bid Hastings Corporation is interested in acquiring Vandell Corporation Vandell has 1 milion shares outstanding and a target capital structure consisting of 30% de s tetas 1.soren start capital structure). Vandell has $11.51 million in debt that trades at parand paysan 7.6% interest rate. Vandelsfree cash flow (FCF) is $2 million per year and is expected to grow at constant rate of 6% a year. Both Vandell and Hastings pay a 30% combined federal and state tax rate. The risk-free rate of w resti 7% and the market risk prem is Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell's free cash flows to be $2.4 million $2.7 million $3.4 million, and $3.98 m Years 1 through 4, respectively, after which the free cash flows will grow at a constant 6% rate. Hastings plans to assume Vander's $11.5 million in debt (which has an 7.6% interest rated additional debt financing at the time of the acquisition Hastings estimates that interest payments will be $1.5 million each year for Years 1, 2, and 3. Alter Year), a target capital of debt will be maintained. Interest at Year 4 will be $1.403 million, after which the interest and the tax shield will grow at 6% Indicate the range of possible prices that Hastings could bid for each share of Vandell common stock in an acquisition Round your answers to the nearest cent. Do not undermediate calculations. The bid for each share should range between $ per share and $ per share