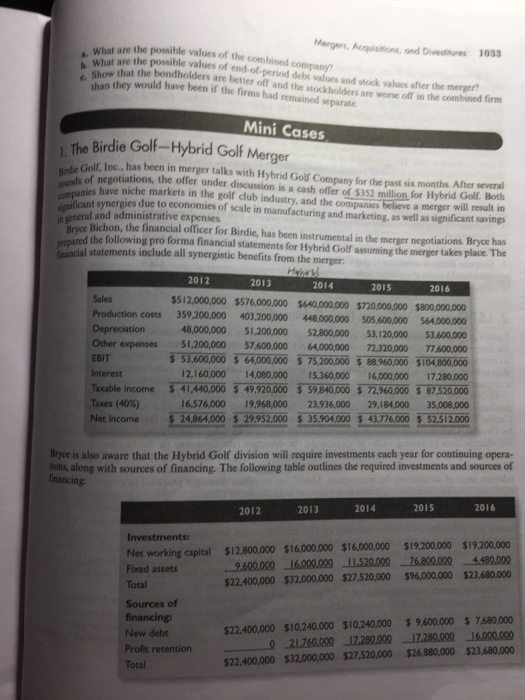

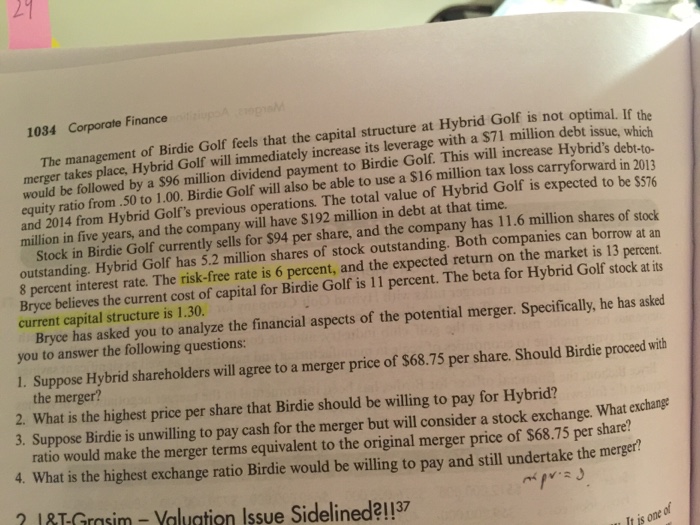

Mergers, Aisitions, and Divedures 1033 What are the posible values of the combined company what are the possible values of end-of-period debi values and stock values after the merger Show that the bondholders are better off and the stockholders are worse off in the combined firm han they would have been if the firms had remained separate e. Show that the Mini Cases The Birdie Golf-Hybrid Golf Merger Bindie Golf, Golf, Inc., has been in merger talks with Hybrid Golf Company for the past six months After several qiods of negotiations, the olfer under discussion is a cash offer of $352 milion for Hybrid Golf. Both eies have niche markets in the golf club industry, and the companics nifcant ynee iche aeneral and administrative expenses believe a merger will result in icant synergies due to economies of scale in manufacturing and marketing, as well as significant savings Bichon, the financial officer for Birdie, has been instrumental in the merger negotiations Bryce has the following pro forma financial statements for Hybrid Golf assuming the merger takes place. The ieancial statements include all synergistic benefits from the merger 2012 2013 2014 2015 2016 Sales 512,000,000 $576,000,000 $640,000,000 $720,000,000 $800,000,000 Production costs 359,200,000 403,200,000 448,000,000 505,600,000 564000,000 48,000,000 51,200,000 52,800,000 53,120,000 53,600,000 Other expenses 51,200,000 57600,000 64,000,000 72,320,000 77,600,000 3.600,000 $ 64,000 000 $ 75.200.000 $ 88960 000 $104,800,000 2,160,00014,080,000 15,360.000 16.000,000 17.280,000 Taxable income $ 41,440,000 3 49.920,000 59,840,000 72,60000 5 87 520,000 6,576,000 19,968,000 23,936000 29,184,000 35,008.000 tion EBIT Interest Taxes (40%) Net income 248641000 23552 000 5 35.504000 5 43,76.00 5 5251200 Bryce is also aware that the Hybrid Golf division will require investments each year for continuing opera- lon, along with sources of financing. The following table outlines the required investments and sources of ng: 2012 2013 2014 2015 2016 Net working capital $12,800,000 $16,000,.000 $16,000,000 $19,200,000 $19,200,000 Fixed assets Total Sources of financing New debt ..2600.000-16,000,000-11520.000-76800000-448000 22,400,000 $32.000,000 $27,520,000 $96,000,000 $23,680,000 22,400,000 $10,240000 $10.240,000 $9,600,000 $ 7.680,000 Profit retention Total .0 1.7600007.280.000-17280.000-16.000.000 22,400,000 $32,000,000 $27,520,000 $26,880,000 $23,680,000