Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Merry Mitten Maltsters Inc. is in the business of converting Michigan grown wheat and barley and processing it into malt for use in microbreweries across

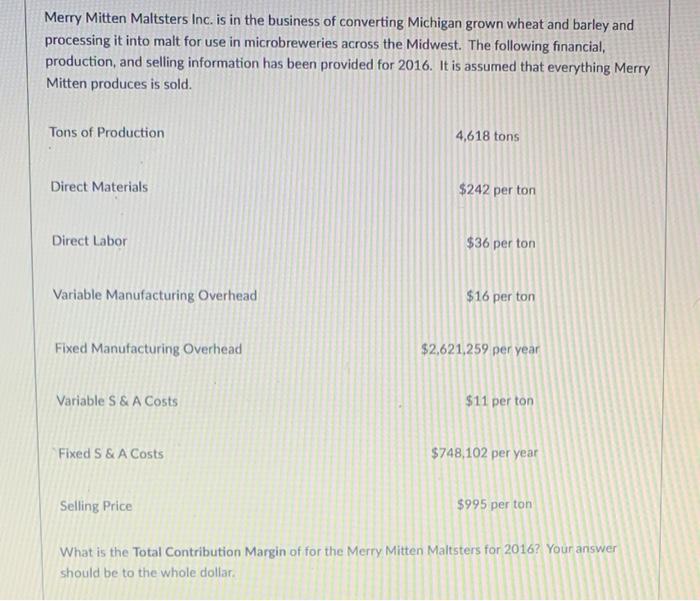

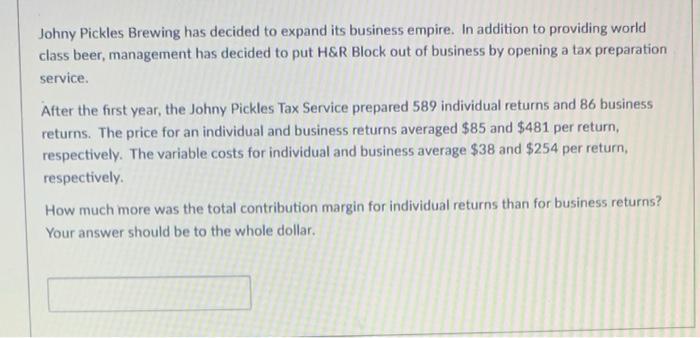

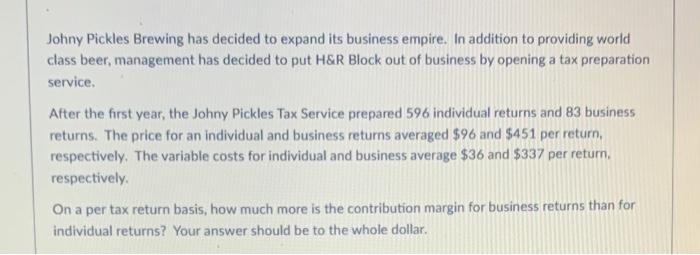

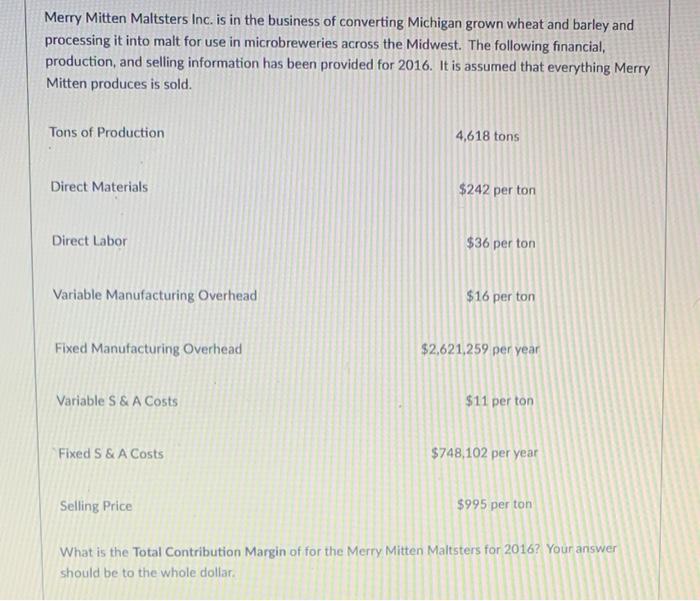

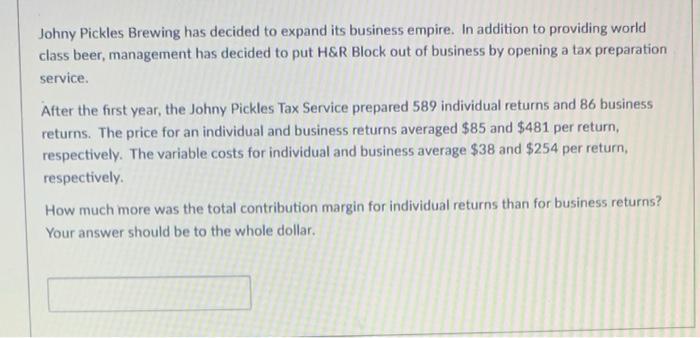

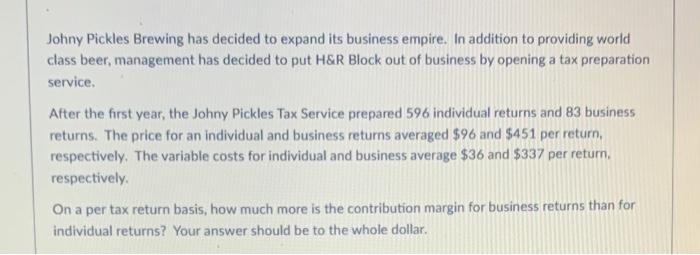

Merry Mitten Maltsters Inc. is in the business of converting Michigan grown wheat and barley and processing it into malt for use in microbreweries across the Midwest. The following financial, production, and selling information has been provided for 2016. It is assumed that everything Merry Mitten produces is sold. Tons of Production 4,618 tons Direct Materials $242 per ton Direct Labor $36 per ton Variable Manufacturing Overhead $16 per ton Fixed Manufacturing Overhead $2,621,259 per year Variable S & A Costs $11 per ton Fixed S & A Costs $748,102 per year Selling Price $995 per ton What is the Total Contribution Margin of for the Merry Mitten Maltsters for 2016? Your answer should be to the whole dollar. Johny Pickles Brewing has decided to expand its business empire. In addition to providing world class beer, management has decided to put H&R Block out of business by opening a tax preparation service. After the first year, the Johny Pickles Tax Service prepared 589 individual returns and 86 business returns. The price for an individual and business returns averaged $85 and $481 per return, respectively. The variable costs for individual and business average $38 and $254 per return, respectively How much more was the total contribution margin for individual returns than for business returns? Your answer should be to the whole dollar. Johny Pickles Brewing has decided to expand its business empire. In addition to providing world class beer, management has decided to put H&R Block out of business by opening a tax preparation service. After the first year, the Johny Pickles Tax Service prepared 596 individual returns and 83 business returns. The price for an individual and business returns averaged $96 and $451 per return, respectively. The variable costs for individual and business average $36 and $337 per return. respectively. On a per tax return basis, how much more is the contribution margin for business returns than for individual returns? Your answer should be to the whole dollar

Merry Mitten Maltsters Inc. is in the business of converting Michigan grown wheat and barley and processing it into malt for use in microbreweries across the Midwest. The following financial, production, and selling information has been provided for 2016. It is assumed that everything Merry Mitten produces is sold. Tons of Production 4,618 tons Direct Materials $242 per ton Direct Labor $36 per ton Variable Manufacturing Overhead $16 per ton Fixed Manufacturing Overhead $2,621,259 per year Variable S & A Costs $11 per ton Fixed S & A Costs $748,102 per year Selling Price $995 per ton What is the Total Contribution Margin of for the Merry Mitten Maltsters for 2016? Your answer should be to the whole dollar. Johny Pickles Brewing has decided to expand its business empire. In addition to providing world class beer, management has decided to put H&R Block out of business by opening a tax preparation service. After the first year, the Johny Pickles Tax Service prepared 589 individual returns and 86 business returns. The price for an individual and business returns averaged $85 and $481 per return, respectively. The variable costs for individual and business average $38 and $254 per return, respectively How much more was the total contribution margin for individual returns than for business returns? Your answer should be to the whole dollar. Johny Pickles Brewing has decided to expand its business empire. In addition to providing world class beer, management has decided to put H&R Block out of business by opening a tax preparation service. After the first year, the Johny Pickles Tax Service prepared 596 individual returns and 83 business returns. The price for an individual and business returns averaged $96 and $451 per return, respectively. The variable costs for individual and business average $36 and $337 per return. respectively. On a per tax return basis, how much more is the contribution margin for business returns than for individual returns? Your answer should be to the whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started