Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MERS 9 Financial Instruments introduces a business model test that requires an entity to assess whether its business objective for a debt instrument is to

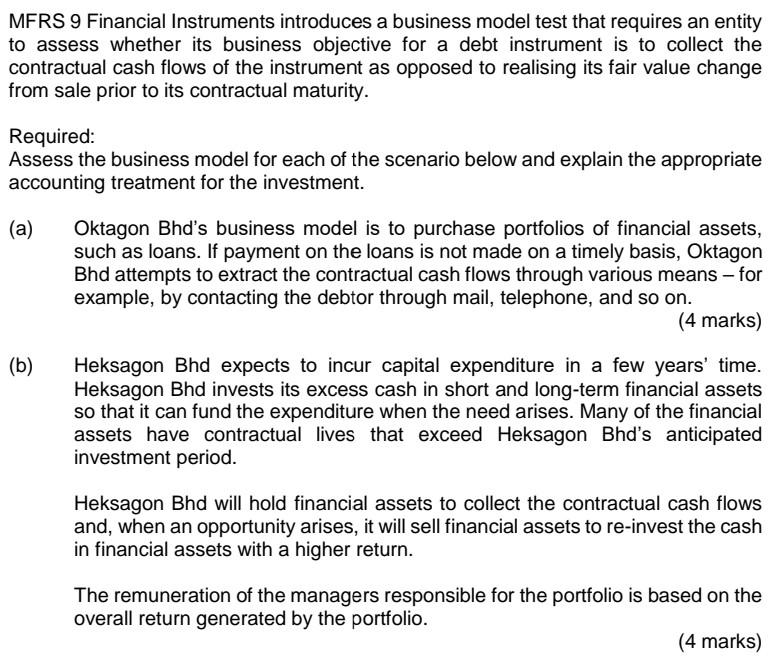

MERS 9 Financial Instruments introduces a business model test that requires an entity to assess whether its business objective for a debt instrument is to collect the contractual cash flows of the instrument as opposed to realising its fair value change from sale prior to its contractual maturity. Required: Assess the business model for each of the scenario below and explain the appropriate accounting treatment for the investment. (a) Oktagon Bhd's business model is to purchase portfolios of financial assets, such as loans. If payment on the loans is not made on a timely basis, Oktagon Bhd attempts to extract the contractual cash flows through various means - for example, by contacting the debtor through mail, telephone, and so on. (4 marks) - (b) Heksagon Bhd expects to incur capital expenditure in a few years' time. Heksagon Bhd invests its excess cash in short and long-term financial assets so that it can fund the expenditure when the need arises. Many of the financial assets have contractual lives that exceed Heksagon Bhd's anticipated investment period. Heksagon Bhd will hold financial assets to collect the contractual cash flows and, when an opportunity arises, it will sell financial assets to re-invest the cash in financial assets with a higher return. The remuneration of the managers responsible for the portfolio is based on the overall return generated by the portfolio. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started