Answered step by step

Verified Expert Solution

Question

1 Approved Answer

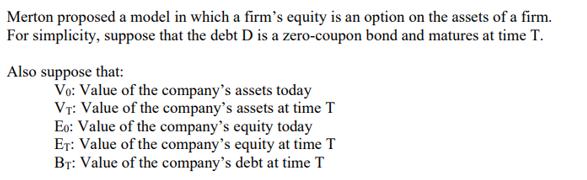

Merton proposed a model in which a firm's equity is an option on the assets of a firm. For simplicity, suppose that the debt

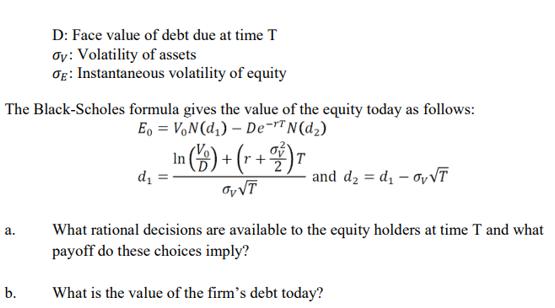

Merton proposed a model in which a firm's equity is an option on the assets of a firm. For simplicity, suppose that the debt D is a zero-coupon bond and matures at time T. Also suppose that: Vo: Value of the company's assets today VT: Value of the company's assets at time T Eo: Value of the company's equity today ET: Value of the company's equity at time T BT: Value of the company's debt at time T The Black-Scholes formula gives the value of the equity today as follows: Eo VoN(d)-De-T N(d) a. D: Face value of debt due at time T dy: Volatility of assets Og: Instantaneous volatility of equity b. d = In ()+(+)T ovT and d=d - ovT What rational decisions are available to the equity holders at time T and what payoff do these choices imply? What is the value of the firm's debt today?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Ans a Value of equity today is given by Black Scholes option pricing formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started