Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Merzin Unit Trust (MUT) was established in 2015 and invested its fund in shares and fixed deposits. In January 2020, MUT purchased a building and

Merzin Unit Trust (MUT) was established in 2015 and invested its fund in shares and fixed deposits. In January 2020, MUT purchased a building and has installed a generator before the building can be rented out. The cost of the generator installation is amounted to RM800,000 and RM1,000,000 for the cost of preparing and levelling the land.

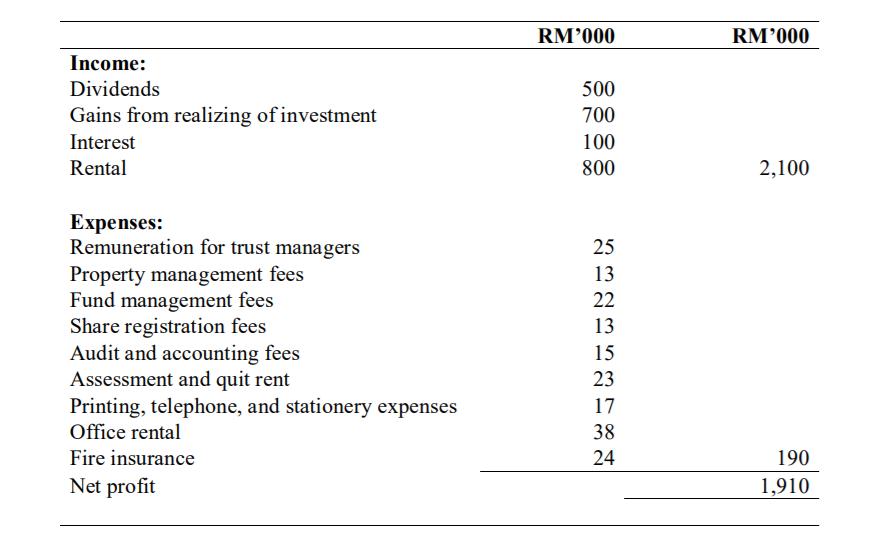

The profit and loss account for MUT for the year ended 31 December 2020 is as follows:

REQUIRED:

Compute tax payable by Merzin Unit Trust for the year assessment 2020.

RM'000 RM'000 Income: Dividends 500 Gains from realizing of investment 700 Interest 100 Rental 800 2,100 Expenses: Remuneration for trust managers 25 Property management fees Fund management fees Share registration fees Audit and accounting fees Assessment and quit rent 13 22 13 15 23 Printing, telephone, and stationery expenses 17 Office rental 38 Fire insurance 24 190 Net profit 1,910

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Computation of tax payable by Me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started