Question

MesoPetrolia Naziha Murad ran the 7th largest refinery in the Majnoon oil fields of Iraq. The refinery was a division of MesoPetrolia, who removes crude

MesoPetrolia Naziha Murad ran the 7th largest refinery in the Majnoon oil fields of Iraq. The refinery was a division of MesoPetrolia, who removes crude oil from the land through their Extraction Division, and refines and sells products through Murads Division ( Refinery Division), and sells to internal and external buyers. An example of an internal buyer was the Commercial Asphalt Division. Murads Refinery Division can purchase crude oil from the inhouse Extraction Division or third -party sellers in the region, the same way they can sell to internal or external buyers.

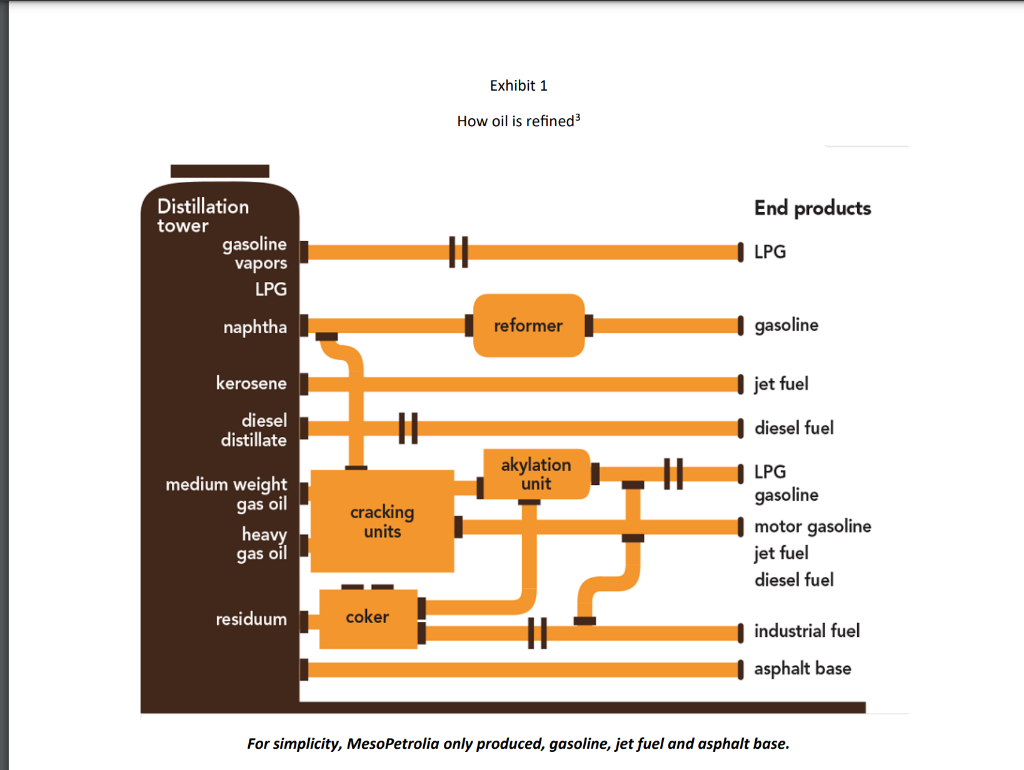

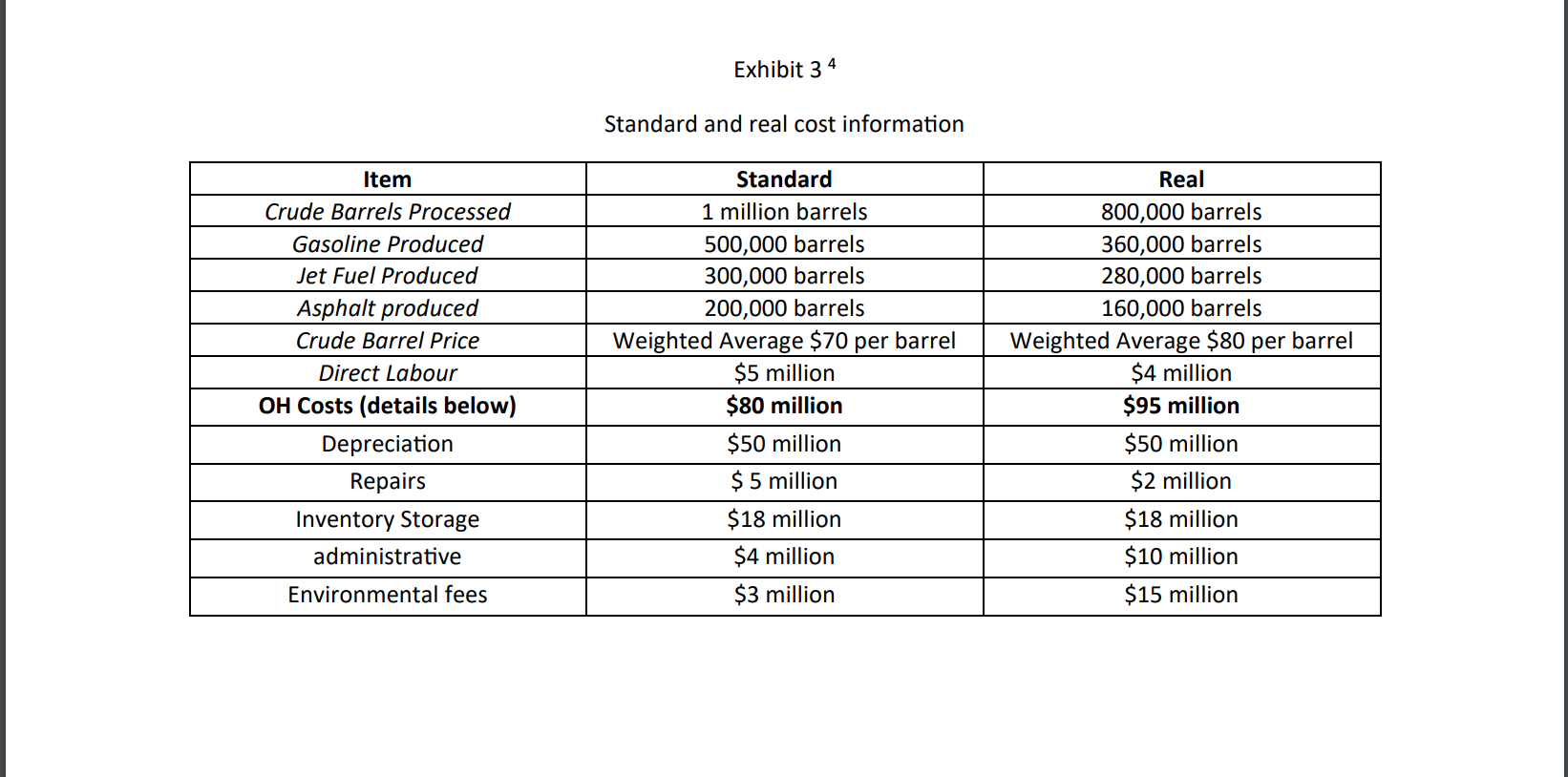

Refining oil involves heating the crude oil to separate out components based on their boiling points, see Exhibit 1 for more information on oil refinement. Murads Refining Division heats and separates the crude oil. Then they can sell the petroleum products to various distributors such as gas stations, jet fuel firms, and asphalt producers. In Murads Division, 50% of crude oil becomes gasoline, 30% becomes jet fuel, and 20% goes into asphalt production. Murads refining facility typically processes 1 million crude oil barrels per year1 . The production process uses little direct labour, but Murad attributes $5 million of direct labour per year to the barrel loaders who empty crude oil barrels into the refinery process and allocates these direct labour costs proportionally to product outcome. The total overhead cost of operating the refinery is $80 million per year which also would be distributed proportionally to product outcomes.

Jet Fuel MesoPetrolia sells jet fuel directly to Erbil International Airports fuel service business. This fuel was to be sold to various airlines and local pilots. Given demand in the market, Murad feels they could price the fuel using total cost + pricing.

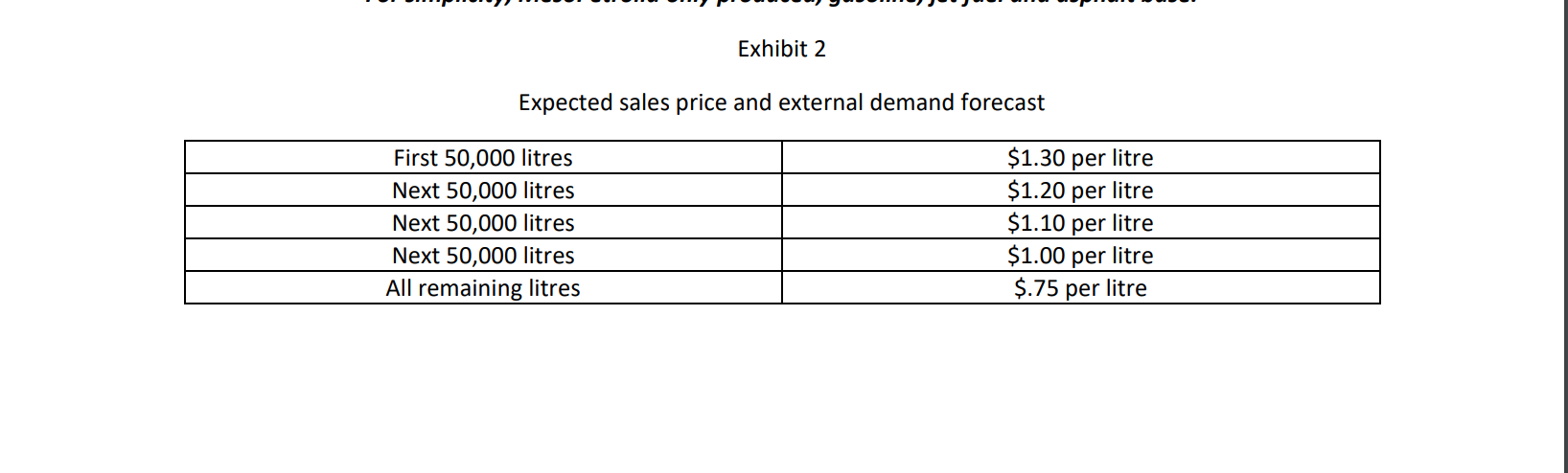

Question 1. Create a chart exploring what prices to set for all combinations of the following scenarios: The price per barrel of crude oil is $60, $80, and $90 per barrel. The desired margin is 10% and 20%. Additionally, if the desired markup is 10% and 30%. Please indicate in your chart your initial finding for total cost per litre in the chart. Jet Fuel (Continued) Murad has the opportunity to invest in a filtration system to increase the purity of the kerosene used in the jet fuel. This would enable a higher price from the buyers. Currently Murad is able to charge a 10% margin into the price using total cost + pricing (Assume your answer from Question 1 is the current price), but with this change she would be able to charge the 30% markup on the original total cost (Assume your answer from Question 1 is correct). This would take an investment of $10 million dollars for equipment lasting five years and an annual operating expense for the filters of $800,000. In addition, each litre of jet fuel needs a trace amount of stabilizer added that cost $0.50 per litre.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started