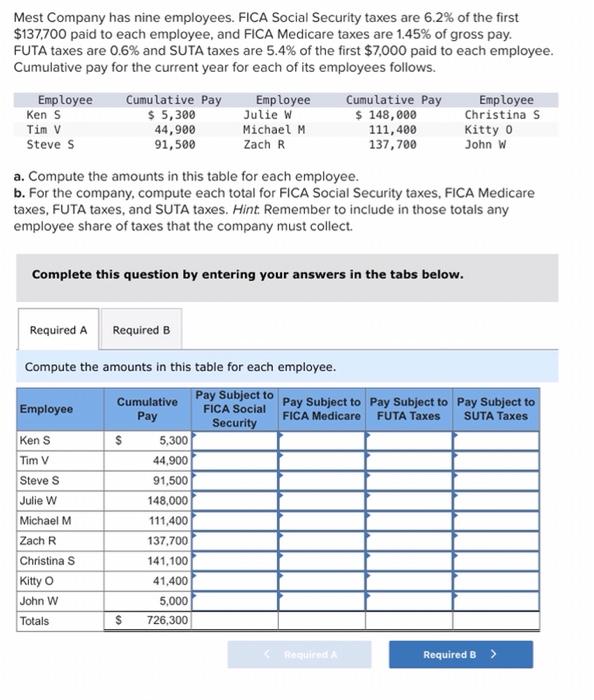

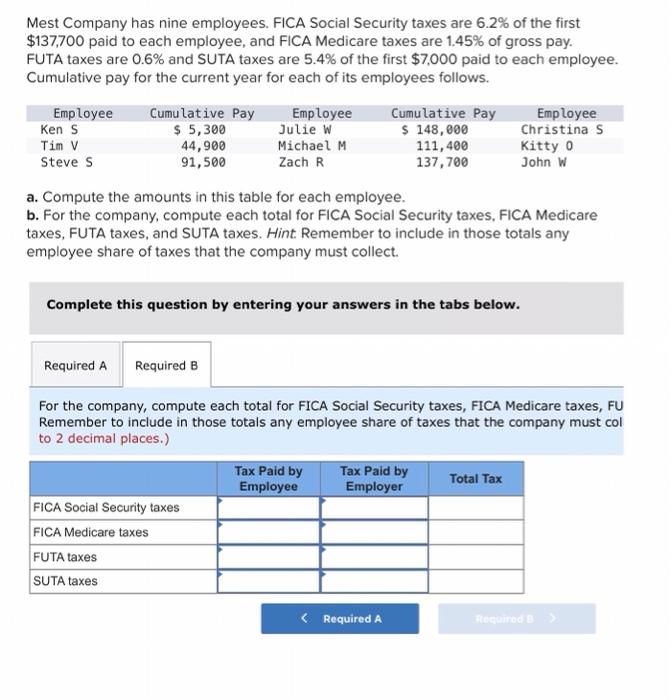

Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Employee Cumulative Pay Employee Ken S $ 5,300 Julie W $ 148,000 Christina s Tim v 44,900 Michael M 111,400 Kitty 0 Steve S 91,500 Zach R 137,700 John W a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint. Remember to include in those totals any employee share of taxes that the company must collect. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amounts in this table for each employee. Employee Pay Subject to Cumulative Pay Subject to Pay Subject to Pay Subject to FICA Social Pay Security FICA Medicare FUTA Taxes SUTA Taxes Ken S $ 5,300 Tim V 44,900 Steve S 91,500 Julie W 148,000 Michael M 111,400 Zach R 137.700 Christina S 141,100 Kitty o 41,400 John W 5,000 Totals $ 726,300 Regu Required B > Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Employee Cumulative Pay Employee Ken S $ 5,300 Julie W $ 148,000 Christina s Tim v 44,900 Michael M 111,400 Kitty o Steve S 91,500 Zach R 137,700 John W a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint. Remember to include in those totals any employee share of taxes that the company must collect. Complete this question by entering your answers in the tabs below. Required A Required B For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FU Remember to include in those totals any employee share of taxes that the company must col to 2 decimal places.) Tax Paid by Tax Paid by Employee Employer Total Tax FICA Social Security taxes FICA Medicare taxes FUTA taxes SUTA taxes