Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Metallic, Inc., produces metal gates in two processes: bending, in which metal is bent to the correct shape, and welding, in which the bent

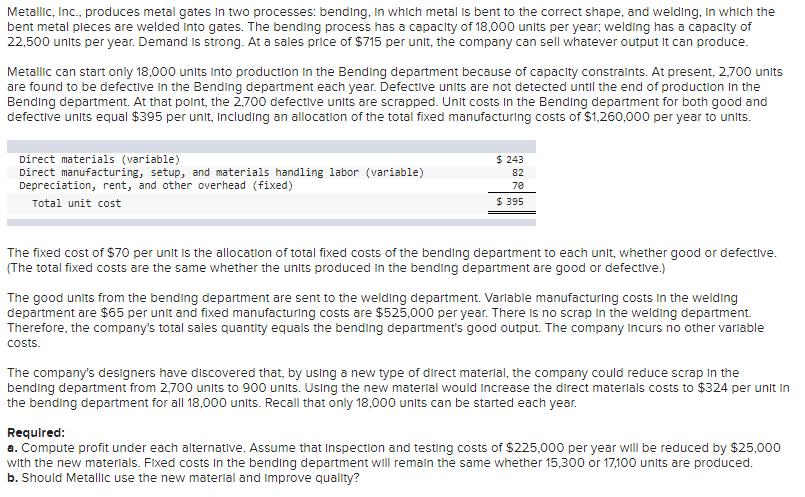

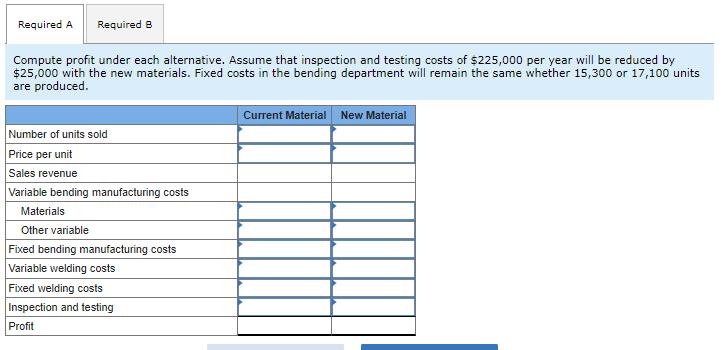

Metallic, Inc., produces metal gates in two processes: bending, in which metal is bent to the correct shape, and welding, in which the bent metal pleces are welded into gates. The bending process has a capacity of 18,000 units per year; welding has a capacity of 22,500 units per year. Demand is strong. At a sales price of $715 per unit, the company can sell whatever output it can produce. Metallic can start only 18,000 units Into production in the Bending department because of capacity constraints. At present, 2,700 units are found to be defective in the Bending department each year. Defective units are not detected until the end of production in the Bending department. At that point, the 2,700 defective units are scrapped. Unit costs in the Bending department for both good and defective units equal $395 per unit, including an allocation of the total fixed manufacturing costs of $1,260,000 per year to units. Direct materials (variable) Direct manufacturing, setup, and materials handling labor (variable) Depreciation, rent, and other overhead (fixed) Total unit cost $ 243 82 78 $ 395 The fixed cost of $70 per unit is the allocation of total fixed costs of the bending department to each unit, whether good or defective. (The total fixed costs are the same whether the units produced in the bending department are good or defective.) The good units from the bending department are sent to the welding department. Varlable manufacturing costs in the welding department are $65 per unit and fixed manufacturing costs are $525,000 per year. There is no scrap in the welding department. Therefore, the company's total sales quantity equals the bending department's good output. The company Incurs no other variable costs. The company's designers have discovered that, by using a new type of direct material, the company could reduce scrap in the bending department from 2,700 units to 900 units. Using the new material would increase the direct materials costs to $324 per unit in the bending department for all 18,000 units. Recall that only 18,000 units can be started each year. Required: a. Compute profit under each alternative. Assume that inspection and testing costs of $225,000 per year will be reduced by $25,000 with the new materials. Fixed costs in the bending department will remain the same whether 15,300 or 17,100 units are produced. b. Should Metallic use the new material and improve quality? Required A Required B Compute profit under each alternative. Assume that inspection and testing costs of $225,000 per year will be reduced by $25,000 with the new materials. Fixed costs in the bending department will remain the same whether 15,300 or 17,100 units are produced. Number of units sold Price per unit Sales revenue Variable bending manufacturing costs Materials Other variable Fixed bending manufacturing costs Variable welding costs Fixed welding costs Inspection and testing Profit Current Material New Material

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the profit under each alternative we need to calculate the relevant costs and revenues for both the current material and the new material Well assume that inspection and testing costs will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started