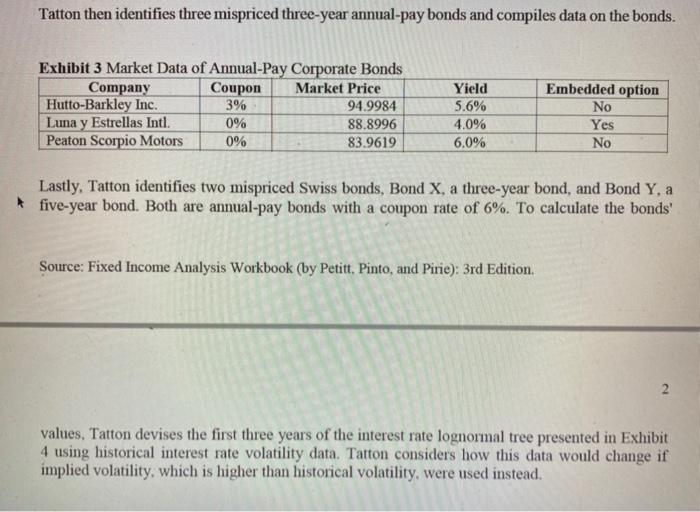

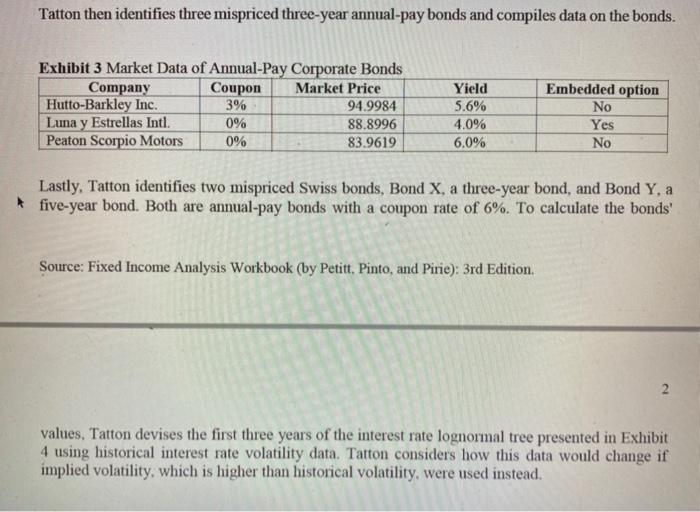

Method 1 would most likely not be an appropriate valuation technique for the bond issued by: A Peaton Scorpio Motors . B Luna y Estrellas Intl. C Hutto - Barkley Inc. Tatton then identifies three mispriced three-year annual-pay bonds and compiles data on the bonds. Exhibit 3 Market Data of Annual-Pay Corporate Bonds Company Coupon Market Price Hutto-Barkley Inc. 3% 94.9984 Luna y Estrellas Intl. 0% 88.8996 Peaton Scorpio Motors 0% 83.9619 Yield 5.6% 4.0% 6.0% Embedded option No Yes No Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y. a five-year bond. Both are annual-pay bonds with a coupon rate of 6%. To calculate the bonds' Source: Fixed Income Analysis Workbook (by Petitt. Pinto, and Pirie): 3rd Edition. 2 values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead. Method 1 would most likely not be an appropriate valuation technique for the bond issued by: A Peaton Scorpio Motors . B Luna y Estrellas Intl. C Hutto - Barkley Inc. Tatton then identifies three mispriced three-year annual-pay bonds and compiles data on the bonds. Exhibit 3 Market Data of Annual-Pay Corporate Bonds Company Coupon Market Price Hutto-Barkley Inc. 3% 94.9984 Luna y Estrellas Intl. 0% 88.8996 Peaton Scorpio Motors 0% 83.9619 Yield 5.6% 4.0% 6.0% Embedded option No Yes No Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y. a five-year bond. Both are annual-pay bonds with a coupon rate of 6%. To calculate the bonds' Source: Fixed Income Analysis Workbook (by Petitt. Pinto, and Pirie): 3rd Edition. 2 values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead