Answered step by step

Verified Expert Solution

Question

1 Approved Answer

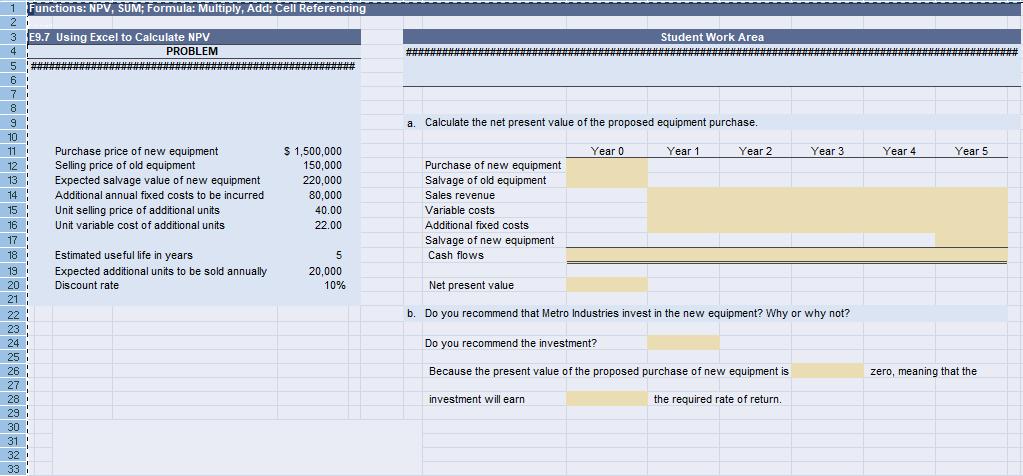

Metro Industries is considering the purchase of new equipment to replace existing equipment that will be sold at the end of its life. During the

- Metro Industries is considering the purchase of new equipment to replace existing equipment that will be sold at the end of its life. During the period of its use, the equipment will allow the company to produce and sell additional units. Information concerning the capital budgeting proposal follows:

1 Functions: NPV, SUM; Formula: Multiply, Add; Cell Referencing 21 3 E9.7 Using Excel to Calculate NPV 4 PROBLEM 5 ####### 6 7 i 8 9 10 ! 11 12 13 14 15 16 17 18 19 i 20 21 22 23 24 25 i 26 27 1 28 29 i 30 31 32 33 Purchase price of new equipment Selling price of old equipment Expected salvage value of new equipment Additional annual fixed costs to be incurred Unit selling price of additional units Unit variable cost of additional units Estimated useful life in years. Expected additional units to be sold annually Discount rate $ 1,500,000 150,000 220,000 80,000 40.00 22.00 5 20,000 10% a. Calculate the net present value of the proposed equipment purchase. Purchase of new equipment. Salvage of old equipment Sales revenue Variable costs Additional fixed costs. Salvage of new equipment Cash flows Net present value Student Work Area Year 0 investment will earn Year 1 Year 2 b. Do you recommend that Metro Industries invest in the new equipment? Why or why not? Do you recommend the investment? Because the present value of the proposed purchase of new equipment is Year 3 the required rate of return. Year 4 Year 5 zero, meaning that the

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the net present value of the proposed equipment purchase To calculate the net present value NPV of the proposed equipment purchase we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started