Answered step by step

Verified Expert Solution

Question

1 Approved Answer

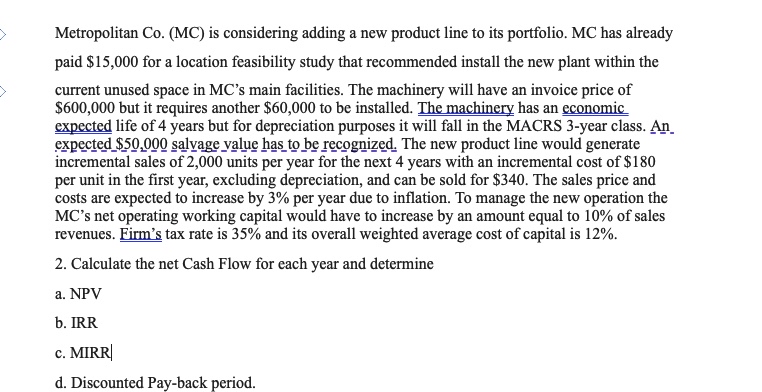

Metropolitan Co . ( MC ) is considering adding a new product line to its portfolio. M C has already paid $ 1 5 ,

Metropolitan CoMC is considering adding a new product line to its portfolio. has already paid $ for a location feasibility study that recommended install the new plant within the current unused space in MCs main facilities. The machinery will have an invoice price of $ but it requires another $ to be installed. The machinery has an economic expected life of years but for depreciation purposes it will fall in the MACRS year class. An expected $ salvage yalue has to be recognized. The new product line would generate incremental sales of units per year for the next years with an incremental cost of $ per unit in the first year, excluding depreciation, and can be sold for $ The sales price and costs are expected to increase by per year due to inflation. To manage the new operation the MCs net operating working capital would have to increase by an amount equal to of sales revenues. Firm's tax rate is and its overall weighted average cost of capital is

Calculate the net Cash Flow for each year and determine

a NPV

b IRR

c MIRR

d Discounted Payback period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started