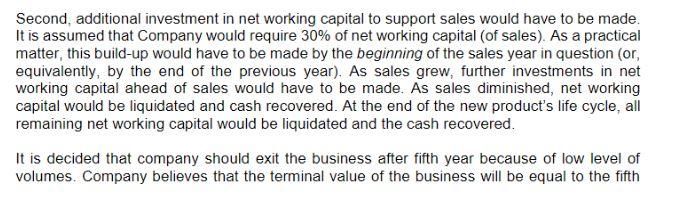

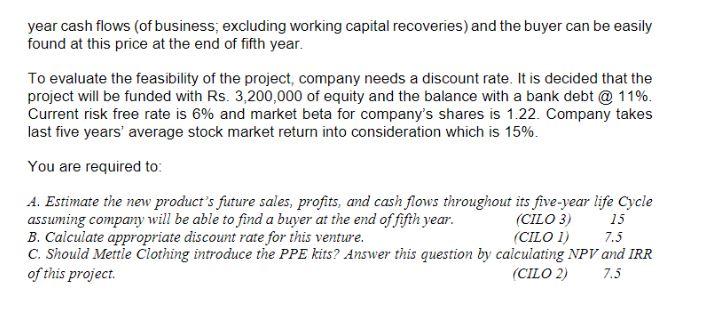

Mettal Clothing Limited has been in the business of apparel business for last ten years with Mettal range of clothing line for men, women and kids. Sales has been on the steady path in recent years. In 2019, Mettal hired DX consultants for expanding in new lines of businesses in the same industry and paid Rupees 2.5 million as fee. In March 2019, the world faced unprecedented situation of COVID 19 which also threatened the business model of Mettal. To convert this threat into an opportunity, company quickly decided to diversify in the manufacturing of personal protection equipment (PPE) kits. Company expected to reach sales of Rs. 18 million in its first full financial year, and 20 million of sales in the second year. Because of intense competition and slowing down of the pandemic, it is expected that the sale will come down to 90% of the peak in the third year and company will see the decline of 25% (of third year) in the fourth year and 50% (of fourth year) in fifth year. Based on its recent experience, cost of sales for the new product were expected to be 60% of total annual sales revenue during each year of its life cycle. Selling, general, and administrative expenses were expected to be 25% of total annual sales. Taxes on profits generated by the new product would be paid at a 40% rate. To launch the new product, Company decided to form a subsidiary and it would have to incur immediate cash outlays of two types. First, it would have to invest Rs. 1,000,000 in specialized new production equipment. This capital investment would be fully depreciated on a straightline basis over the five-year anticipated life cycle of the new product. It was not expected to have any material salvage value at the end of its depreciable life. No further fixed capital expenditures were required after the initial purchase of equipment. Second, additional investment in net working capital to support sales would have to be made. It is assumed that Company would require 30% of net working capital (of sales). As a practical matter, this build-up would have to be made by the beginning of the sales year in question (or, equivalently, by the end of the previous year). As sales grew, further investments in net working capital ahead of sales would have to be made. As sales diminished, net working capital would be liquidated and cash recovered. At the end of the new product's life cycle, all remaining net working capital would be liquidated and the cash recovered. It is decided that company should exit the business after fifth year because of low level of volumes. Company believes that the terminal value of the business will be equal to the fifth year cash flows (of business; excluding working capital recoveries) and the buyer can be easily found at this price at the end of fifth year. To evaluate the feasibility of the project, company needs a discount rate. It is decided that the project will be funded with Rs. 3,200,000 of equity and the balance with a bank debt @ 11\%. Current risk free rate is 6% and market beta for company's shares is 1.22 . Company takes last five years' average stock market return into consideration which is 15%. You are required to: A. Estimate the new product's future sales, profits, and cash flows throughout its five-year life Cycle assuming company will be able to find a buyer at the end of fifth year. (CILO 3) 15 B.Calculateappropriatediscountrateforthisventure.(CILO1)7.5 C. Should Mettle Clothing introduce the PPE kits? Answer this question by calculating NPV and IRR of this project. (CILO 2) 7.5