Answered step by step

Verified Expert Solution

Question

1 Approved Answer

mework Help Save & Exit Sub Check my wo Required information Use the following information for the Exercises below. The following information applies to the

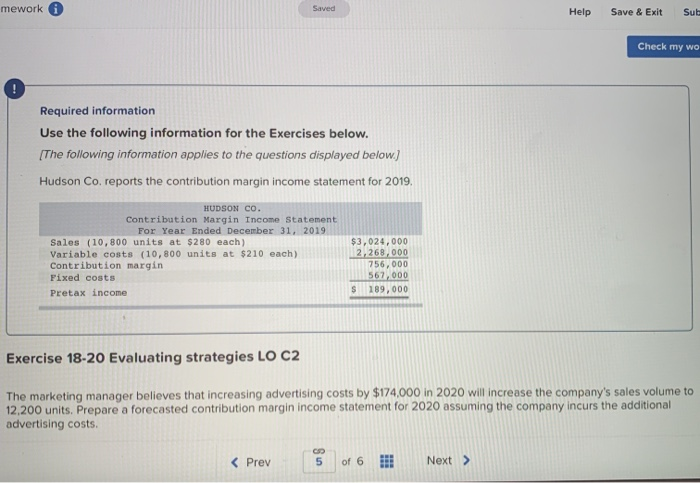

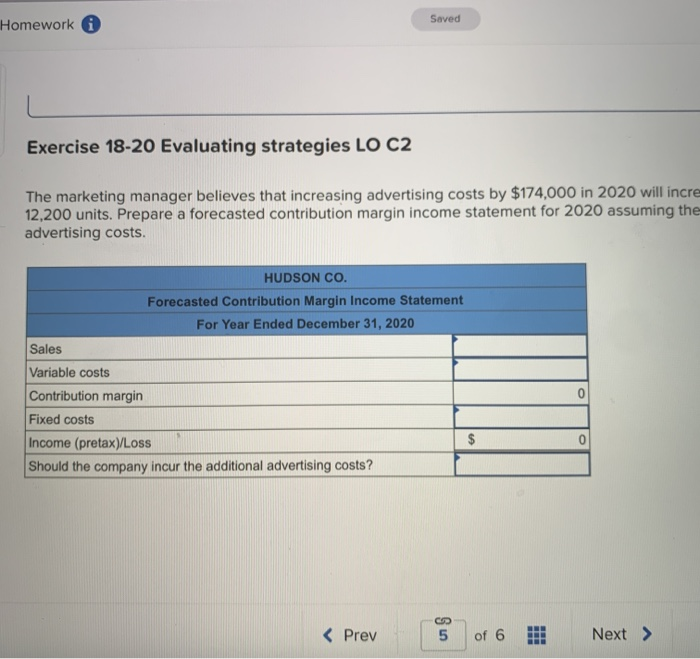

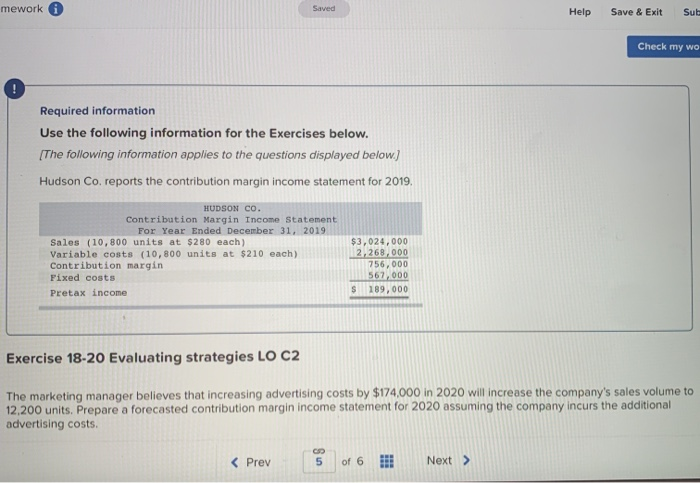

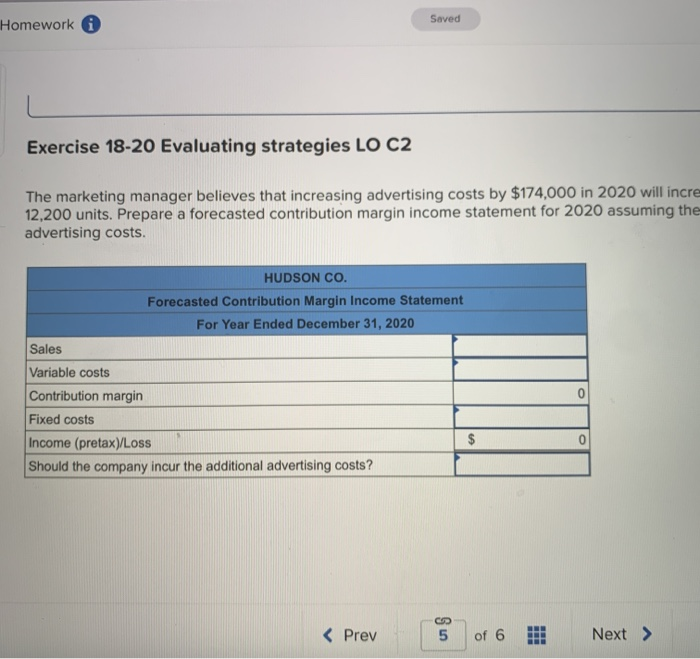

mework Help Save & Exit Sub Check my wo Required information Use the following information for the Exercises below. The following information applies to the questions displayed below) Hudson Co. reports the contribution margin income statement for 2019, HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,800 units at $280 each) Variable costs (10,800 units at $210 each) Contribution margin Fixed costs Pretax income $3,024,000 2,268,000 756,000 567,000 S 189,000 Exercise 18-20 Evaluating strategies LO C2 The marketing manager believes that increasing advertising costs by $174,000 in 2020 will increase the company's sales volume to 12,200 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs. Homework Saved Exercise 18-20 Evaluating strategies LO C2 The marketing manager believes that increasing advertising costs by $174,000 in 2020 will incre 12,200 units. Prepare a forecasted contribution margin income statement for 2020 assuming the advertising costs. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales Variable costs Contribution margin Fixed costs Income (pretax)/Loss Should the company incur the additional advertising costs?

mework Help Save & Exit Sub Check my wo Required information Use the following information for the Exercises below. The following information applies to the questions displayed below) Hudson Co. reports the contribution margin income statement for 2019, HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,800 units at $280 each) Variable costs (10,800 units at $210 each) Contribution margin Fixed costs Pretax income $3,024,000 2,268,000 756,000 567,000 S 189,000 Exercise 18-20 Evaluating strategies LO C2 The marketing manager believes that increasing advertising costs by $174,000 in 2020 will increase the company's sales volume to 12,200 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs. Homework Saved Exercise 18-20 Evaluating strategies LO C2 The marketing manager believes that increasing advertising costs by $174,000 in 2020 will incre 12,200 units. Prepare a forecasted contribution margin income statement for 2020 assuming the advertising costs. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales Variable costs Contribution margin Fixed costs Income (pretax)/Loss Should the company incur the additional advertising costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started