Answered step by step

Verified Expert Solution

Question

1 Approved Answer

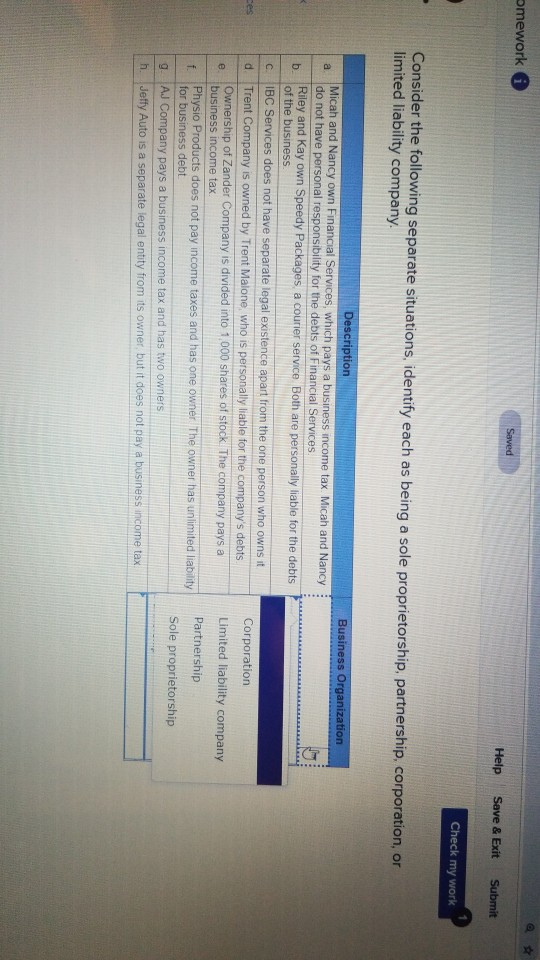

mework Saved Help Save & Exit Submit Check my work Consider the following separate situations, identify each as being a sole proprietorship, partnership, corporation, or

mework Saved Help Save & Exit Submit Check my work Consider the following separate situations, identify each as being a sole proprietorship, partnership, corporation, or limited liability company. Business Organization Description Micah and Nancy own Financial Services, which pays a business income tax. Micah and Nancy do not have personal responsibility for the debts of Financial Services Riley and Kay own Speedy Packages a courier service Both are personally liable for the debts of the business IBC Services does not have separate legal existence apart from the one person who owns it d Trent Company is owned by Trent Malone who is personally liable for the company's debts. Ownership of Zander Company is divided into 1000 shares of stock. The company pays a business income tax Physio Products does not pay income taxes and has one owner The owner has unlimited liability for business debt g. AJ Company pays a business income tax and has two owners h. Jeffy Auto is a separate legal entity from its owner but it does not pay a business income tax Corporation Limited liability company Partnership Sole proprietorship

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started