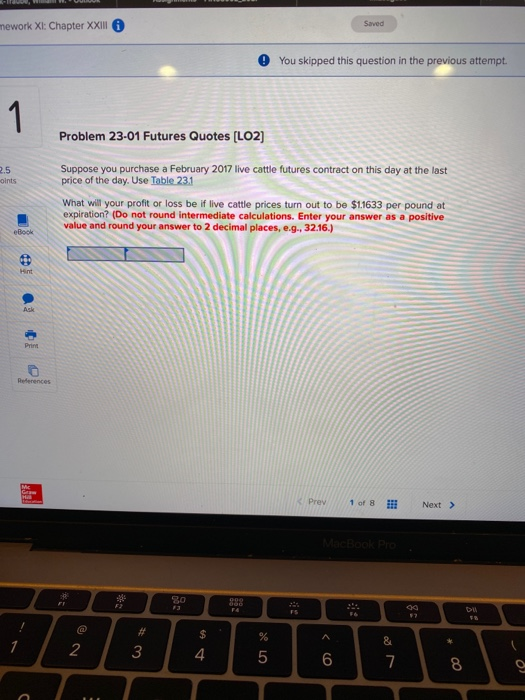

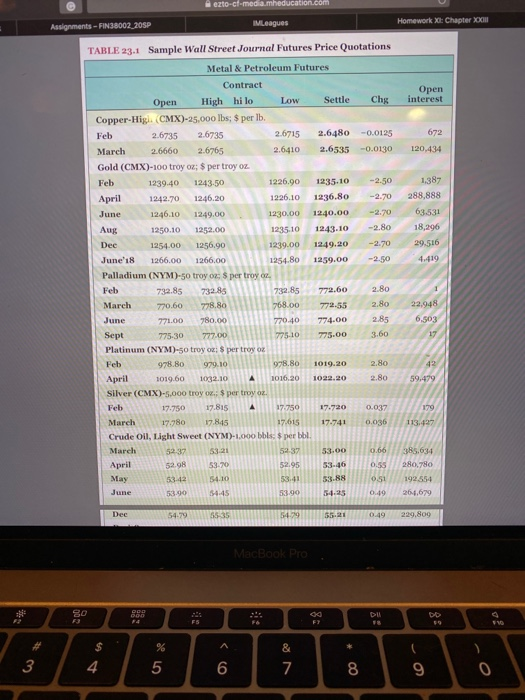

mework XI: Chapter XXIII O You skipped this question in the previous attempt. Problem 23-01 Futures Quotes (LO2) Suppose you purchase a February 2017 live cattle futures contract on this day at the last price of the day. Use Table 231 onts What will your profit or loss be if live cattle prices turn out to be $1.1633 per pound at expiration? (Do not round Intermediate calculations. Enter your answer as a positive value and round your answer to 2 decimal places, e.g., 32.16.) a ez az oo MacBook Pro S 888 or ezto-ct-media meducation.com Assignments - FIN38002_20SP IMLeagues Homework X: Chapter XH Open interest 672 120,434 1,387 288,888 63,531 18,296 29.516 4.419 TABLE 23.1 Sample Wall Street Journal Futures Price Quotations Metal & Petroleum Futures Contract Open High hilo Low Settle Chg Copper-Higl (CMX)-25,000 lbs: $ per lb. Feb 2.6735 2.6735 2.6715 2.6480 -0.0125 March 2.6660 2.6765 2.6410 2.6535 -0.0130 Gold (CMX)-100 troy oz; $ per troy oz Feb 1239.40 1243.50 1226.90 1235.10 -2.50 April 1242.70 1246.20 1226.10 1236.80 -2.70 June 1246.10 1249.00 1230.00 1240.00 -2.70 Aug 1250.10 1252.00 1235.10 1243.10 2.80 Dee 1254.00 1256,90 1239.00 1249.20 -2.70 June 18 1266.00 1266.00 1254.80 1259.00 -2.50 Palladium (NYM)-50 troy oc: $ per troy oz. Feb 732.85 732.8511111732.85 772.60 2.80 March 770.60 778.80 768.00 772.55 2.80 June 771.00 780.00 770.40 774.00 2.85 Sept 775.30 77. 00 0 .00 3.60 Platinum (NYM)-50 troy ox: $ per troy oz Feb 978.80 979. 10 9 78.80 1019.20 2.80 April 1019.60 1032.10 A 1016.20 1022.20 2.80 Silver (CMX)-5.000 troy on, $ per troy oz. Feb 17.750 17.815 A 17.750 17.720 0.037 March 17.780 17.845 17.615 17.741 0.036 Crude Oil, Light Sweet (NYM)-1.000 bls: $ per bol. March 54.37 53.000.66 April 52.98 53.70 53-46 10:55 May 53-42 54.10 53.88 H OSI June 50:45 5.25 0.49 22.948 59,479 1 79 113.427 385.634 280,780 192554 264,679 53.90 54.79 55.21 0.49 229.809 MacBook Pro on mework XI: Chapter XXIII O You skipped this question in the previous attempt. Problem 23-01 Futures Quotes (LO2) Suppose you purchase a February 2017 live cattle futures contract on this day at the last price of the day. Use Table 231 onts What will your profit or loss be if live cattle prices turn out to be $1.1633 per pound at expiration? (Do not round Intermediate calculations. Enter your answer as a positive value and round your answer to 2 decimal places, e.g., 32.16.) a ez az oo MacBook Pro S 888 or ezto-ct-media meducation.com Assignments - FIN38002_20SP IMLeagues Homework X: Chapter XH Open interest 672 120,434 1,387 288,888 63,531 18,296 29.516 4.419 TABLE 23.1 Sample Wall Street Journal Futures Price Quotations Metal & Petroleum Futures Contract Open High hilo Low Settle Chg Copper-Higl (CMX)-25,000 lbs: $ per lb. Feb 2.6735 2.6735 2.6715 2.6480 -0.0125 March 2.6660 2.6765 2.6410 2.6535 -0.0130 Gold (CMX)-100 troy oz; $ per troy oz Feb 1239.40 1243.50 1226.90 1235.10 -2.50 April 1242.70 1246.20 1226.10 1236.80 -2.70 June 1246.10 1249.00 1230.00 1240.00 -2.70 Aug 1250.10 1252.00 1235.10 1243.10 2.80 Dee 1254.00 1256,90 1239.00 1249.20 -2.70 June 18 1266.00 1266.00 1254.80 1259.00 -2.50 Palladium (NYM)-50 troy oc: $ per troy oz. Feb 732.85 732.8511111732.85 772.60 2.80 March 770.60 778.80 768.00 772.55 2.80 June 771.00 780.00 770.40 774.00 2.85 Sept 775.30 77. 00 0 .00 3.60 Platinum (NYM)-50 troy ox: $ per troy oz Feb 978.80 979. 10 9 78.80 1019.20 2.80 April 1019.60 1032.10 A 1016.20 1022.20 2.80 Silver (CMX)-5.000 troy on, $ per troy oz. Feb 17.750 17.815 A 17.750 17.720 0.037 March 17.780 17.845 17.615 17.741 0.036 Crude Oil, Light Sweet (NYM)-1.000 bls: $ per bol. March 54.37 53.000.66 April 52.98 53.70 53-46 10:55 May 53-42 54.10 53.88 H OSI June 50:45 5.25 0.49 22.948 59,479 1 79 113.427 385.634 280,780 192554 264,679 53.90 54.79 55.21 0.49 229.809 MacBook Pro on