Answered step by step

Verified Expert Solution

Question

1 Approved Answer

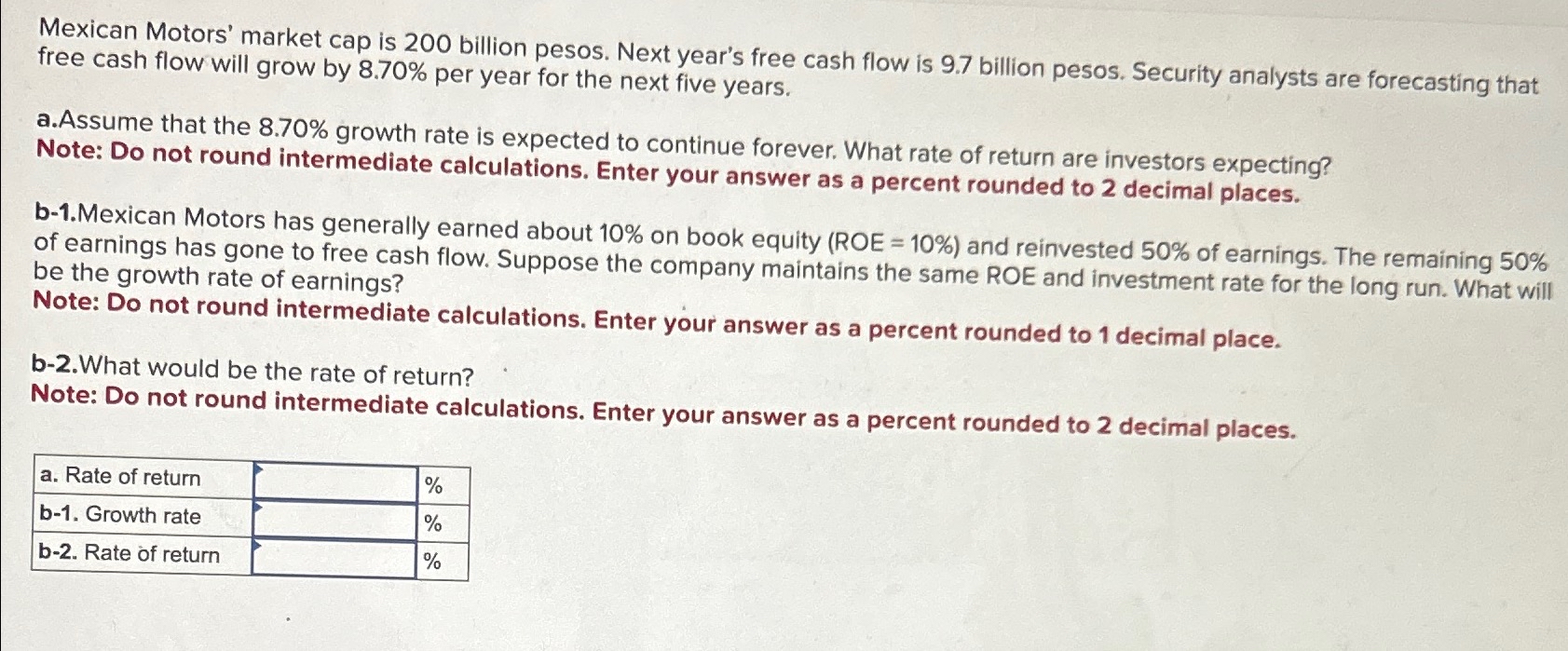

Mexican Motors' market cap is 2 0 0 billion pesos. Next year's free cash flow is 9 . 7 billion pesos. Security analysts are forecasting

Mexican Motors' market cap is billion pesos. Next year's free cash flow is billion pesos. Security analysts are forecasting that free cash flow will grow by per year for the next five years.

aAssume that the growth rate is expected to continue forever. What rate of return are investors expecting? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

bMexican Motors has generally earned about on book equity ROE and reinvested of earnings. The remaining of earnings has gone to free cash flow. Suppose the company maintains the same ROE and investment rate for the long run. What will be the growth rate of earnings?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal place.

b What would be the rate of return?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

tablea Rate of return,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started