Question

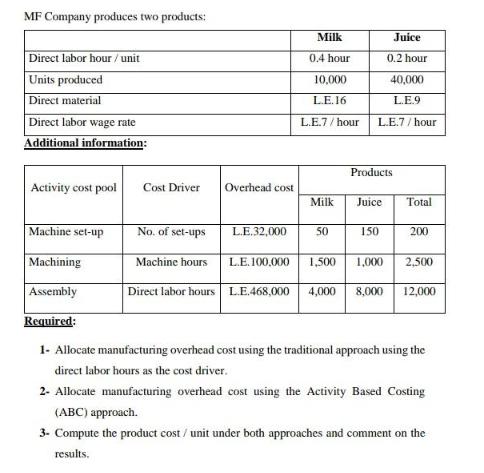

MF Company produces two products: Direct labor hour / unit Units produced Direct material Direct labor wage rate Additional information: Activity cost pool Cost

MF Company produces two products: Direct labor hour / unit Units produced Direct material Direct labor wage rate Additional information: Activity cost pool Cost Driver No. of set-ups Machine hours Overhead cost Direct labor hours. Milk 0.4 hour 10,000 L.E.16 L.E.7/hour L.E.32,000 Milk 50 40,000 L.E.9 L.E.7/hour Machine set-up Machining Assembly Required: 1- Allocate manufacturing overhead cost using the traditional approach using the direct labor hours as the cost driver. 2- Allocate manufacturing overhead cost using the Activity Based Costing (ABC) approach. 3- Compute the product cost / unit under both approaches and comment on the results. Products Juice Juice 0.2 hour 150 L.E.100.000 1,500 1,000 Total 200 2,500 L.E.468,000 4,000 8,000 12,000

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan K. Wolcott

2nd Edition

978-0-470-7694, 0470769424, 978-0470769423

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App