Question

MFB Industries borrowed $3,000,000 and agrees to make quarterly interest payments at the spot rate implied by the three-month zero-coupon bond price plus 90

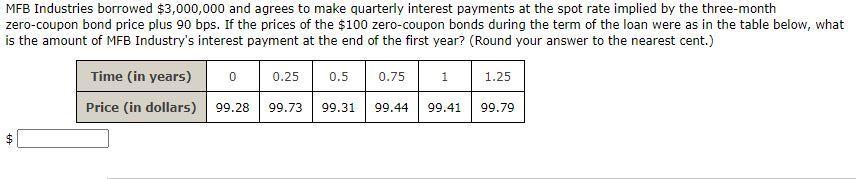

MFB Industries borrowed $3,000,000 and agrees to make quarterly interest payments at the spot rate implied by the three-month zero-coupon bond price plus 90 bps. If the prices of the $100 zero-coupon bonds during the term of the loan were as in the table below, what is the amount of MFB Industry's interest payment at the end of the first year? (Round your answer to the nearest cent.) 69 Time (in years) Price (in dollars) 0 99.28 0.25 99.73 0.5 0.75 99.31 99.44 1 99.41 1.25 99.79

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 9692 2 9752 3 9812 4 9872 The correct answer is option 4 9872 To calculate the interest payment we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App