Question

MG Capital Group needs your professional help to examine and provide a detailed valuation and analysis of Paradise Company (PC), a privately held real estate

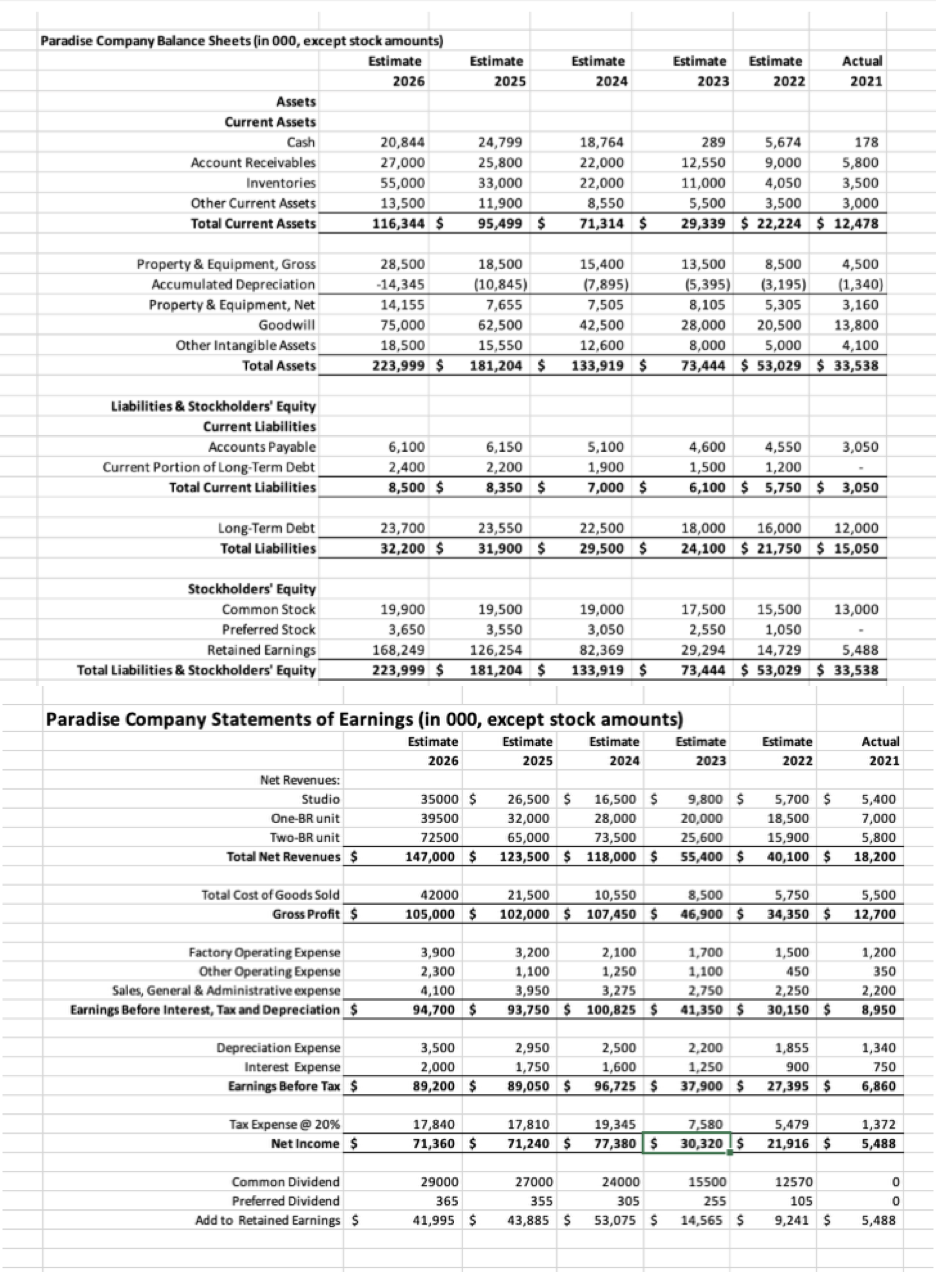

MG Capital Group needs your professional help to examine and provide a detailed valuation and analysis of Paradise Company (PC), a privately held real estate developer. The Company started in 2021 and has offered its common stock at $65 per share from the start. The risk-free rate is 2%, PC's beta is 1.8, and the market return is 10%. The growth rate after 2026 for dividend, net income, and cash flows are 3%.

Required Questions

1-Conduct industry analysis (life cycle, average growth rate, expected growth rate, main players, etc.) (10 points)

2-Conduct financial ratio analysis with the industry benchmarks for at least six profitability ratios (Must include ROA and ROCE (ROE)) and three risk ratios for 2022-2026. Discuss the ratios' calculations in relation to the company's performance individually and as a whole.

3-Create a statement of cash flows from 2022-2026 based on provided financial statements.

a. Discuss the validity of the statement of cash flows by examining the accounting quality of the provided financial statements.

4-Create two tables of free cash flows: 1. Free cash flows for all debt and equity stakeholders. 2.

Free cash flows for common equity shareholders.

5-Explain which free cash flows to use to examine PC for MG Capital Group. (Must decide on only one type of free cash flows to use.)

6-Calculate the intrinsic value per share price with dividend valuation method, Dividend Discount Model. (Must discuss and present all calculation steps in written format.

7-Calculate the intrinsic value per share price with cashflows from question 3's decision,

Discounted Cash Flows. (Must discuss and present all calculation steps in written format.

8-Calculate the intrinsic value per share price with the residual income method, Residual Income Model. Since PC launched in 2021, use 2021 equity book value to calculate 2021's residual income for the year 2021. (Must discuss and present all calculation steps in written format.

9-Discuss the different numerical results from questions 6-8 by examining the strengths and weaknesses of each calculation method.

10-Based on results from questions 1-9, present a recommendation to MG Capital Group to invest in PC or not. Be sure to include the logic of the recommendation in a detailed written format based on the numerical results from questions 1-9.

Paradise Company Balance Sheets (in 000, except stock amounts) Estimate 2026 Assets Current Assets Cash Account Receivables Inventories Other Current Assets Total Current Assets Property & Equipment, Gross Accumulated Depreciation Property & Equipment, Net Goodwill Other Intangible Assets Total Assets Liabilities & Stockholders' Equity Current Liabilities Accounts Payable Current Portion of Long-Term Debt Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Common Stock Preferred Stock Retained Earnings Total Liabilities & Stockholders' Equity Net Revenues: Studio One-BR unit Two-BR unit Total Net Revenues $ Total Cost of Goods Sold Gross Profit $ Factory Operating Expense Other Operating Expense Sales, General & Administrative expense Earnings Before Interest, Tax and Depreciation $ Depreciation Expense Interest Expense Earnings Before Tax $ Tax Expense @ 20% Net Income $ 20,844 27,000 55,000 Common Dividend Preferred Dividend Add to Retained Earnings $ 13,500 116,344 $ 28,500 -14,345 14,155 75,000 18,500 223,999 $ 6,100 2,400 8,500 $ 23,700 32,200 $ 19,900 3,650 168,249 223,999 $ Estimate 2025 18,500 (10,845) 7,655 62,500 15,550 181,204 $ 24,799 25,800 33,000 11,900 95,499 $ 35000 $ 39500 72500 147,000 $ 3,900 2,300 4,100 94,700 $ 3,500 2,000 89,200 $ 6,150 2,200 8,350 $ 23,550 31,900 $ Paradise Company Statements of Earnings (in 000, except stock amounts) Estimate Estimate 2026 2025 17,840 71,360 $ 29000 365 41,995 $ Estimate 2024 19,500 19,000 3,550 3,050 126,254 82,369 181,204 $ 133,919 $ 18,764 22,000 22,000 8,550 71,314 $ 5,100 1,900 7,000 $ 15,400 4,500 (7,895) (1,340) 7,505 5,305 3,160 42,500 28,000 20,500 13,800 12,600 5,000 4,100 8,000 133,919 $ 73,444 $ 53,029 $ 33,538 2,950 1,750 89,050 $ 26,500 $ 16,500 $ 32,000 28,000 65,000 17,810 71,240 $ 27000 355 43,885 $ 73,500 123,500 $ 118,000 $ Estimate 2024 Estimate Estimate 2023 2022 289 178 12,550 5,800 11,000 3,500 5,500 3,000 29,339 $22,224 $ 12,478 13,500 (5,395) 8,105 2,100 1,250 3,275 22,500 18,000 16,000 12,000 29,500 $ 24,100 $21,750 $ 15,050 24000 305 53,075 $ 10,550 8,500 5,750 42000 21,500 105,000 $ 102,000 $ 107,450 $ 46,900 $ 34,350 $ 4,600 1,500 6,100 $5,750 $ 3,050 Estimate 2023 3,200 1,100 3,950 2,750 93,750 $ 100,825 $ 41,350 $ 5,674 9,000 4,050 3,500 9,800 $ 20,000 25,600 55,400 $ 8,500 (3,195) 17,500 15,500 13,000 2,550 1,050 14,729 5,488 29,294 73,444 $ 53,029 $ 33,538 1,700 1,100 4,550 1,200 15500 255 14,565 $ Estimate 2022 5,700 $ 18,500 15,900 40,100 $ Actual 2021 1,500 450 2,500 2,200 1,855 1,600 1,250 900 96,725 $ 37,900 $ 27,395 $ 2,250 30,150 $ 19,345 7,580 5,479 77,380 $30,320 $ 21,916 $ 3,050 12570 105 9,241 $ Actual 2021 5,400 7,000 5,800 18,200 5,500 12,700 1,200 350 2,200 8,950 1,340 750 6,860 1,372 5,488 0 0 5,488

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Paradise Company Valuation and Analysis 1 Industry Analysis Life Cycle The real estate development industry is cyclical with periods of growth and decline driven by economic conditions interest rates ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started