Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Micah Corporation is trying to determine the initial investment required to replace an old machine with a new one. The new machine costs $ 6

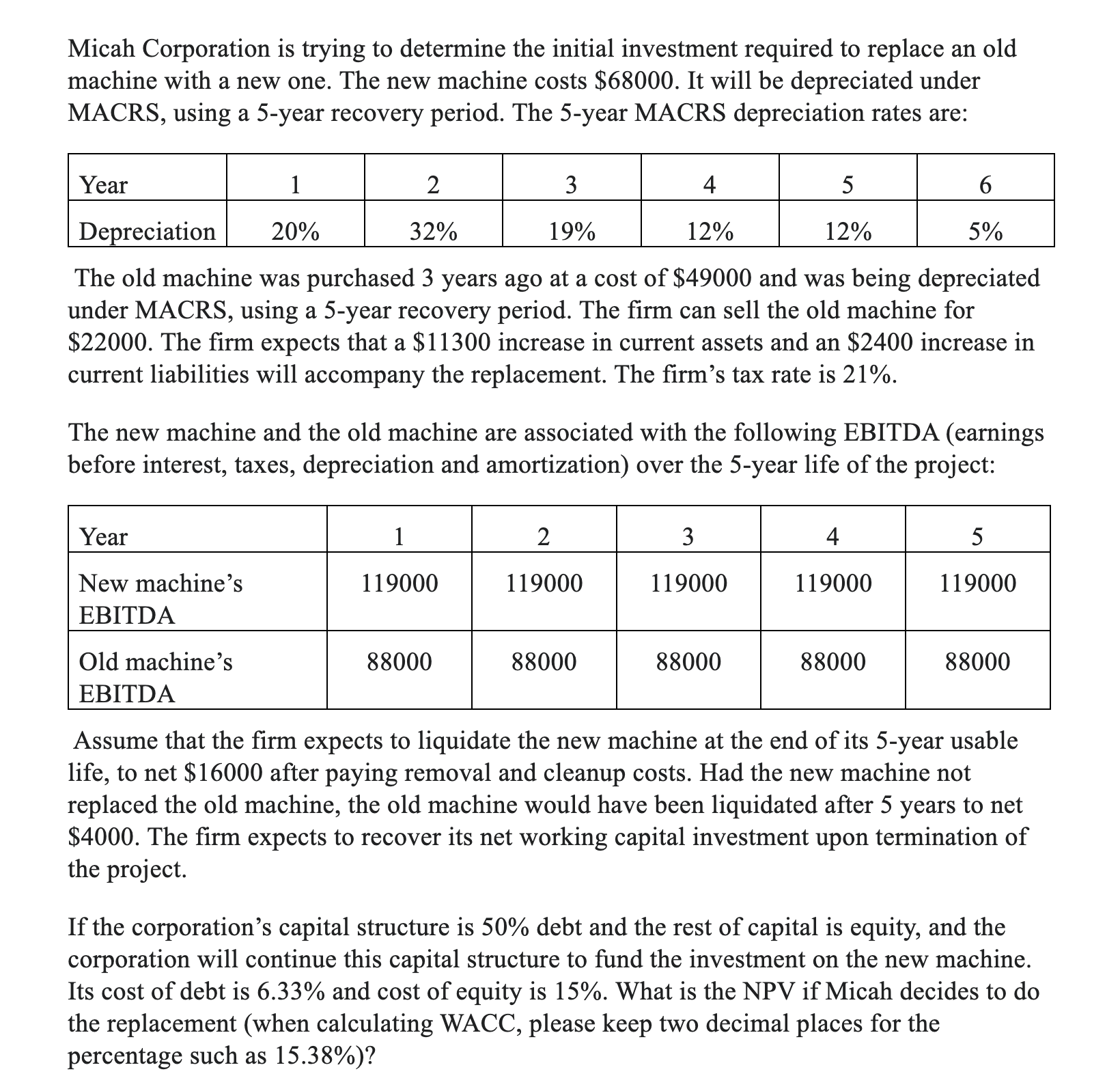

Micah Corporation is trying to determine the initial investment required to replace an old

machine with a new one. The new machine costs $ It will be depreciated under

MACRS, using a year recovery period. The year MACRS depreciation rates are:

The old machine was purchased years ago at a cost of $ and was being depreciated

under MACRS, using a year recovery period. The firm can sell the old machine for

$ The firm expects that a $ increase in current assets and an $ increase in

current liabilities will accompany the replacement. The firm's tax rate is

The new machine and the old machine are associated with the following EBITDA earnings

before interest, taxes, depreciation and amortization over the year life of the project:

Assume that the firm expects to liquidate the new machine at the end of its year usable

life, to net $ after paying removal and cleanup costs. Had the new machine not

replaced the old machine, the old machine would have been liquidated after years to net

$ The firm expects to recover its net working capital investment upon termination of

the project.

If the corporation's capital structure is debt and the rest of capital is equity, and the

corporation will continue this capital structure to fund the investment on the new machine.

Its cost of debt is and cost of equity is What is the NPV if Micah decides to do

the replacement when calculating WACC, please keep two decimal places for the

percentage such as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started