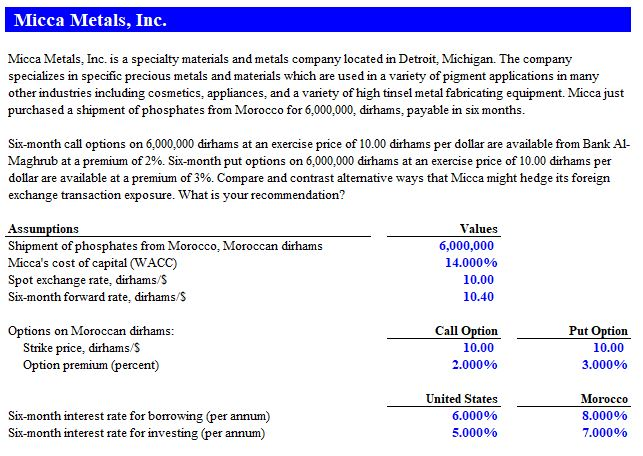

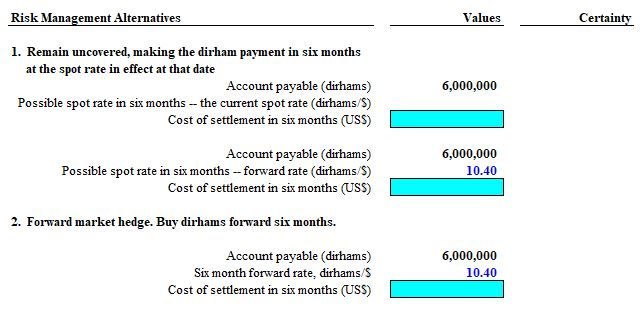

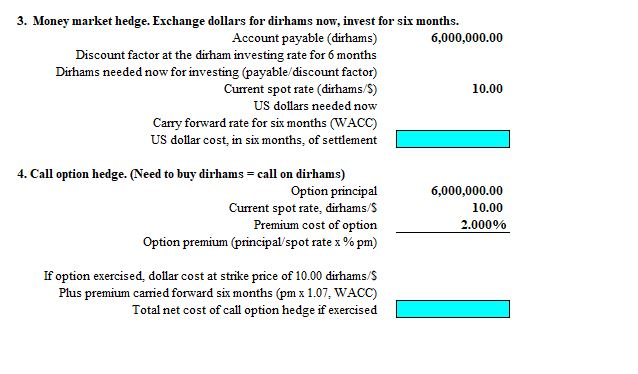

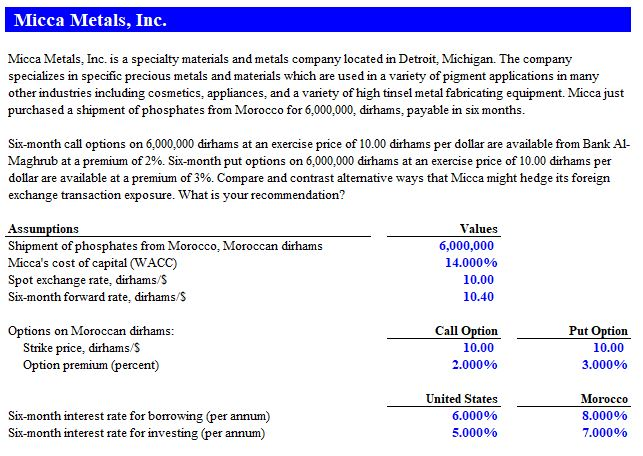

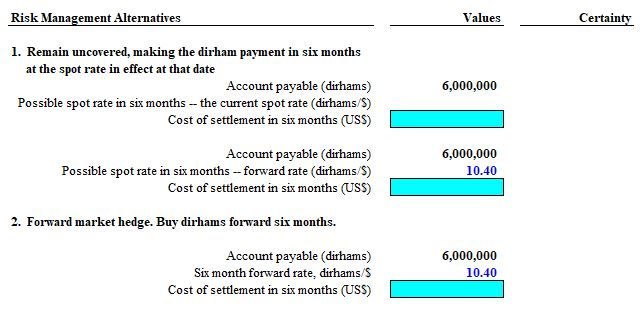

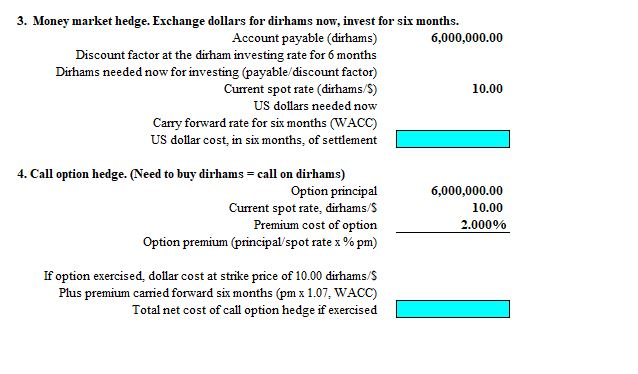

Micca Metals, Inc. Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 6.000.000, dirhams, payable in six months. Six-month call options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available from Bank Al- Maghrub at a premium of 2%. Six-month put options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available at a premium of 3%. Compare and contrast alternative ways that Micca might hedge its foreign exchange transaction exposure. What is your recommendation? Assumptions Shipment of phosphates from Morocco, Moroccan dirhams Micca's cost of capital (WACC) Spot exchange rate, dirhams/S Six-month forward rate, dirhams/S Values 6,000,000 14.000% 10.00 10.40 Options on Moroccan dirhams: Strike price, dirhams/S Option premium (percent) Call Option 10.00 2.000% Put Option 10.00 3.000% Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum) United States 6.000% 5.000% Morocco 8.000% 7.000% Risk Management Alternatives Values Certainty 1. Remain uncovered, making the dirham payment in six months at the spot rate in effect at that date Account payable (dirhams) Possible spot rate in six months -- the current spot rate (dirhams/S) Cost of settlement in six months (USS) 6,000,000 Account payable (dirhams) Possible spot rate in six months -- forward rate (dirhams/S) Cost of settlement in six months (USS) 6,000,000 10.40 2. Forward market hedge. Buy dirhams forward six months. Account payable (dirhams) Six month forward rate, dirhams/S Cost of settlement in six months (USS) 6,000,000 10.40 3. Money market hedge. Exchange dollars for dirhams now, invest for six months. Account payable (dirhams) 6,000,000.00 Discount factor at the dirham investing rate for 6 months Dirhams needed now for investing (payable discount factor) Current spot rate (dirhams/S) 10.00 US dollars needed now Carry forward rate for six months ( WACC) US dollar cost, in six months, of settlement 4. Call option hedge. (Need to buy dirhams = call on dirhams) Option principal Current spot rate, dirhams/S Premium cost of option Option premium (principal spot ratex% pm) 6,000,000.00 10.00 2.000% If option exercised dollar cost at strike price of 10.00 dirhams/S Plus premium carried forward six months (pm x 1.07, WACC) Total net cost of call option hedge if exercised Micca Metals, Inc. Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 6.000.000, dirhams, payable in six months. Six-month call options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available from Bank Al- Maghrub at a premium of 2%. Six-month put options on 6,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available at a premium of 3%. Compare and contrast alternative ways that Micca might hedge its foreign exchange transaction exposure. What is your recommendation? Assumptions Shipment of phosphates from Morocco, Moroccan dirhams Micca's cost of capital (WACC) Spot exchange rate, dirhams/S Six-month forward rate, dirhams/S Values 6,000,000 14.000% 10.00 10.40 Options on Moroccan dirhams: Strike price, dirhams/S Option premium (percent) Call Option 10.00 2.000% Put Option 10.00 3.000% Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum) United States 6.000% 5.000% Morocco 8.000% 7.000% Risk Management Alternatives Values Certainty 1. Remain uncovered, making the dirham payment in six months at the spot rate in effect at that date Account payable (dirhams) Possible spot rate in six months -- the current spot rate (dirhams/S) Cost of settlement in six months (USS) 6,000,000 Account payable (dirhams) Possible spot rate in six months -- forward rate (dirhams/S) Cost of settlement in six months (USS) 6,000,000 10.40 2. Forward market hedge. Buy dirhams forward six months. Account payable (dirhams) Six month forward rate, dirhams/S Cost of settlement in six months (USS) 6,000,000 10.40 3. Money market hedge. Exchange dollars for dirhams now, invest for six months. Account payable (dirhams) 6,000,000.00 Discount factor at the dirham investing rate for 6 months Dirhams needed now for investing (payable discount factor) Current spot rate (dirhams/S) 10.00 US dollars needed now Carry forward rate for six months ( WACC) US dollar cost, in six months, of settlement 4. Call option hedge. (Need to buy dirhams = call on dirhams) Option principal Current spot rate, dirhams/S Premium cost of option Option premium (principal spot ratex% pm) 6,000,000.00 10.00 2.000% If option exercised dollar cost at strike price of 10.00 dirhams/S Plus premium carried forward six months (pm x 1.07, WACC) Total net cost of call option hedge if exercised