Answered step by step

Verified Expert Solution

Question

1 Approved Answer

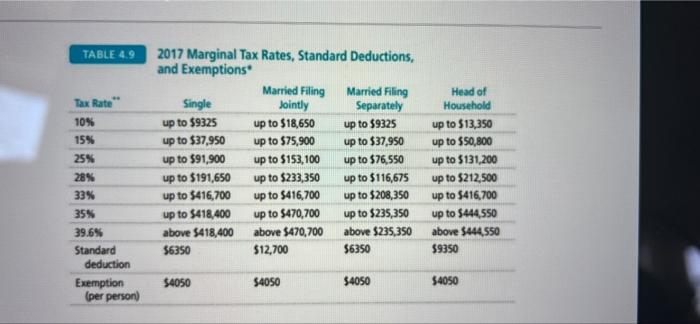

2017 Marginal Tax Rates, Standard Deductions, and Exemptions TABLE 4.9 Married Filing Jointly Married Filing Separately Head of Tax Rate Single Household up to

2017 Marginal Tax Rates, Standard Deductions, and Exemptions TABLE 4.9 Married Filing Jointly Married Filing Separately Head of Tax Rate Single Household up to $9325 up to $37,950 10% up to $18,650 up to $9325 up to $13,350 15% up to $75,900 up to $37,950 up to $50,800 up to $153,100 up to $233,350 up to $416,700 up to $76,550 up to $16,675 up to $208,350 up to $235,350 25% up to $91,900 up to $131,200 up to $191,650 up to $416,700 28% up to $212,500 33% up to $416,700 up to $444,550 above $444,550 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 above $235,350 Standard $6350 $12,700 $6350 $9350 deduction $4050 $4050 $4050 Exemption (per person) $4050

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Quis Marti and Nice filing Jonintly odj usted Gro88 Income 59250 Charitable contsibut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started