Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael and Rebecca Johnson are married and file a joint tax return. Michael and Rebecca, who live in Sacramento, California, have two children Max,

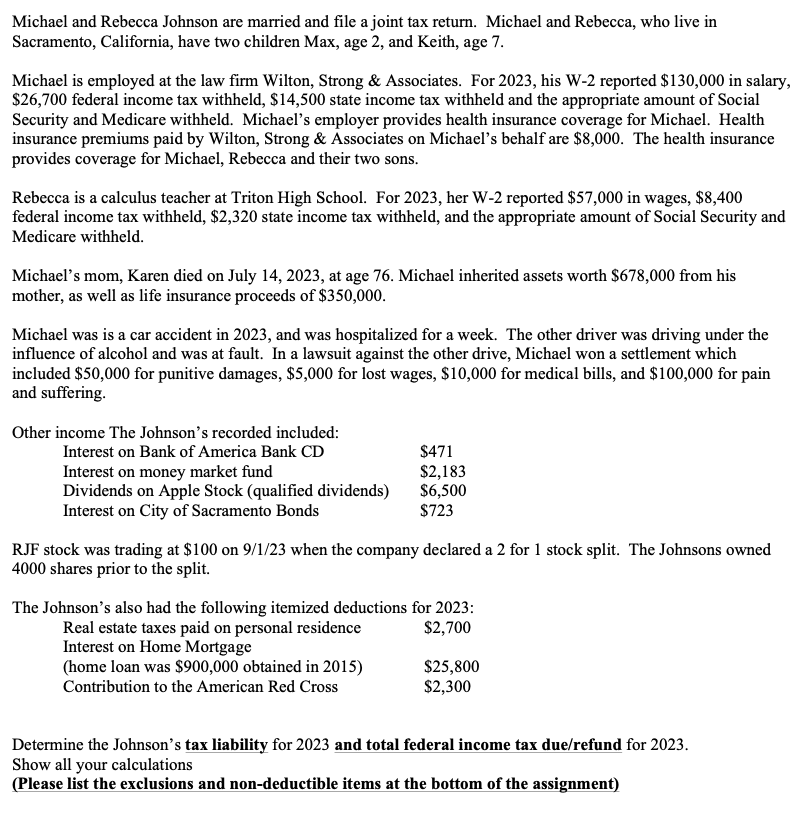

Michael and Rebecca Johnson are married and file a joint tax return. Michael and Rebecca, who live in Sacramento, California, have two children Max, age 2, and Keith, age 7. Michael is employed at the law firm Wilton, Strong & Associates. For 2023, his W-2 reported $130,000 in salary, $26,700 federal income tax withheld, $14,500 state income tax withheld and the appropriate amount of Social Security and Medicare withheld. Michael's employer provides health insurance coverage for Michael. Health insurance premiums paid by Wilton, Strong & Associates on Michael's behalf are $8,000. The health insurance provides coverage for Michael, Rebecca and their two sons. Rebecca is a calculus teacher at Triton High School. For 2023, her W-2 reported $57,000 in wages, $8,400 federal income tax withheld, $2,320 state income tax withheld, and the appropriate amount of Social Security and Medicare withheld. Michael's mom, Karen died on July 14, 2023, at age 76. Michael inherited assets worth $678,000 from his mother, as well as life insurance proceeds of $350,000. Michael was is a car accident in 2023, and was hospitalized for a week. The other driver was driving under the influence of alcohol and was at fault. In a lawsuit against the other drive, Michael won a settlement which included $50,000 for punitive damages, $5,000 for lost wages, $10,000 for medical bills, and $100,000 for pain and suffering. Other income The Johnson's recorded included: Interest on Bank of America Bank CD $471 Interest on money market fund $2,183 Dividends on Apple Stock (qualified dividends) Interest on City of Sacramento Bonds $6,500 $723 RJF stock was trading at $100 on 9/1/23 when the company declared a 2 for 1 stock split. The Johnsons owned 4000 shares prior to the split. The Johnson's also had the following itemized deductions for 2023: Real estate taxes paid on personal residence $2,700 Interest on Home Mortgage (home loan was $900,000 obtained in 2015) Contribution to the American Red Cross $25,800 $2,300 Determine the Johnson's tax liability for 2023 and total federal income tax due/refund for 2023. Show all your calculations (Please list the exclusions and non-deductible items at the bottom of the assignment)

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the Johnsons tax liability for 2023 and determine their total federal income tax duerefund for the year Well first calculate their adju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started